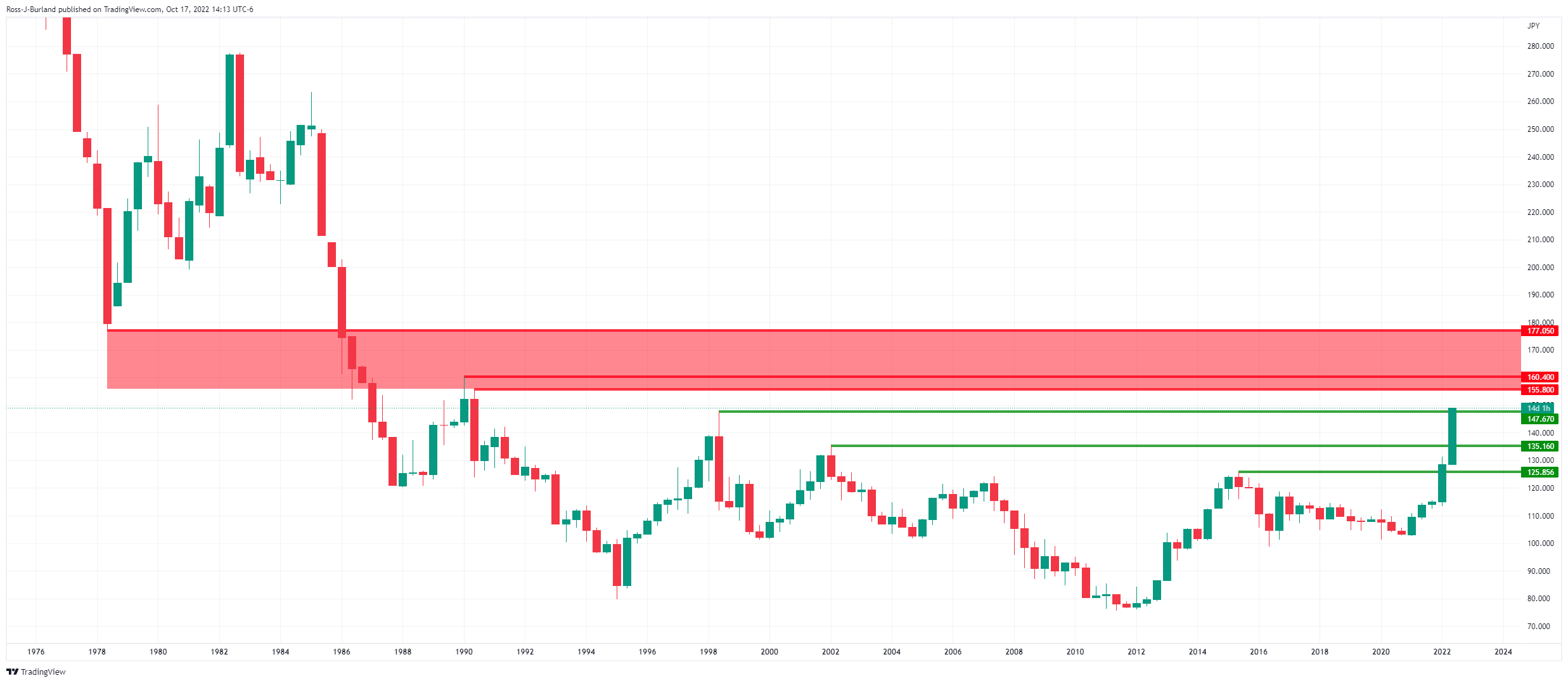

- The Japanese yen hits a new 32-year low.

- Will the BOJ intervene again this week?

The USD/JPY has broken above the 149.00 level according to the following 5-month chart:

The bulls have a chance to rally to the psychological level of 150, where there is speculation of a new intervention by the Japanese authorities. Earlier in the week, Japan’s top foreign exchange diplomat, Masato Kanda, said authorities would respond firmly to any excessive fluctuations in the currency.

Each country would respond appropriately to the agreement on foreign exchange market movements reached at last week’s Group of Seven (G7) and G20 meetings,” he said.

Japan’s Finance Minister Shun’ichi Suzuki has also weighed in and said that they will take decisive action against excessive currency movements based on speculation. Suzuki says that they are constantly monitoring currency movements with a sense of urgency.

The yen has already fallen almost 30% against the dollar this year, due to the divergence between the hawkish stance of the US Federal Reserve and the ultra-liberal policy of the Bank of Japan. Last month, Japanese authorities carried out the largest currency intervention in their history to support the yen’s rapid decline, spending 2.84 trillion yen on their efforts, which had a fleeting effect.

Meanwhile, the US dollar weakened against a basket of major currencies and the pound sterling rose on Monday after Britain’s new finance minister dumped most of the government’s “mini-budget”, while some earnings Better-than-expected Bank of America credits helped boost risk appetite.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.