- The WTI price is behind the channel, so it is bullish in the long term.

- The WTI H4 M formation is bullish and a break of the neckline is likely to put the bias back in the favor.

- A break below $76.4 will put committed bulls in trouble.

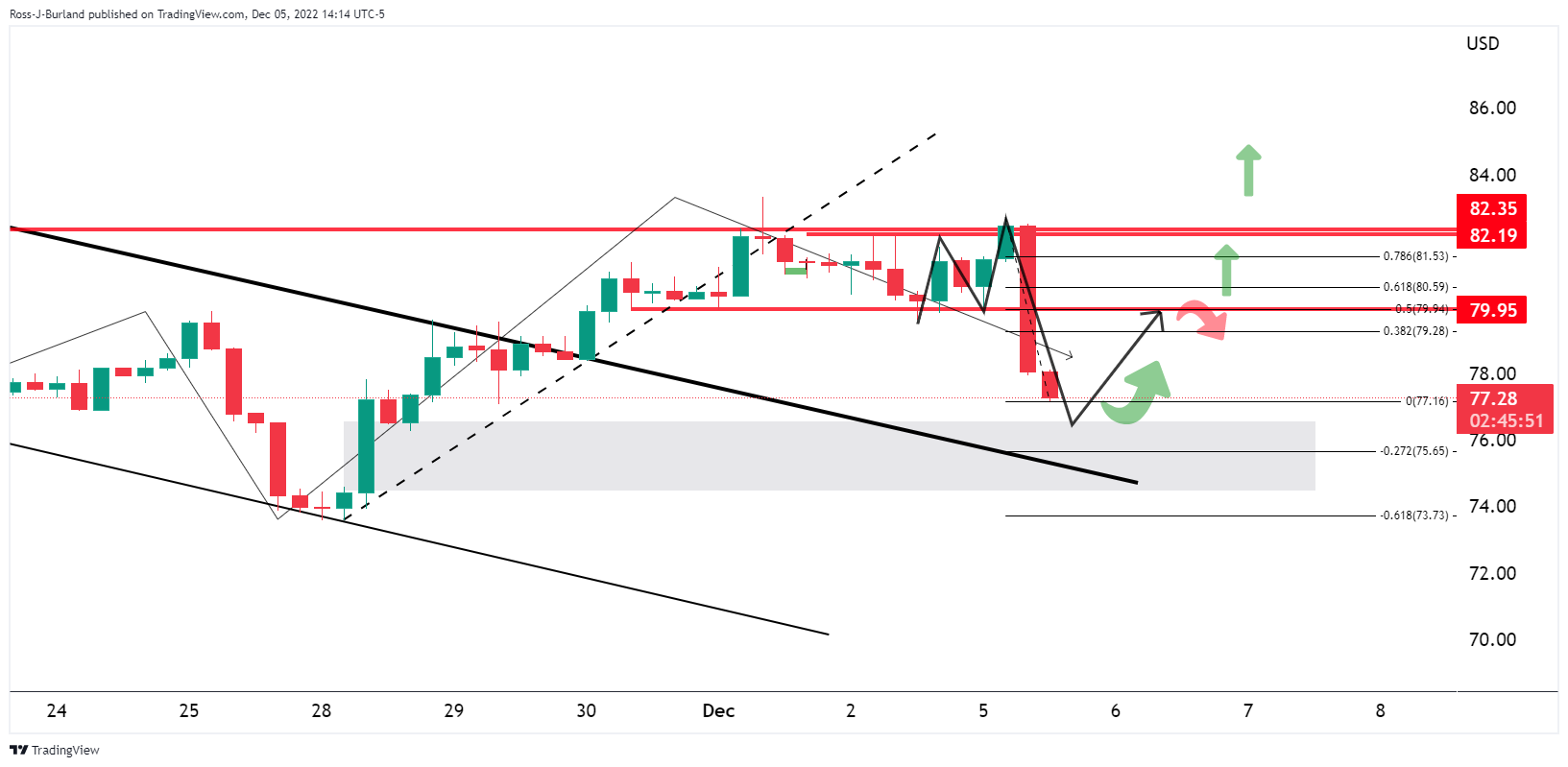

According to him analysis Previously, the price has been in a distribution phase during the month of December, until now, after the breakout of a major bearish channel, as the following analysis will illustrate:

