- The dollar rebounds and is once again under the control of the bulls.

- Dollar bulls are targeting 105.35 and 106.00 thereafter.

The US dollar (DXY) is trading in confluence with the lingering inflation theme, as data over the past few days has turned the tables and reversed the script regarding the timing of a Fed turnaround.

Rising Treasury yields and the forecast of a 5.3% Fed funds terminal rate have led to a resurgence in the Dollar Index, DXY. This index measures the dollar against a basket of currencies, as the following Technical Analysis will illustrate, which leans with a bullish bias:

Given the fundamentals outlined above, does the dollar have room to go higher until major resistance is seen?

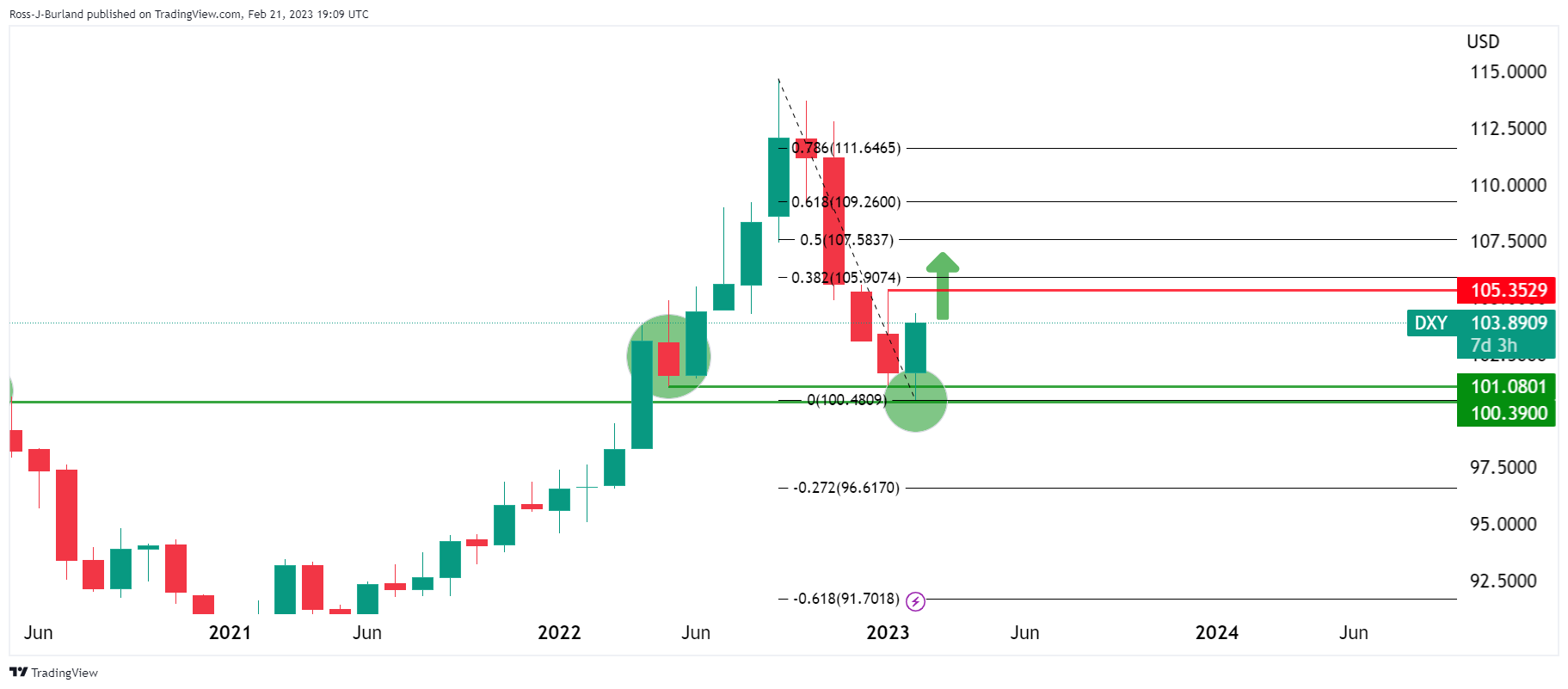

DXY monthly chart

Looking at the chart above and the monthly structures, we can see that there has been a lot of reaction from the recent lows near 101.00 over many months of history on the DXY Index. If the index is going to continue to use this as support, where is the next area of liquidity for the dollar based on the DXY chart?

