- USD/JPY bears are testing the support of the structure protecting yesterday’s closing price.

- Bears will remain in control as long as they are below the micro-trend line resistance.

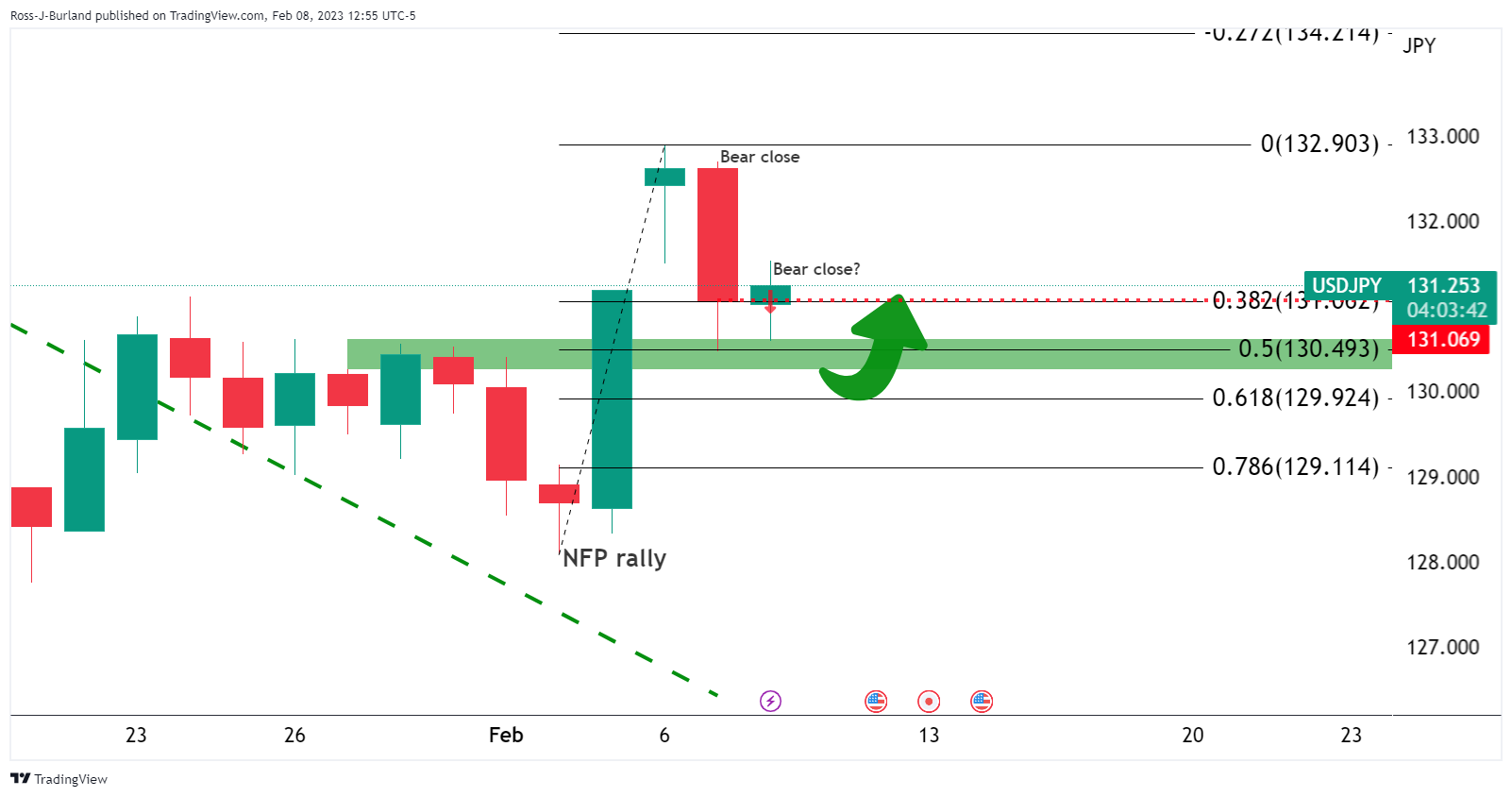

USD/JPY is starting to break out of the bullish structure and bears are moving in as the US dollar comes under pressure after a recovery. Below is a bias to the downside based on closing prices for the week so far, with Tuesday breaking Friday’s Nonfarm Payrolls-induced recovery that had led to two days of higher closings.

USD/JPY daily chart

The thesis is bullish now that the price has broken the previous resistance of the downtrend line. However, after the breakout on Friday, a correction is in the offing and the question is how far does it have to go yet?

The thesis is that the most common thing, after such a strong bearish close, is that the following day or days continue to fall following the momentum of the first day. Therefore, Wednesday would be a high probability short setup:

However, so far the bulls have managed to rally the day, approaching the lows around 130.60 in the London session and pushing the bears back to a high of 131.53 in the US session. For the thesis to be true, the bears have to return below Tuesday’s closing price of 130.99, and as of this writing, about 20 pips remain. The ATR is around 170 pips and the range for the day so far has been 94 pips so there is room for further momentum from the bears.

USD/JPY M15 chart

Bears are testing the support of yesterday’s closing price structure, but will remain in control as long as they are below the micro-trend line resistance.

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.