Previous WTI analysis

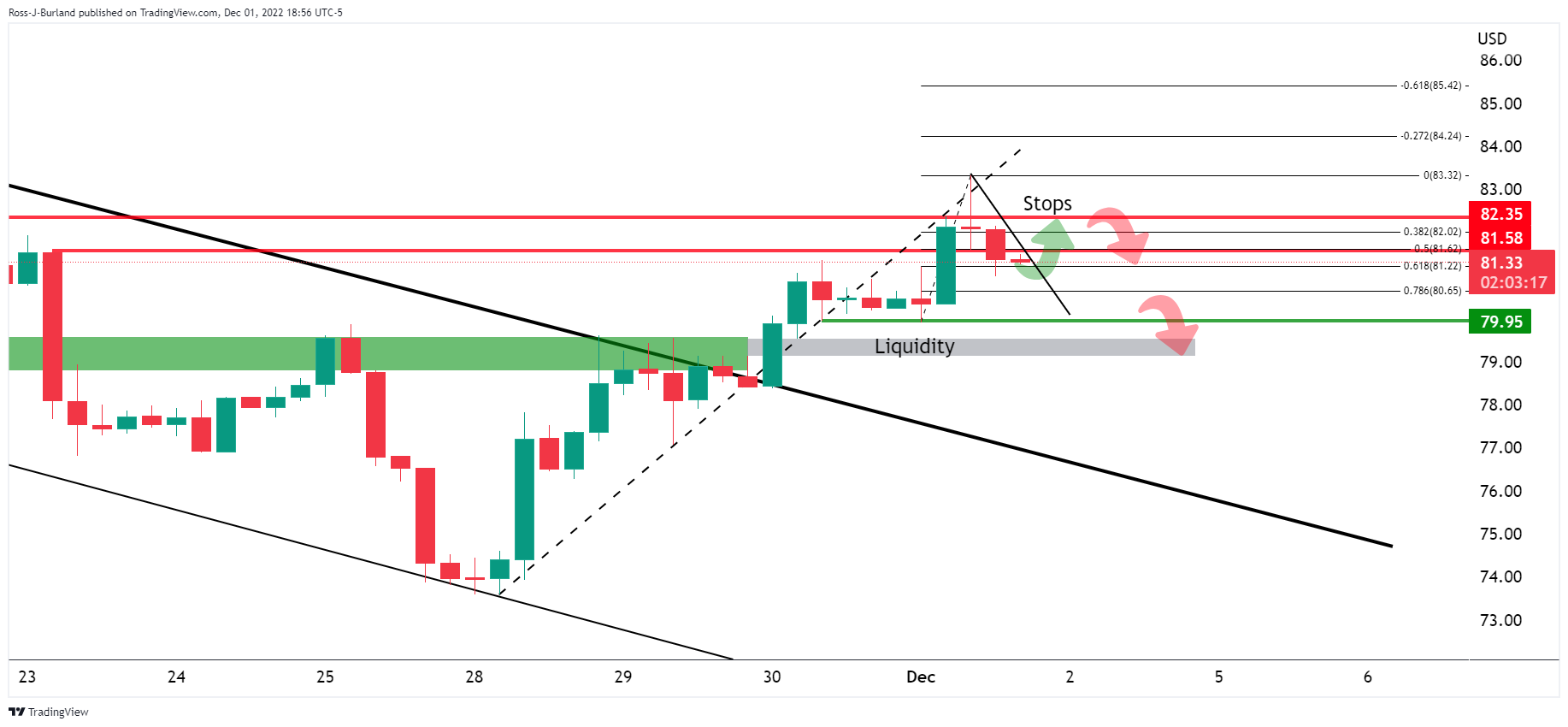

On previous daily charts, WTI was seen to be moving towards previous highs and this had dragged down liquidity where a distribution scheme was published:

A move to where the stops on short WTI positions were anticipated was anticipated based on the hourly chart above.

Oil expected continuation lower to target liquidity below $78.00 eventually while below $81.50

WTI Update

On the daily chart, the formation of the “W” has caused the price to move to test the neckline.

On the 4 hour chart, the M formation is bullish and a break of the neckline, or a 50% reversal of the mean, will likely put the bias back in favor of the bulls for a bullish continuation. After all, the price is at the back of the channel, so it is bullish in the longer term. However, a break below $76.40 will challenge committed bulls, based on the following daily and 4-hour charts:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.