Bitcoin

Bitcoin grew by 7.4% in the week from January 10 to January 17, 2025. This allowed the largest cryptocurrency by capitalization to once again overcome the $100,000 mark. However, the first half of the week was not so rosy, as BTC dropped below $90,000.

Source: tradingview.com

The main growth of Bitcoin occurred in the second half of the week. The main driver of the positive dynamics was inflation statistics in the United States. The consumer price index rose for the third month in a row and amounted to 2.9%. However, what is much more important, there was a decrease in core inflation – the one that does not take into account changes in the cost of food and energy resources. The rate fell to 3.2% in December after being flat at 3.3% for three months. Exactly fall in core inflation caused optimism among crypto investors.

And the analytical platform IntoTheBlock tried

debunk the prevailing stereotype according to which Bitcoin has very high volatility. According to the site, over the past three months, the price of BTC has changed more slowly than many tech stocks. PayPal, AMD, and Nvidia turned out to be more volatile than Bitcoin.

Despite the fact that the price of Bitcoin is no longer changing as quickly as it once was, the CryptoQuant analytical platform

believesthat the cost of the largest cryptocurrency by capitalization at the end of 2025 will be from $145,000 to $249,000, which is 42-145% higher than current indicators. The main factors in favor of this point of view

sees legislative easing, monetary policy and cyclical changes.

According to technical analysis, the advantage has again shifted to buyers. Indicators support this. The price is above the 50-day moving average (indicated in blue), and the RSI is rising and exceeding 50. The nearest resistance level for BTC is the all-time high of $108,364, and support is the low of last week, $89,164.

Source: tradingview.com

Index

fear and greed compared to last week increased by 25 points. The current value is 75. This indicates the predominance of greed over fear in the sentiments of crypto investors.

Ethereum

Ether has gained 3.18% over the past seven days. Like Bitcoin, the second half of the week for ETH turned out to be better than the first. During trading on Monday, January 13, ETH dropped below $3,000 for the first time since November 9, 2024, but then the losses were recouped.

Source: tradingview.com

First of all, the increase in value is associated with the withdrawal of ether from cryptocurrency exchanges. Investors turned out to be more interested in accumulating ETH rather than trading the asset. In total, from January 10 to January 16, ether worth $360.78 million was withdrawn from exchanges.

Source: coinglass.com

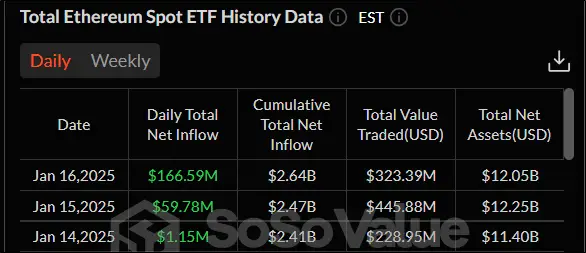

At the same time, in the last three trading sessions, there has been a positive trend for spot ETFs on ETH. From January 14 to January 16, the inflow of funds into exchange-traded funds for ether amounted to $227.52 million.

Source: sosovalue.com

The Ethereum team has decided on the timing of the Pectra update. It should

take place in early or mid March. On February 12, the update will be deployed to the Sepolia test network, and on February 19 to the Holesky test network.

From the point of view of technical analysis, Ethereum has a predominant downtrend. This is evidenced by the price being below the 50-day moving average (marked in blue). At the same time, from January 9 to January 13, the stochastic indicator gave a signal such as “bullish divergence,” which speaks in favor of buyers. In fact, over the past four days, ETH has risen in price by more than $400. The current resistance level is $3,474.3, and the support level is $2,919.5.

Source: tradingview.com

Ripple

Ripple grew by more than 40% from January 10 to January 17. This catapulted the price to $3.3. On many exchanges such as Bitstamp, Bybit and Coinbase, the Ripple cryptocurrency has reached its all-time high. On Binance, the XRP coin came close to its January 2018 peaks.

Source: tradingview.com

One of the main reasons for the growth of Ripple was the announcement of the largest American investment bank JP Morgan about spot ETFs for this cryptocurrency. According to representatives of the credit institution, exchange-traded funds based on XRP will have quite serious success and will be able to attract from $4 billion to $8 billion. Information

shared Matthew Sigel, head of digital assets research at VanEck investment company.

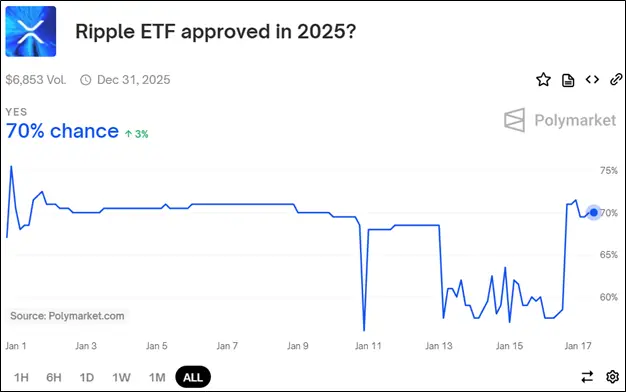

Interestingly, prediction platform Polymarket estimates the likelihood of Ripple spot ETFs being approved in 2025 at 70%.

Source: polymarket.com

The price of XRP was also influenced by the increase in the number of large (over $1 million) transactions. On January 15, this figure reached 341. Information

shared cryptanalyst Ali Martinez.

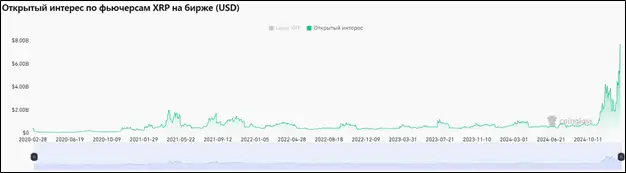

Another catalyst for growth was a new record in open interest—the number of XRP derivatives that are in circulation on crypto exchanges. On January 16, the figure reached $7.61 billion. This indicates unprecedented demand for Ripple from crypto investors.

Source: coinglass.com

From a technical analysis point of view, Ripple is in an upward trend. This is confirmed by the fact that the price is above the 50-day moving average (marked in blue). At the same time, the ADX indicator is only slightly above 20 – the trend is still quite weak and is in its infancy. The current support and resistance levels are $2.9055 and $3.4, respectively.

Source: tradingview.com

Conclusion

Thus, cryptocurrencies began to rise. However, the situation is different for large coins. Ether is still dominated by bears, Bitcoin is on its way to an all-time high, and Ripple’s uptrend is not yet strong.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.