- The Canadian economy grew at a 0% annualized pace in the fourth quarter, justifying the Bank of Canada’s pause in raising rates.

- US House Prices fell, while the Dollar continued to trade lower.

- USD/CAD Price Analysis: Upside is warranted with a daily close above 1.3600.

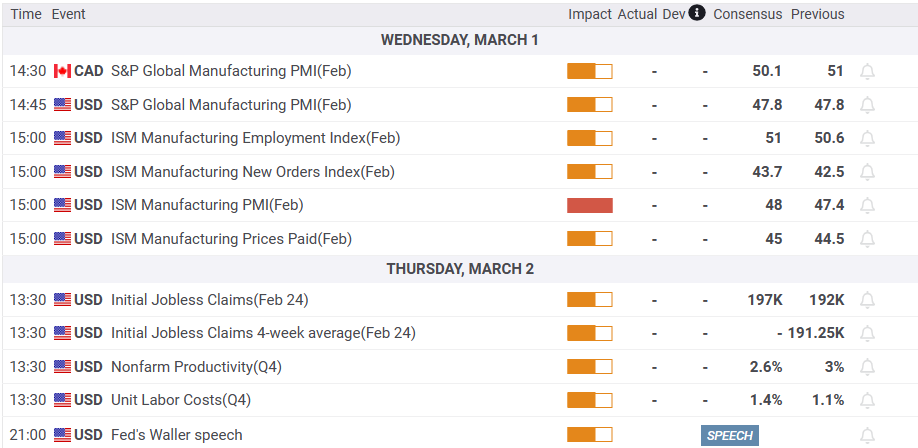

Following the dismal economic data reported from Canada, the USD/CAD It advances towards 1.3600, while the US dollar (USD) registers some losses. Additionally, market sentiment soured as US stocks opened lower. At the time of writing, USD/CAD is trading around 1.3610.

Canadian GDP flat, a tailwind for USD/CAD

Statistics Canada revealed that fourth quarter Gross Domestic Product (GDP) came in at 0% qoq, below the 2.9% expected. According to the agency, the accumulation of inventories and the decrease in business investment, mainly in machinery and equipment, were the causes of the lower growth in the fourth quarter.

This reading makes it unlikely that the Bank of Canada (BoC) will raise rates further, as it will not want to exacerbate weak growth by raising borrowing costs. The BoC announced at its last monetary policy meeting that it would pause rate hikes, and the GDP data reinforces that promise. This is CAD negative and therefore further USD/CAD strength is warranted as instead the US Federal Reserve (Fed) is expected to continue its tightening cycle. There is speculation in financial markets that the Fed could go as high as 6%, according to Bank of America (BofA) Global Research.

The USD/CAD pair rallied after the data release, reaching a daily high of 1.3609. However, when things calmed down, the major pairs fell back to the 1.3590 area.

In the United States, House Prices fell 0.1% month-on-month in December, according to data released Tuesday by the Federal Housing Finance Agency. At the same time, the S&P/Case-Shiller home price index stood at 4.6% year-on-year in December, down from 6.8% in November and analysts’ estimate of 6.1%.

USD/CAD Technical Analysis

The USD/CAD daily chart shows the pair biased higher after bottoming around 1.3200. Since hitting lows at 1.3262, the USD/CAD has extended its gains and broken above crucial resistance zones such as the 20, 50 and 100 day EMAs. Therefore, interest rate differentials and technical momentum could pave the way for further hikes.

The next resistance for USD/CAD would be the daily high at 1.3609. A break of the latter would expose the yoy high at 1.3685, ahead of 13700, followed by the Nov 3 swing high at 1.3808.

To consider

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.