Specialist RBC Crypto I analyzed the situation in the market and appreciated the prospects for the movement of the Bitcoin course for the next seven days.

“The market is still faced with certain challenges”

Bitriver financial analyst Vladislav Antonov

The past week has become a period of sustainable recovery for the first cryptocurrency. Bitcoin demonstrated confident growth against the backdrop of the weakening of the US dollar, the growth of stock indices due to the softening of geopolitical tension. Since the beginning of the week, the price of bitcoin increased by more than 10%, while Ethereum (ETH) has grown by almost 15%, despite a significant loss of market share in recent months.

For a week, Bitcoin traded in the range from $ 85,144 to $ 95,758, overcoming a psychologically important level of $ 90,000. The most significant increase occurred on April 22, when the cryptocurrency rate was 6.77%, rising from $ 87,516 to $ 93,442. This impulse was caused by the mitigation of the rhetoric of the US president Donald Trump. In relation to the federal reserve system and positive signals in the field of international trade relations.

From a technical point of view, Bitcoin successfully implemented a “double base” reversal model with minimums of $ 74,508 and $ 76,606, which allowed the price to recover by 26% of local minimums. The key resistance is the level of $ 95,500, the overcoming of which will open the way to the historical maximum in the area of $ 109,588. At the same time, the retention of prices above $ 90,000 is of critical importance for maintaining a bull impulse. Technical analysis in the hourly timeframe shows the potential for rapid growth up to $ 98,000 with a favorable information background.

The weakening of the US dollar to minimal values from March 2022 provoked a retirement of capital into alternative assets. It is unlikely that they expected a mass exit from dollar assets. A sharp fall in the dollar was associated with fears regarding the independence of the Fed after the criticism of its chairman Jerome Powell by President Trump. However, by the middle of the week the situation was stabilized after the statements that Powell was not planned.

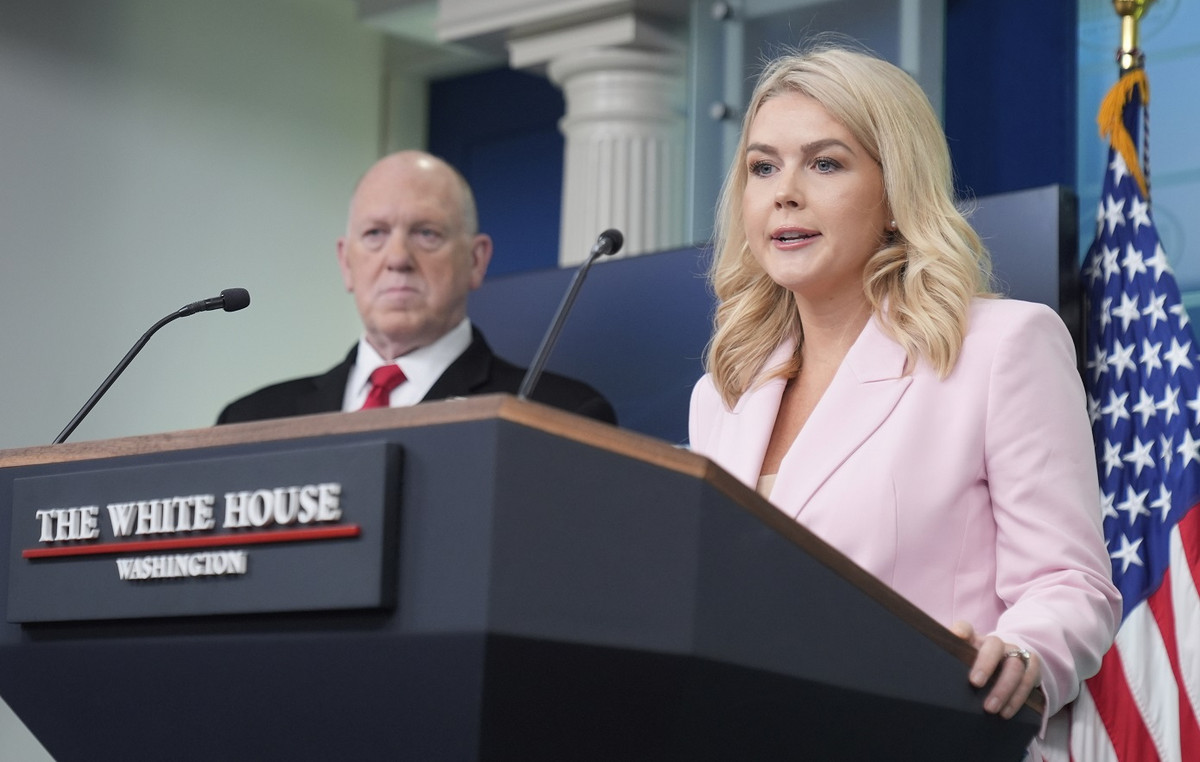

Events related to trade relations between the United States and China had a significant impact on the market. US Minister of Finance Scott Immentin announced progress in trade negotiations, and the White House confirmed active negotiations with 34 countries on trade agreements. Despite the official refutation of China, the fact of negotiations, information appeared from CNN and Bloomberg that the Chinese authorities without a public announcement began to cancel additional duties for some categories of goods from the United States, including semiconductors, and also provided benefits for the aviation industry.

It is also worth mentioning the appointment of the Atkins’s premises to the post of head of the US SEC, which can lead to a more favorable regulatory environment for the industry. In addition, on April 24, the federal reserve withdrew the order of 2022, in which banks were recommended to limit the interaction with cryptocurrencies, which significantly simplifies the process of institutional acceptance of digital assets.

Institutional investors continue to show interest in bitcoin: ETF set a new record for an influx of funds, attracting $ 1.83 billion investments in a short period of time. Strategy (ex-Microstratrategy) increased its portfolio by 6556 BTC, and the Japanese Metaplanet brought the volume of its investments to 5000 BTC, which confirms the trend of bitcoin to the category of “digital gold” for corporations.

Despite favorable conditions, the market is still faced with certain challenges. Short -term investors, fearing the repetition of recent sharp collapses, with a growth of 10% begin to fix profit, which creates constant pressure of sales. In addition, fears regarding the recession in the United States intensified – according to a survey of economists conducted by Bloomberg, the probability of a recession increased from 30% to 45%.

This week (April 28 – May 4), a number of key economic data are expected to have a significant impact on stock indices and, as a result, on the cryptocurrency market.

On April 30, data on US GDP will be published for the first quarter (growth is predicted by 0.4%, which is much lower than previous expectations), May 1 – data on the number of primary applications for unemployment benefits and business activity indexes in the production sector, and on May 2 – data on a change in the number of employees in the non -agricultural sector and the level of unemployment. If GDP data is negative, this can signal the beginning of the recession in the United States, which will affect global financial markets.

According to Bitriver, in the short term for Bitcoin, it is critical to consolidate above the level of $ 95,500, which will create prerequisites for the movement to the historical maximum. In turn, increased correction in the direction of $ 90,000 may indicate an ascending correction to the descending trend. In general, the external background remains favorable for continuing the rising movement, especially given the growth of stock indices on Friday, which can support bitcoin on weekends.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.