- USD/JPY is rising on Thursday, testing territory above 151.00.

- Late USD breakout driven by rally in US Treasury yields.

- Japan’s trade balance data disappointed expectations, further eroding the Yen.

The pair USD/JPY continues to advance in the session on Thursday, looking for new offers above the 151.00 area.

USD/JPY made a new intraday high near 151.30. Treasury yields reacted higher following lower-than-expected institutional demand at an auction of 30-year US bonds.

St. Louis Federal Reserve (Fed) President Kathleen Paese has also echoed concerns that the general public’s expectations may be misaligned with the Fed’s current policy path going forward. . St. Louis Fed President Paese’s comments are likely to have limited effect as Paese serves as an interim non-voting substitute on the Federal Open Market Committee (FOMC).

Japan’s current account figures disappointed expectations early on Thursday, as the non-seasonally adjusted main current account for September came in at 2.723 trillion yen, below the 3 trillion expected but still making a small improvement. compared to the 2,279 billion in August.

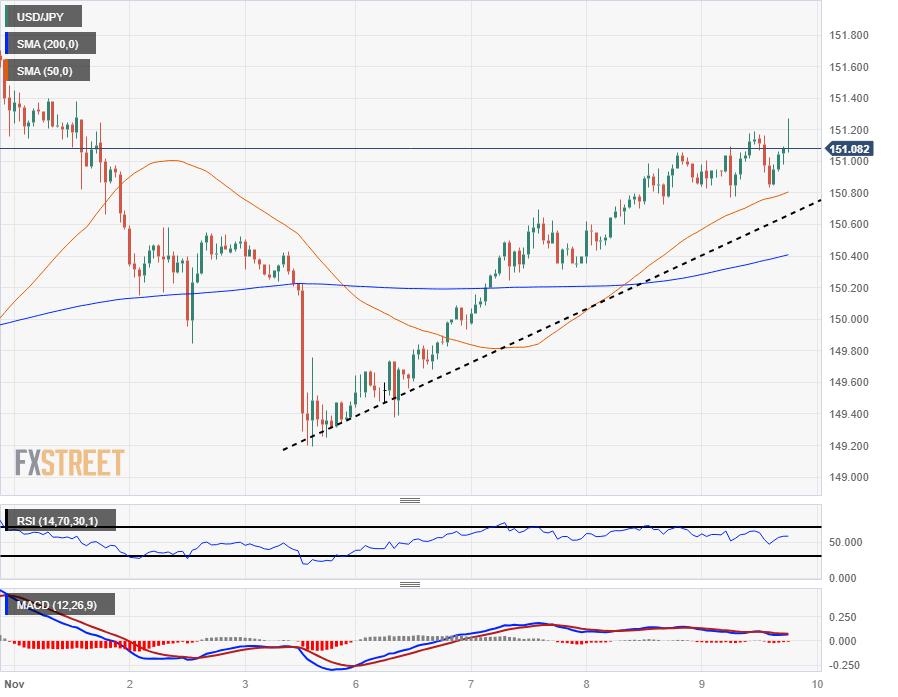

USD/JPY Technical Outlook

The Dollar-Yen pair is currently in play around the 151.00 zone, looking for a bullish continuation as the USD continues to push higher and above the JPY.

Short-term action has the pair slowing its recent pace of bullish momentum, with the 50-hour Simple Moving Average (SMA) starting to catch up with intraday bids, but the pair remains firmly bullish with the 200-hour SMA near 150.40, with enough room in between for a pullback to signal a potential bid opportunity for investors looking to jump in and make a new challenge.

USD/JPY Hourly Chart

USD/JPY technical levels

USD/JPY

| Overview | |

|---|---|

| Latest price today | 151.1 |

| Today I change daily | 0.10 |

| Today’s daily variation | 0.07 |

| Today’s daily opening | 151 |

| Trends | |

|---|---|

| daily SMA20 | 150.06 |

| daily SMA50 | 148.89 |

| SMA100 daily | 146.01 |

| SMA200 daily | 140.69 |

| Levels | |

|---|---|

| Previous daily high | 151.06 |

| Previous daily low | 150.33 |

| Previous weekly high | 151.72 |

| Previous weekly low | 148.81 |

| Previous Monthly High | 151.72 |

| Previous monthly low | 147.32 |

| Daily Fibonacci 38.2 | 150.78 |

| Fibonacci 61.8% daily | 150.61 |

| Daily Pivot Point S1 | 150.53 |

| Daily Pivot Point S2 | 150.07 |

| Daily Pivot Point S3 | 149.8 |

| Daily Pivot Point R1 | 151.26 |

| Daily Pivot Point R2 | 151.53 |

| Daily Pivot Point R3 | 151.99 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.