This is what you need to know to trade today wednesday november 23:

Stock markets continued their bullish mood on Tuesday, with more gains for the major indices. Falling bond yields helped, as did some recent results from the retail sector, which followed showing the resistance of the American consumer. However, volume was light in this shortened week, and that will continue to be the case today. We are likely to see some profit taking before the long weekend, and some headwinds could contribute to that. The news from China is not positivesince the new closures due to the covid are putting pressure on the reopening of the market.

Oil has risen to see that the Saudi government has denied the news from The Wall Street Journal. This is inflationary although it has since gone down as The EU seeks to put a low cap on Russian oil. The EU cap for gas is set at a very high level. Apple (APPL) appears to be in trouble with news of major disruptions and protests at its Foxconn-owned supplier factory. Finally, we will have the FOMC minutes later. Given how tough Powell was at the press conference, there’s no reason to expect the minutes to be much different.

This morning, the Petroleum it works its way back below $78. The dollar index It has gone down a bit, down to 106.96. The Prayed is trading at $1,735, and the Bitcoin it has risen to $16,500.

European markets are calm:

- Eurostoxx: -0.3%

- FTSE: flat

- DAX: flat

US futures are trading flat.

Wall Street News

It is rumored that The EU will put a cap of $65 to $70 on Russian oil.

Apple (AAPL): Reuters reports protests at the Foxconn factory.

Deere (DE) Post some good results.

HP (HPQ) announces big job cuts.

The Manchester United (MANU) goes up due to rumors of the sale of the club.

Guess (GES) down due to its weak prospects.

Credit Suisse (CS) down due to its capital increase plans.

Reuters news

Nordstrom (JWN): The company said Tuesday that net sales at its namesake retail stores fell 3.4% in its third quarter.

ConocoPhillips (COP) and Sempra Energy (SRE): Sempra Energy said Tuesday that ConocoPhillips will buy five million tons of liquefied natural gas (LNG) a year.

Alibaba Group (BABA): Debt-laden Chinese conglomerate Fosun International is trying to divest itself of a minority stake in Alibaba Group’s logistics arm Cainiao.

Berkshire Hathaway (BRKB): The Warren Buffett-owned investment firm has sold 3.23 million shares of Hong Kong-listed electric vehicle maker BYD for HK$630.33 million, according to a stock statement.

Elon MuskCEO of Tesla (TSLA)has stated that South Korea is among its top candidate locations for a factory it plans to build in Asia to make electric vehicles (EVs), according to the South Korean presidential office.