Considering the bidding momentum on the monthly chart, it is clear that the bulls are in control and by some margin, with 105.35 in the spotlight:

The 38.2% fibonacci retracement is also convincing near 106.00.

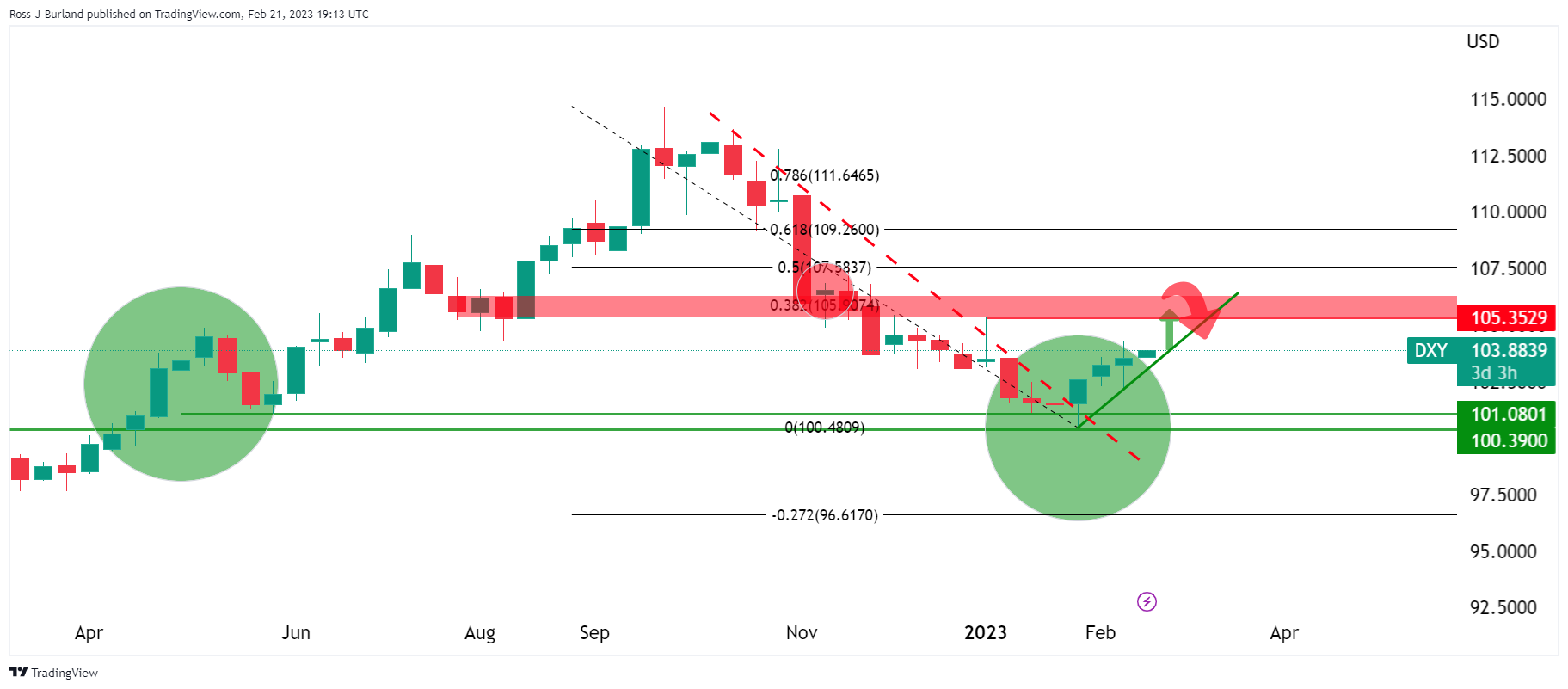

On the weekly chart, 106 is considered a clear target and resistance zone:

From a daily point of view, 104.30 is immobilized, but there is room to the upside after the correction in the old resistance that now acts as a support structure.

In conclusion, being in front of the dynamic support line, the bulls can target at least the space between today’s highs and all the way to the early year highs near 105.35:

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.