- USD/CAD bulls find resistance in BoC-induced sell-off correction.

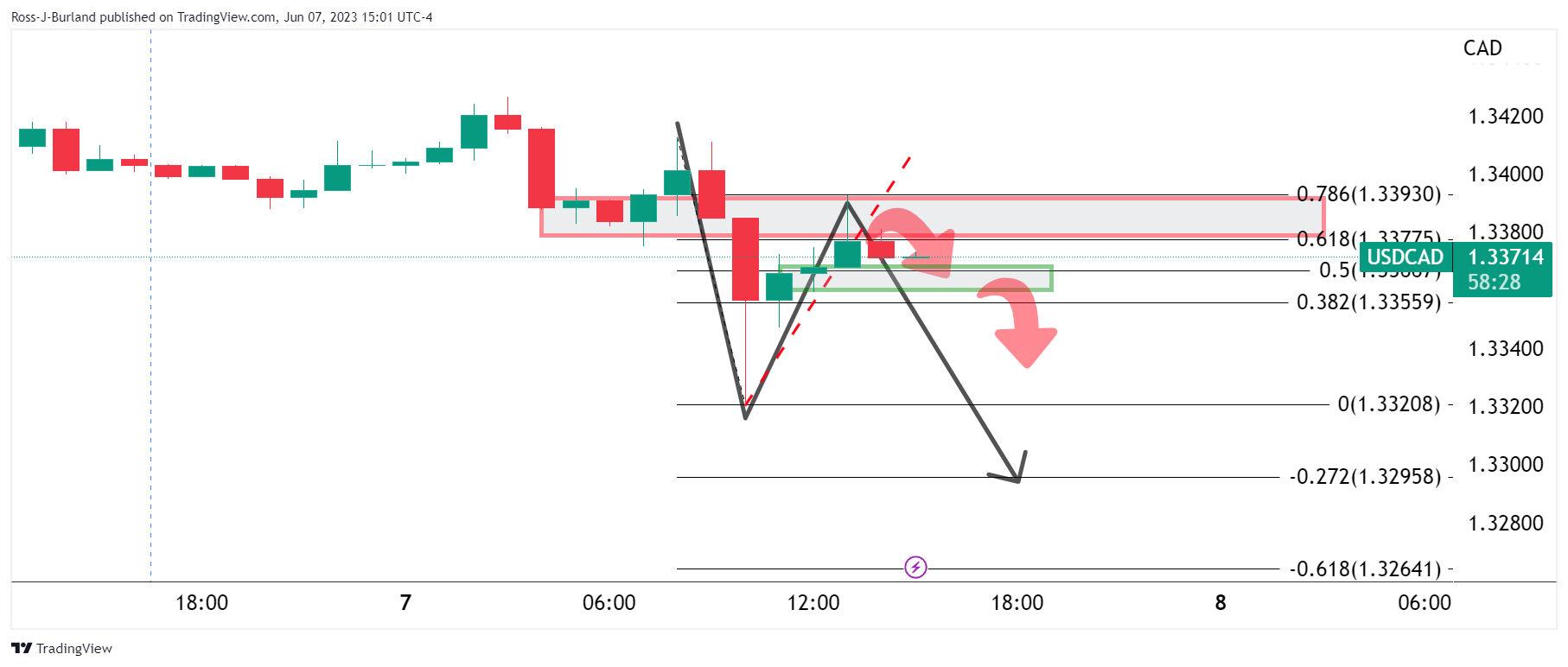

- USD/CAD bears eye an extension to the downside if it breaks the 15-minute support zone between 1.3370 and 1.3360.

The Canadian dollar hit four-week highs against the greenback on Wednesday after the Bank of Canada said it would continue to raise interest rates next month after tightening for the first time since January. The Bank of Canada showed its cards to the market by warning that inflation could be significantly above its 2% target amid persistently strong economic growth.

This has flipped the technical script ahead of the US Consumer Price Index and Federal Reserve events next week, putting bears back in control as the following technical analysis will illustrate:

USD/CAD daily chart

The bears are targeting the lows and we could see more selling after this correction. However, traders would be watching CPI and Fed events early next week and therefore we could see some risk reduction in events that would likely see bearish momentum slow as outlined above. .

1 hour and 15 minute chart

At the moment though, it appears that the correction is slowing down at resistance and this could lead to further selling pressure in the sessions and days ahead before the end of the week. An extension to the downside could occur if the 15 minute support zone between 1.3370 and 1.3360 gives way and sellers could be encouraged to rally below 1.3350.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.