Elliott’s wave theory is a method for analyzing and predicting prices in financial markets by identifying various cycles (waves). Its founder was the American financier Ralph Nelson Elliott in the mid-1930s.

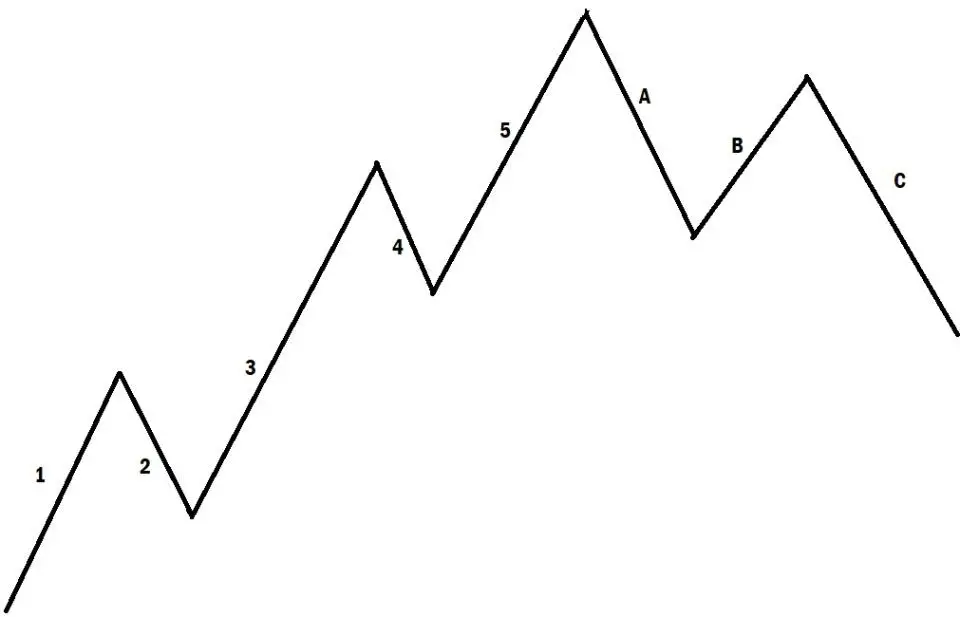

The theory is reduced to the definition of moving (impulse) waves and corrective ones. Elliot revealed that they constantly replace each other. At the same time, the pulse phase consists of five waves, and the correctional phase – of three. In the first case, the designations are carried out by numbers from 1 to 5, and in the second – English letters A, B, C.

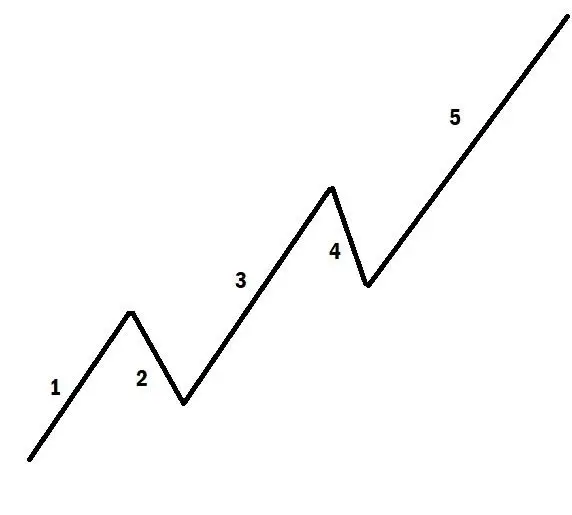

Impulse wave

Below is an example of an impulse consisting of five waves:

Inside the impulse itself, the waves are also divided into impulse and correctional. The first includes 1, 3 and 5, the second – 2 and 4. For each of them there are rules that are required to execute, otherwise the calculation of the waves will be incorrect:

-

The wave 2 should not fall below the beginning of the wave 1. If this happens, then there is no impulse on the market;

-

Corrective wave 4 cannot drop below the end of the wave 1;

-

The wave 3 cannot be the shortest among the impulse;

-

The maximum wave 5 can be both above the peak of the third wave, and below it in the case of “truncation”.

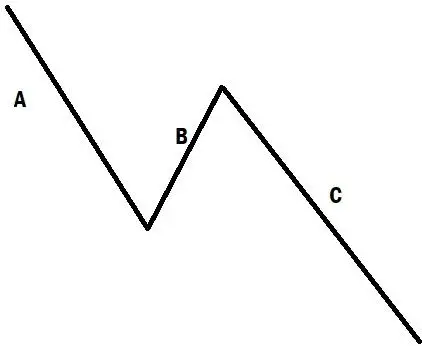

Corrective wave

Unlike the impulse, the correctional phase is represented only by three waves:

In the correction, unlike the impulse, only one rule: the wave B should not rise above the beginning of the wave A.. Otherwise, this is not a correction, but a continuation of the impulse. As a result, if you combine the pulse phase and correctional, you get a model of eight waves:

Wave theory and Fibonacci

Often the size of the waves is associated with the sequence of Fibonacci. So, many corrections relate to the previous pulse in relations 0.618, 0.5 or 0.382. Impulse waves can be connected in the same way. For example, the wave 5 can be 1.618 from the beginning of the wave 1 to the end of the wave 3. Other cases are possible: the wave 5 is 0.618, while the first four waves are 0.382, or vice versa. For example, we will use the monthly schedule of bitcoin and consider the period from November 2022 to January 2025, when the BTC showed an increase of $ 15,479 to $ 109,356.

The first growth wave happened from November 2022 to July 2023. During this period, Bitcoin rose from $ 15,479 to $ 31,818. The second wave was short enough and lasted from July to September 2022. Bitcoin during this time decreased from $ 31,818 to $ 24,920. At least the first wave – $ 15,479 – was not overcome, so everything satisfies the conditions. The third wave lasted from September 2022 to March 2024. Bitcoin over this period has grown from $ 24,920 to $ 73,794. Already at this stage, a condition was met where the third wave will not be the smallest of the impulse, since it was $ 48,874 ($ 73,794 – $ 24,920), while the first was $ 16,339 ($ 31,818 – $ 15,479). The fourth wave was recorded from March to August 2024. At this time, Bitcoin fell to $ 49,577. The fifth wave was formed from August 2024 to January 2025. Bitcoin during this period grew to $ 109,356. If we talk about the coefficients of Fibonacci, then the first three waves amounted to 0.618 of general growth. Thus, all conditions were met.

Source: TradingView.com

Pros and Minus of Eliott theory

The main plus of waves is their versatility: they can be used on graphs with any timeframes. The second advantage is the ability to quite reliably determine the phases of the turn in a particular cryptocurrency. The third positive point-the wave theory allows the traders to clearly set the stop applications to limit losses.

The main minus of the waves lies in their subjectivity. Traiders can interpret certain formations that occur on the graph in different ways. In addition, it is quite difficult. In order to trade profitably with the help of wave analysis, it is necessary to devote a lot of time to both theoretical and practical components.

Conclusion

Despite its almost centuries -old history, Eliott’s wave theory remains an important tool for crypto traders. This tool can be used when trading any coins on various timeframes. However, in order to succeed, it is necessary to work hard and earnest and be prepared for errors in the recognition of waves on the graphs.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.