- USD/JPY was down 0.13% at 145.68, pressured by disappointing US labor market data and lower-than-expected GDP growth in the 2nd quarter.

- The 10-year US Treasury yield falls to 4.102%, further weakening the dollar, while the DXY index falls 0.43% to 103.041.

- BOJ board member Naoki Tamura notes that inflation is “clearly in sight,” pointing to a possible end to negative rates next year, which could further strengthen the yen.

He Japanese Yen (JPY) posts back-to-back positive sessions against the US dollar (USD), which remains under lower pressure after last Tuesday’s data showed that the US job market is cooling off. Today’s data reinforced the latter, easing pressure on the US central bank to raise borrowing costs. USD/JPY is trading at 145.68, shedding 0.13%, after hitting a daily high of 146.84.

Yen Gains Momentum Against a Dollar Battered by Labor and GDP Data

The dollar extended its losses thanks to weaker than expected growth data. The US Commerce Department’s second-quarter Gross Domestic Product (GDP) came in 2.1% below previous government estimates of 2.4%, up from 2% in the first quarter. This data, together with the ADP national employment report, which missed estimates of 195,000 and stood at 177,000, revealed that the labor market is running out of steam.

On Tuesday, the US Department of Labor revealed 1.51 job openings for every unemployed person, the lowest ratio since September 2021, up from 1.54 in June.

In the face of worse than expected economic data, US Treasury yields fell. The 10-year US Treasury yield fell two basis points to 4.102%, putting a headwind for USD/JPY due to its close positive correlation. This hurt the US dollar (USD), which according to its index, the Dollar Index (DXY) fell 0.43% to 103.041.

On the Japanese front, Bank of Japan (BoJ) board member Naoki Tamura said inflation is “clearly in sight”, indicating that negative rates could come to an end next year. Market participants are watching the BoJ’s next move as it is the only global central bank easing its monetary policy. Once the BOJ normalizes its monetary policy, broad strength in the Japanese Yen (JPY) is expected. It could pare its losses of 11.22% yoy against the dollar, suggesting further USD/JPY decline is in store.

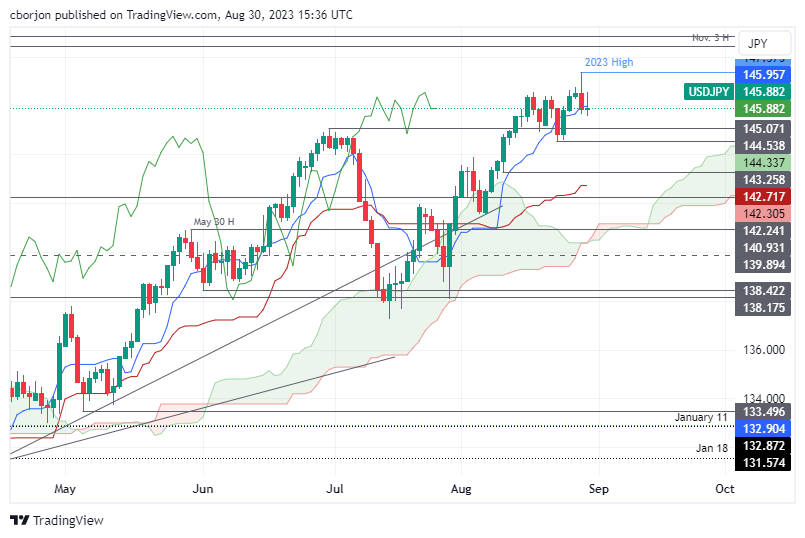

USD/JPY Price Analysis: Technical Perspective

From a technical perspective, USD/JPY remains biased to the upside, although the pair’s slide below the Tenkan-Sen line at 145.95 could open the door for a pullback, with support emerging at the June 30 daily high turned support at 145.07. Otherwise, if the buyers retrace the Tenkan-Sen line, the next stop would be 146.00. Otherwise, if the buyers recapture the Tenkan-Sen line, the next level would be 146.00. Breaking past this last level would pave the way to test the year-to-date high at 147.37.

USD/JPY

| Overview | |

|---|---|

| Last price today | 145.81 |

| today’s daily change | -0.07 |

| today’s daily variation | -0.05 |

| today’s daily opening | 145.88 |

| Trends | |

|---|---|

| daily SMA20 | 144.87 |

| daily SMA50 | 143.04 |

| daily SMA100 | 140.14 |

| daily SMA200 | 136.73 |

| levels | |

|---|---|

| previous daily high | 147.38 |

| previous daily low | 145.67 |

| Previous Weekly High | 146.64 |

| previous weekly low | 144.54 |

| Previous Monthly High | 144.91 |

| Previous monthly minimum | 137.24 |

| Fibonacci daily 38.2 | 146.32 |

| Fibonacci 61.8% daily | 146.72 |

| Daily Pivot Point S1 | 145.24 |

| Daily Pivot Point S2 | 144.6 |

| Daily Pivot Point S3 | 143.53 |

| Daily Pivot Point R1 | 146.95 |

| Daily Pivot Point R2 | 148.02 |

| Daily Pivot Point R3 | 148.66 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.