SOLANA is actively restored after losses incurred over the past three months. Recently, SOL has been gaining popularity thanks to long -term holders (LTH), who support its growth.

We figure out what is happening on the SOLANA (SOL) market and what to expect from the price of cryptocurrency in May 2025.

SOLANA investors can expect positive changes

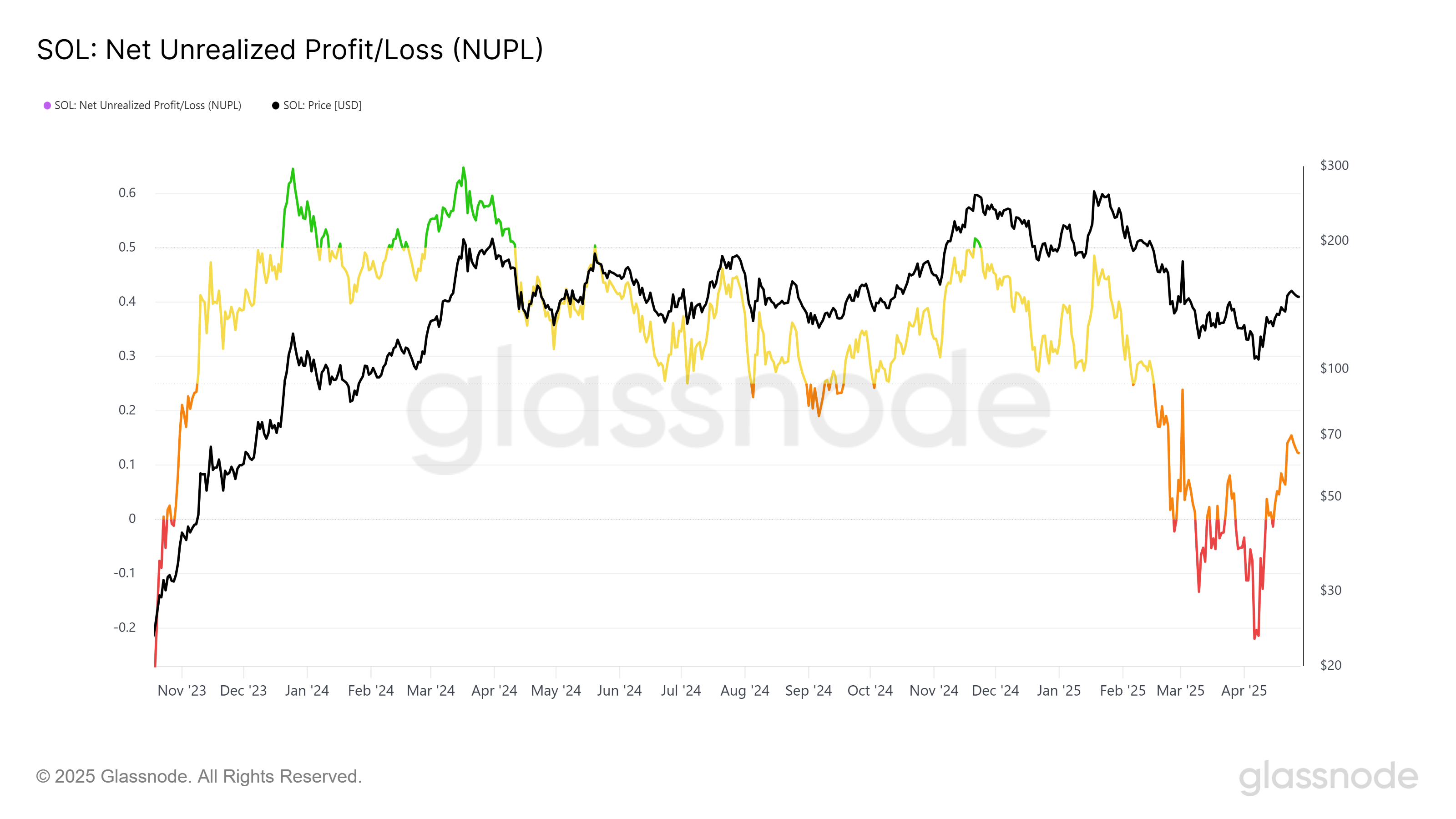

Now SOLANA is located in the Nadezhda zone in the Net Unrealized Profit/Loss (NUPL) indicator. Historically, being in this zone often preceded a price increase, especially when the indicator approached the Optimism zone at 0.25. Although Solana has not yet reached this level, the price of altcoin can grow in anticipation of further growth.

In addition to a strong NUPL signal, Solana is of considerable interest among institutional investors. This strengthens positive moods in the market, as more and more institutional investors increase their investments in SOLANA. Such trust will probably contribute to a further increase in prices and strengthen SOLANA positions.

Recently, Canada approved the world’s first spite ETF on SOL. However, Chris Chung, the general director and co -founder of Titan, in an interview with Beincrypto noted their weak influence.

Recently, there has been a sharp increase in the change in the pure position of the Hodler. This surge indicates a growing accumulation from long -term holders (LTH), which indicates an increase in confidence in the asset.

The fact that LP is increasingly holding their positions is a strong confidence indicator in the future of SOLANA. This trend can help stabilize the price and maintain further growth, since LP usually strongly affect the direction of the market.

SOL price on the way to growth

The price of SOLANA increased by 41% this month, reaching $ 149 at the time of writing. The next significant resistance is at $ 180. Its overcoming will be an important step towards restoration after the March losses. To achieve $ 180 SOL, it is necessary to rise by 21.8%, which seems quite possible taking into account the current impulse.

If Solana successfully overcome $ 180, it will be in a good position to maintain growth. Further rise can help SOL play the loss of February, potentially raising the price to $ 221. However, this growth will probably be accompanied by the saturation of the market, which will limit further immediate profits.

However, if investors decide to sell their assets prematurely, the price of SOLANA can fall significantly. The inability to overcome the $ 180 resistance level threatens to lead to a decrease – probably to $ 123. This scenario cancel the current bull trend, signaling the possible turn and stop recovery.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.