Bitcoin

The cost of bitcoin from April 4 to 11, 2025 fell by 1.64 %. At the same time, at the minimum of the week, the first cryptocurrency was traded below $ 74,500. The last time the BTC was less than November 6, 2024. Nevertheless, an increase of 8.33 % on Wednesday, April 8, raised the price of an asset above $ 80,000.

Source: TradingView.com

The main catalyst for the movement of all markets in the world in April 2025 is the import duties of Donald Trump. Import to America from China will have to be subjected to breathtaking 145%. It is worth noting that China this week first announced duties from goods from the United States by 84%, and later – 125%. Such mutual countermeasures will lead to anything else, as an increase in prices, which should be very much hit on the wallet of people. As a result, cryptocurrencies are still falling. Investors do not know what actions should be expected from the US authorities, and prefer

Do not invest In risky assets with high volatility.

Against the background of what is happening, published data on inflation in the United States for March turned out to be very positive. The annual indicator decreased from 2.8% to 2.4% in February. In March, a total drop in prices by 0.1%was recorded. This is the first such case from May of the Pandemium 2020. Nevertheless, the crypto -investors met the unconditionally positive news quite cold. While all their attention

absorbed Trump’s new extravagant actions.

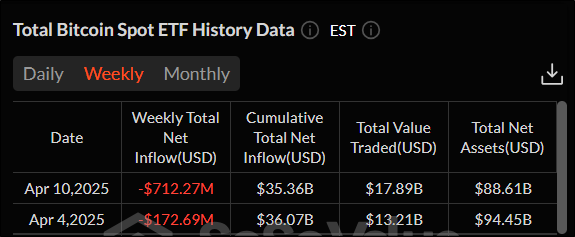

Negative dynamics has also developed in the spotal ETF on bitcoin. The outflow of funds from these exchange funds have been recorded all week. In total, they amounted to $ 712.27 million. This is the second consecutive, when investors prefer not to invest in ETF, but to take money from there.

Source: sosovalue.com

From the point of view of technical analysis, bitcoin remains on the territory of the bears. The descending trend is confirmed by the fact that the price is still located below the 50-day sliding average (indicated in blue). In addition, the RSI does not reach the value of 50 – the sign also bears a bearish character. Support and resistance levels: $ 74,434 and $ 89 164, respectively.

Source: TradingView.com

Index

Fear and greed He sank compared to last week by three points. Now its value is 25. This suggests that extreme fear reigned in the moods of crypto -investors.

Ethereum

The broadcast collapsed from April 4 to 11 at once by 14.44%. The second in capitalization of cryptocurrency in the moment even dropped below $ 1,400. This has not happened to it for more than two years – since March 2023.

Source: TradingView.com

Trump’s actions have an obvious effect on the air. However, ETH has its own problems. For example, these are high commissions that lead to the fact that some users prefer other networks or second -level solutions. As a result, an increase in activity in the Ethereum network does not reach similar indicators among competitors. For example, if you take unique active wallets (UAW), that is, those related to decentralized applications, then over the past 30 days their number has decreased by 33%. At the same time, competitors of Polygon, Tron and Arbitrum demonstrated an increase of 14% to 113.5%.

Source: Dappradar.com

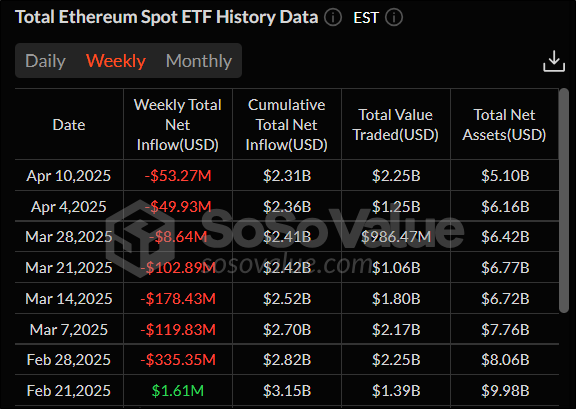

The dynamics of spotes ETF on air, as well as in BTC funds, leaves much to be desired. Firstly, the activity itself is quite low. Secondly, there is an outflow of funds. Over the past seven days, the net outflow amounted to $ 53.27 million. In general, it was the seventh contract, when money is withdrawn from spotal ETFs, and not vice versa.

Source: sosovalue.com

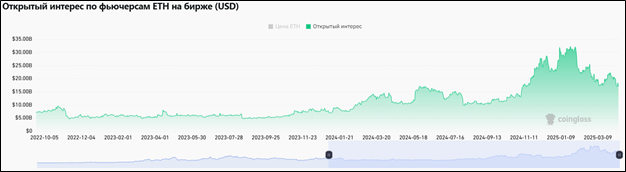

Open interest – the number of fixed -term air contracts – fell to $ 16.95 billion. This is almost half as much as it was at the maximum in January 2025. In addition, this is a minimum of the past six months. Thus, there is a decline in the desire of crypto -investors to invest in derivative financial instruments on ETH, and as a result, in the Coin itself.

Source: Coinglass.com

From the point of view of technical analysis, the ether remains in the descending trend. This is evidenced by the fact that the price is below the 50-day sliding average (indicated in blue). In addition, the trend not only does not fade, but rather worsen. The bear trend is only strengthened, which is indicated by the growth of the ADX indicator. The former level of support – $ 1,754,2 – has now become resistance. The current level of support is a minimum of the past week, $ 1,385.7.

Source: TradingView.com

BNB

The BNB price from April 4 to 11 decreased by 2.38 %. At the same time, the week was strictly divided into two halves. In the first BNB, he fell mercilessly, bargaining at a minimum of $ 518.8, and in the second, on the contrary, showing growth up to $ 580.

Source: TradingView.com

The successes of the second half of the week are largely explained by the implementation of the Lorentz hardforte in the BNB Chain test network. This made it possible to reduce the block time in the BSC network to one and a half seconds, and in OPBNB to 0.5 seconds, increasing the speed of transactions and work efficiency. The implementation of updates on the main network is scheduled for April 21 and 29. It is worth noting that the next major Maxwell update is scheduled for June 2025. As a result, the time of the block should be

Reduced up to 0.75 seconds.

Also, from positive aspects, an increase in the number of active addresses can be noted. Over the past year, BNB Chain

I took it The second place in this indicator with 27.7 million. The leader became SOLANA with 68.9 million. recognized capitalization leaders, bitcoin and ether are located in the fifth and sixth places with 10.9 million and 6.6 million, respectively.

In addition, institutional investors are interested in BNB. This week Grayscale Management Company

I presented it A list of crypto acts for consideration for the second quarter of 2025. One of 35 cryptocurrencies was Binance Coin (BNB). Thus, the leadership will consider the possibility of including an asset in its new products.

In terms of technical analysis, BNB in a descending trend. This is indicated by the price of the price below the 50-day sliding average (indicated in blue), as well as the negative value of the MACD histogram. Support and resistance levels are located in marks $ 508.1 and $ 645.3, respectively.

Source: TradingView.com

Conclusion

Donald Trump, with his duties and the trade war, remains the main stumbling block for the growth of crypto. If the decision of the American president was relatively soft for bitcoin and BNB, then the broadcast has fallen much more – this is also explained by high commissions and a decrease in the network.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.