- Private hiring in February increased by 145,000 people, below expectations.

- The ISM Non-Manufacturing PMI falls to 51.2, disappointing expectations and the previous month’s reading.

- USD/CHF Price Analysis: Bullish continuation requires recapture of 0.9100 resistance; otherwise, further losses will occur below 0.9000.

He USD/CHF hits a fresh yearly low at 0.9005 but bounces as risk aversion momentum sees a flight to safety as evidenced by lower US stocks. Growing concern in the United States (USD) arose after the latest tranche of US economic data raised the likelihood of a recession. At the time of writing, the USD/CHF pair is trading at 0.9070.

Wall Street fluctuates between gains and losses. US Treasury yields continued to fall as the bond market rallied, thanks to investors seeking safe haven. USD/CHF fell to multi-month lows, though regained some ground after US data revealed heightened recession fears.

The ISM Non-Manufacturing PMI came in at 51.2 points, below the 54.4 expected, and was below the previous month’s reading of 55.1 points. Deteriorating business activity and declining growth in new orders were the causes of the decline. Earlier, the ADP Employment Change report showed that private hiring in February increased by 145,000 positions, below the 200,000 forecast, down from January’s upwardly revised figure of 261,000.

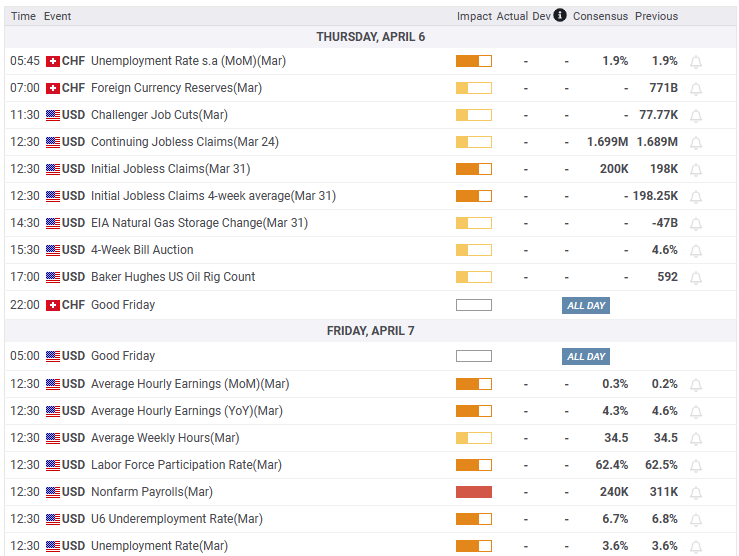

Background: Labor market indicators suggest a recession in jobless claims, which could pave the way for a weak Nonfarm Payrolls report. Consensus estimates that the US economy created 240,000 jobs in March, down from 311,000 in February.

USD/CHF Technical Analysis

On the daily chart, the USD/CHF pair continues to fall. Wednesday’s slide towards a multi-month low around 0.9005 and a late recovery is forming a hammer, which, preceded by a downtrend, can exacerbate a bullish correction. For a bullish continuation, USD/CHF needs to recover 0.9100. Above resistance, a previous support trend line turned into resistance around 0.9170-0.9180, which would be the next bid zone, before testing the 20 day EMA. Otherwise, USD/CHF could extend its losses below 0.9000.

what to watch out for?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.