- USD/MXN is back above 20.00 as the dollar strengthens against emerging market currencies.

- The pair reaches the 100-day SMA and pulls back.

- Daily close above 20.25 points to more gains.

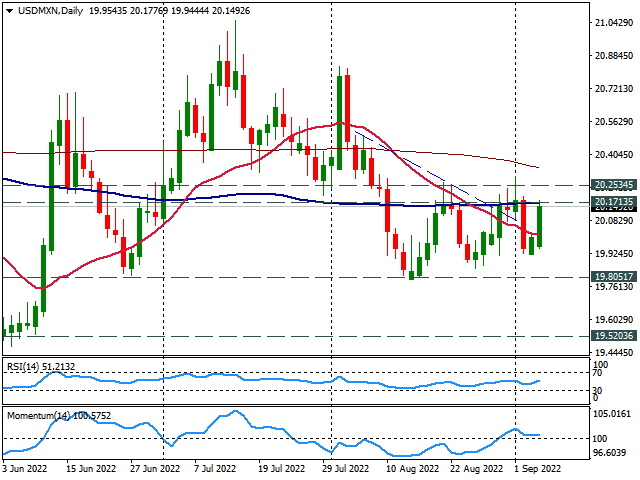

The USD/MXN rose for the second day in a row on Tuesday, buoyed by a stronger dollar and extending a bounce after approaching 19.90. The pair reached a high of 20.17, after the release of US economic data, matching the 100-day Simple Moving Average (SMA).

Immediate resistance is at 20.17; above, USD/MXN could rise to test 20.25. A breakout to the upside would change the short-term bias to neutral/bullish. A daily close above 20.25 would mean a positive evolution of the dollar, with the objective of reaching the 20.45 zone.

Since mid-August, the USD/MXN has been moving sideways in a range between 19.80 and 20.25. An interim support area is seen at 19.90. A firm break below 19.80 would further weaken the dollar, exposing it to 19.72.

USD/MXN daily chart

Technical levels

USD/MXN

| Panorama | |

|---|---|

| Last Price Today | 20,177 |

| Today’s Daily Change | 0.1753 |

| Today’s Daily Change % | 0.88 |

| Today’s Daily Opening | 20,0017 |

| Trends | |

|---|---|

| 20 Daily SMA | 20.0244 |

| 50 Daily SMA | 20.2911 |

| 100 Daily SMA | 20.1694 |

| 200 Daily SMA | 20.3516 |

| levels | |

|---|---|

| Previous Daily High | 20.0295 |

| Previous Daily Minimum | 19.9447 |

| Previous Maximum Weekly | 20.2946 |

| Previous Weekly Minimum | 19.9114 |

| Monthly Prior Maximum | 20.8261 |

| Previous Monthly Minimum | 19.8019 |

| Daily Fibonacci 38.2% | 19.9971 |

| Daily Fibonacci 61.8% | 19.9771 |

| Daily Pivot Point S1 | 19.9544 |

| Daily Pivot Point S2 | 19.9072 |

| Daily Pivot Point S3 | 19.8696 |

| Daily Pivot Point R1 | 20.0392 |

| Daily Pivot Point R2 | 20.0768 |

| Daily Pivot Point R3 | 20.1241 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.