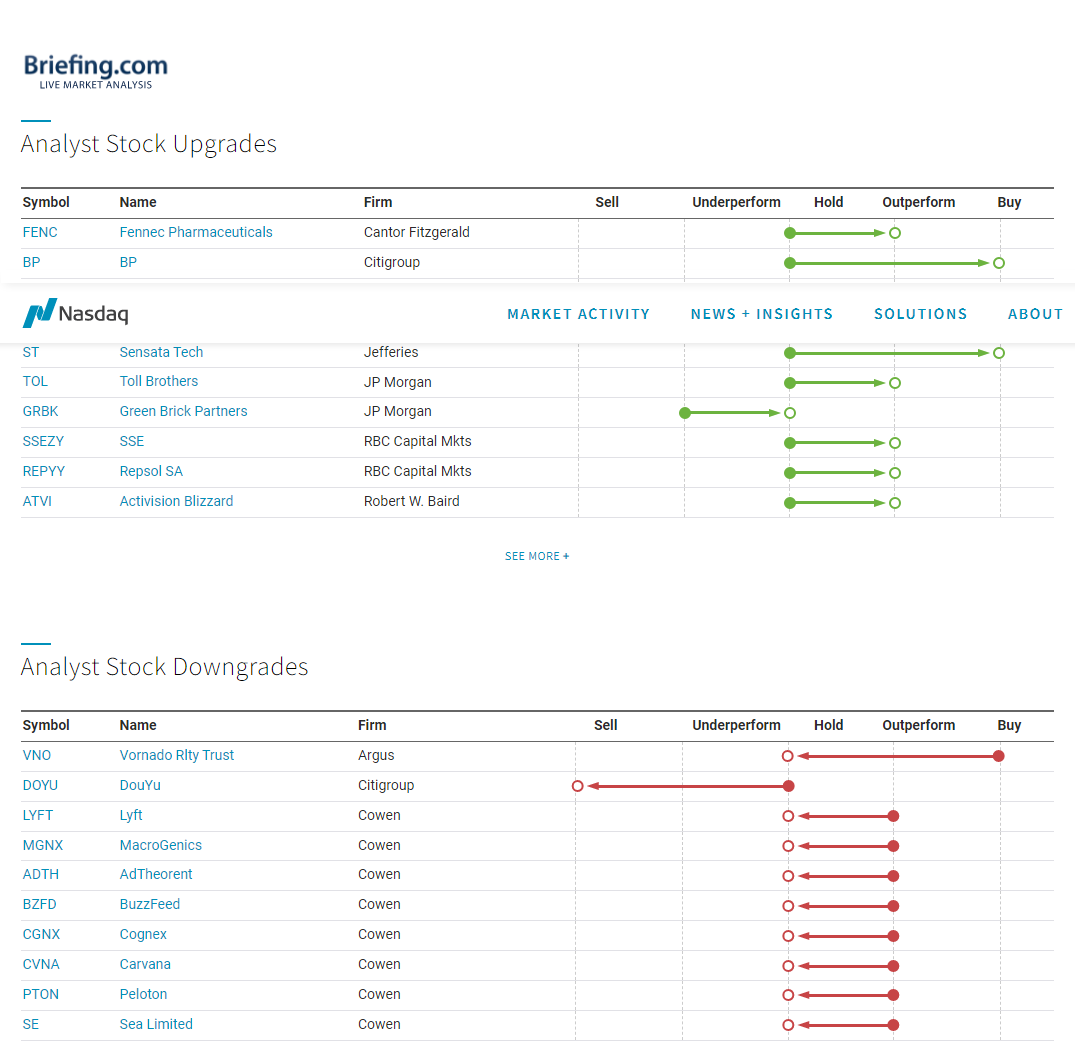

upgrades and downgrades

Source: Nasdaq.com

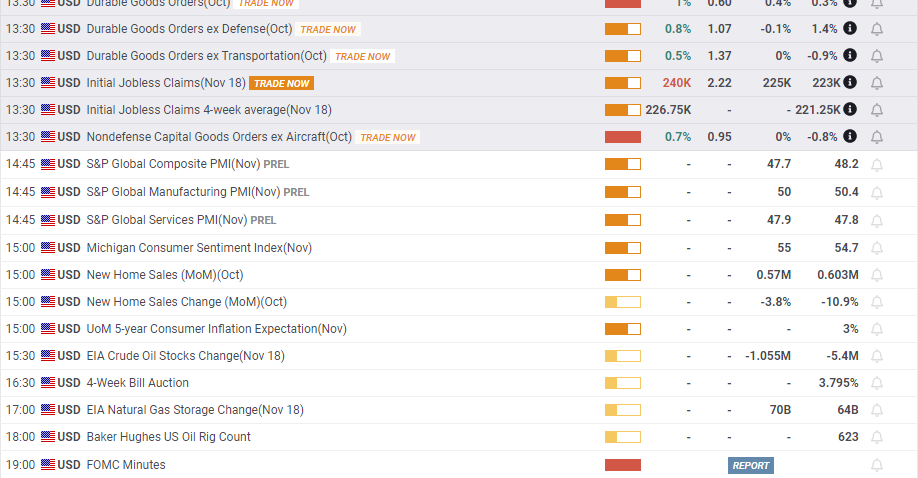

Economic data

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.