- The EUR/JPY gives a downward turn while the ECB anticipates a deterioration in the Eastern Economic Perspectives due to Trump’s tariff measures.

- The ECB has reduced its key interest rates at 25 basic points for the sixth consecutive time.

- The Japanese Yen fails to capitalize on fluid commercial conversations between the US and Japan.

The EUR/JPY pair renounces all its intradic earnings and lowers about 161.50 during negotiation hours in North America on Thursday. The Par faces a strong mass sale since the euro (EUR) has a lower yield after the monetary policy announcement of the European Central Bank (ECB).

The ECB has cut its key interest rates in 25 basic points (PBS), as expected, carrying the deposit rate and the main refinancing operations rate to 2.25% and 2.4%, respectively. This is the sixth cut of consecutive interest rates by the ECB and the seventh since June, when the Central Bank began to dismantle the restrictive monetary policy position.

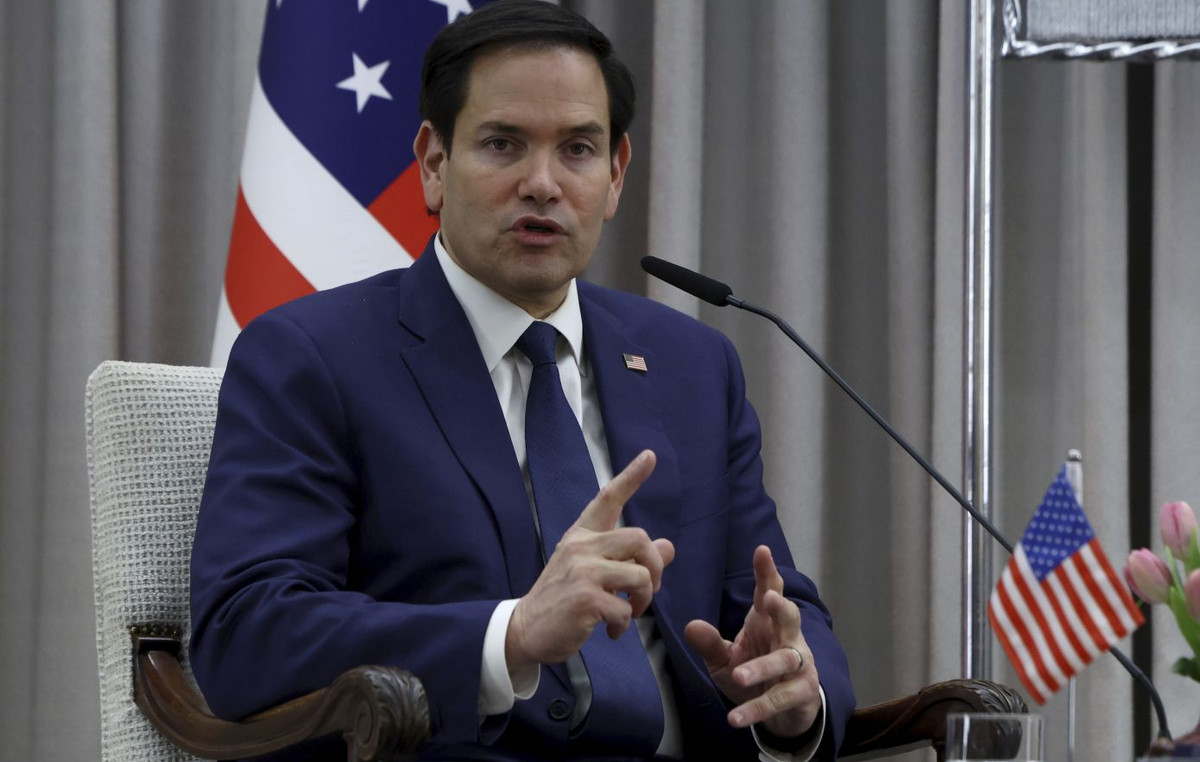

It seems that the ECB has changed its posture of “accommodation” to “neutral” by omitting the use of the phrase that interest rates remain restrictive. However, he has presented a gloomy panorama of the Eastern Economic Perspectives before the tariffs imposed by the president of the United States (USA), Donald Trump, who are currently in pause for 30 days. “The growth prospects have deteriorated due to the increase in commercial tensions,” said the ECB in the monetary policy statement.

Meanwhile, the president of the ECB, Christine Lagarde, has expressed confidence that the expense in defense and infrastructure will boost manufacturing activities in her press conference after the policy decision. Lagarde does not expect the economy to have contracted in the first quarter, but warns that economic perspectives are “clouded by uncertainty”.

Although investors have backed the euro over the Japanese Yen (JPY), this struggle to overcome their other peers, even when the US president Trump has confirmed that commercial conversations with the Minister of Economic Revitalization of Japan, Ryosei Akazawa, passed without problems.

“A great honor to have met with the Japanese delegation on trade. Great progress!” Wrong US president Donald Trump in a publication on the Truth. Social Wednesday.

Meanwhile, Japanese officials are still concerned about economic perspectives due to the passive effects of Trump’s tariffs on their economy. Earlier in the day, Japanese Minister of Finance, Shunichi Kato, said he is “deeply concerned” by US tariffs that affect “Japan and the world economy”.

Economic indicator

ECB rate in the ease of deposits

One of the three key interest rates of the European Central Bank (ECB)the rate of ease of deposit, is the rate at which banks gain interest when they deposit funds in the ECB. It is announced by the European Central Bank in each of its eight scheduled annual meetings.

Read more.

Last publication:

PLAY APR 17, 2025 12:15

Frequency:

Irregular

Current:

2.25%

Dear:

2.25%

Previous:

2.5%

Fountain:

European Central Bank

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.