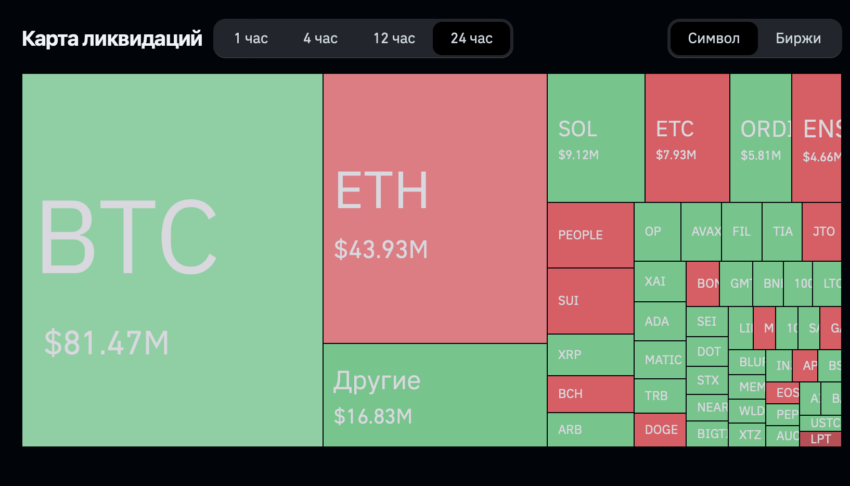

The total amount of liquidations on the crypto market over the past 24 hours exceeded $220 million. Most of the forced closed positions were in BTC and ETH.

A sharp jump in the price of Bitcoin to a new maximum of $49 thousand and the subsequent pullback cost traders $81.47 million. Market participants who opened positions in Ethereum (ETH) also suffered significant losses – the rise of the second largest cryptocurrency by capitalization to $2,700 cost them $43.93 million.

More than 90% of forced closures were distributed between Binance, Bybit, OKX and CoinEx. The largest order was executed by Binance: the exchange liquidated short BTCUSDT in the amount of $6.61 million.

What's happening to the price of Bitcoin

The start of trading in shares of spot Bitcoin ETFs from a number of issuers, including BlackRock and Grayscale, provoked a sharp increase in the price of Bitcoin. On the day the instrument was launched, BTC came close to the $49 thousand level, but after that it corrected.

At the time of writing, the asset is trading around $45,900.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.