This is what you need to know to trade today, Thursday, December 1:

December is already here, and this must be the time of Santa’s recovery. Santa arrived early Wednesday in the form of one Jerome Powell, delivering a parting gift. The Fed chair started off in a relatively grinch tone when talking about a higher terminal rate, but he left with gifts under the tree. The time for a pause in 75 basis point rate hikes may come as early as December, and this good cheer ignited the Christmas candle fireworks under stocks. The Nasdaq rose 4.4% on the good news. The PCE data that has just been published confirms this, so stocks are expected to continue this recovery.

The dollar, for its part, remains ill after breaking the 1.05 zone against the euro. The Dollar Index falls to 104.90. Oil is boosted by the weaker dollar and the reopening of China, rising another 2% to $82.30. Bitcoin rises to $17,100 and Gold rises to $1,786.

European markets Mixed: The FTSE and the Eurostoxx are up 0.4%, but the Dax is up 0.9%.

The futures Americans rise, the S&P 500 and Dow rise 0.3%, and the Nasdaq rise 0.5%.

Top Wall Street News

Fed Chairman Jerome Powell says the time to slow the pace may be in December.

The PCE shows that inflation is cooling off.

Reuters headlines

Dollar General Corp. (DG): The company raised its forecast for annual same-store sales, buoyed by strong demand for cheaper groceries and household staples from budget-conscious shoppers amid stubbornly high inflation.

Tesla (TSLA) is about to unveil its long-overdue Semi, a heavy-duty 18-wheeler.

Tesla It will issue software updates to more than 435,000 vehicles in China to fix a problem with its side marker lights that, in extreme circumstances, could lead to a collision, a regulatory body said.

Netflix (NFLX) will let more subscribers see content in advance – WSJ.

Salesforce Inc. (CRM): The San Francisco-based company said Wednesday that Bret Taylor will step down as co-CEO in January.

Snowflake Inc (SNOW): The cloud data company posted a bigger quarterly loss on Wednesday, hurt by a sharp jump in its research and development and marketing spending.

Apple Inc (AAPL): Elon Musk tweeted on Wednesday that the misunderstanding over Twitter’s possible removal from Apple’s App Store had been resolved following his meeting with iPhone maker CEO Tim Cook.

Chevron Corp (CVX): The oil company continues to work with the United States government to comply with sanctions on Venezuelan crude exports, Chief Executive Michael Wirth said on Wednesday.

Ford Engine (F): Detroit-based carmaker to invest an additional £149m to increase electric vehicle power unit capacity at its northern England engine factory by 70%, as the US automaker accelerates his impulse towards electricity.

Ryanair Holding Plc (RYAAY) & Shell Plc : The Irish airline signed a sustainable aviation fuel supply agreement with Shell, but its chief executive, Michael O’Leary, said it would take a “revolution” to reach its target of powering 12.5% of flights with this fuel by 2030.

taiwan Semiconductor Manufacturing Co (TSM): The chipmaker will offer advanced 4-nanometer chips when it opens its new $12 billion plant in Arizona in 2024.

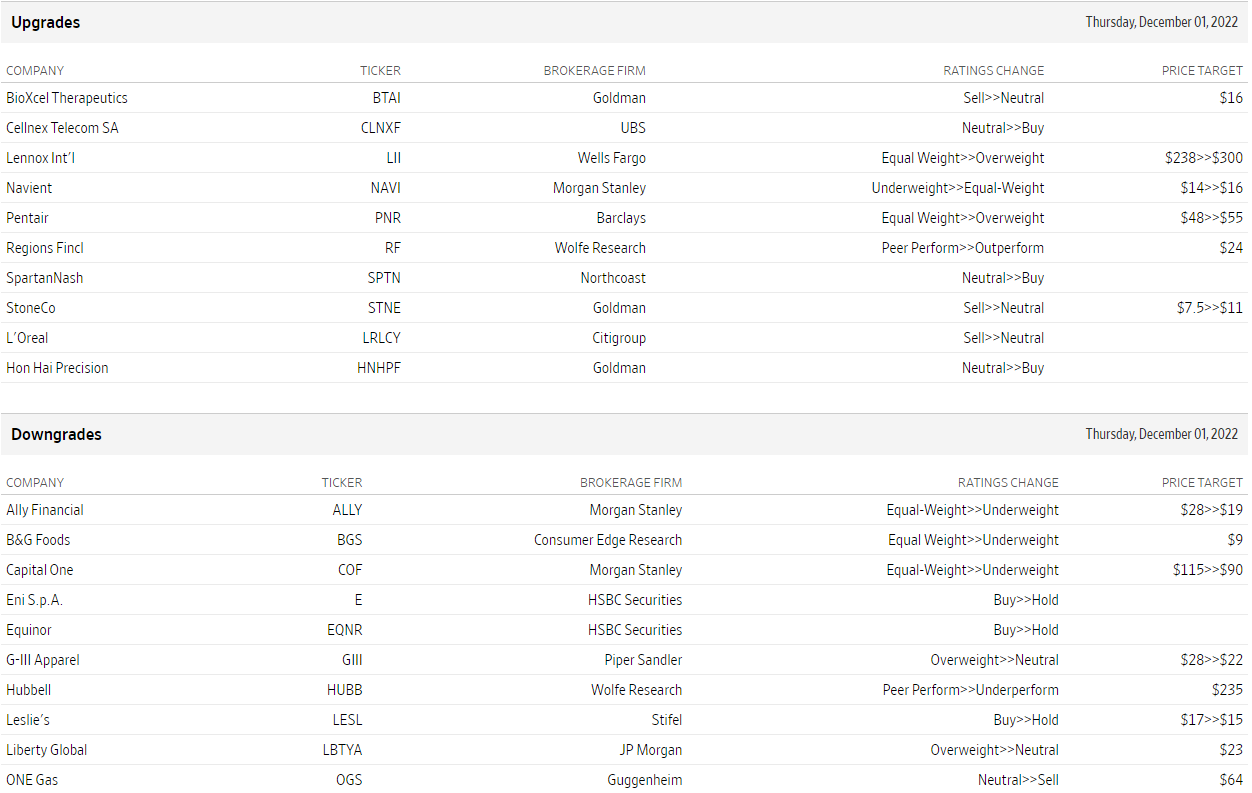

Ups and downs

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.