- The US dollar is listed lateralized on Tuesday after reaching a minimum of three years on Monday.

- The markets prepare for a series of speakers of the Fed and the profits of Tesla after the closing of the session.

- The American dollar index remains below the 100.00 mark while Trump intensifies his attacks against the Fed president, Jerome Powell.

The American dollar index (DXY), which tracks the performance of the US dollar (USD) compared to six main currencies, quotes in general plane on Tuesday about a minimum of three years, consolidating the losses of Monday. The markets were surprised when the US dollar suffered a fall during negotiation hours in Asia, while European and American markets operated with limited capacity due to Easter Monday’s bank holiday. The president of the United States, Donald Trump, has changed his approach to the Federal Reserve (Fed) and lashed out at its president, Jerome Powell, calling him “a great loser” for not lowering interest rates, while looking for ways to get rid of the president, which exerts greater downward pressure over the dollar.

In the economic calendar, all eyes are set in the preliminary data of the purchasing managers index (PMI) for April on Wednesday and in the requests for durable goods on Thursday. For this Tuesday, a series of Fed speakers are scheduled to speak, while the least important manufacturing data of the Richmond Fed will also be published for April.

In US shares markets, the approach will be in the Tesla (TSLA) earning calls after the closing of the US session, when CEO Elon Musk could announce its departure date of the Government Efficiency Department (Doge).

Daily summary of market movements: Fed speakers everywhere

- At 13:30 GMT, Patrick Harker, president of the Federal Reserve of Philadelphia, participates in a seminar on Economic Development at the University of Pennsylvania, focusing on regional growth and financial inclusion.

- At 14:00 GMT, the vice president of the FED, Philip Jefferson, pronounces a speech on “economic mobility and the dual mandate” at the Economic Mobility Summit of the Federal Reserve of the Federal Reserve of Philadelphia, Philadelphia.

- The Richmond Fed manufacturing index for April will be published in that same time interval, around 14:00 GMT. A new contraction to -6 is expected, coming from -4 in the previous reading.

- The president of the Fed of Minneapolis, Neel Kashkari, will speak around 17:40 GMT while participating in a question and answers session at the global summit of the US Chamber of Commerce in Washington DC.

- Final comments for this Tuesday around 22:00 GMT of the governor of the Bank of the Federal Reserve, Adriana Kugler, who will pronounce a speech on “transmission of monetary policy” at the round table of the Heller-Hurwicz 2025 Institute of Economy 2025, Minneapolis.

- After the closing of the session in the US, all eyes will focus on Tesla’s profits. Rumors indicate that the president of Tesla, Elon Musk, is ready to announce his departure date of the Government Efficiency Department (Doge), reports NBC.

- The actions seek direction on Tuesday with minor losses in Europe, while US actions rise 1% on average while trying to recover from Monday’s losses.

- The CME Fedwatch tool shows the possibility of an interest rate cut by the Federal Reserve at the May meeting at 10.4% compared to any change in 89.6%. The June meeting still has about 62% possibilities for a rate cut.

- The yields of 10 years of the US are quoted around 4.41% after US bonds have sold quite substantially in recent weeks.

Technical analysis of the US dollar index: testing the waters

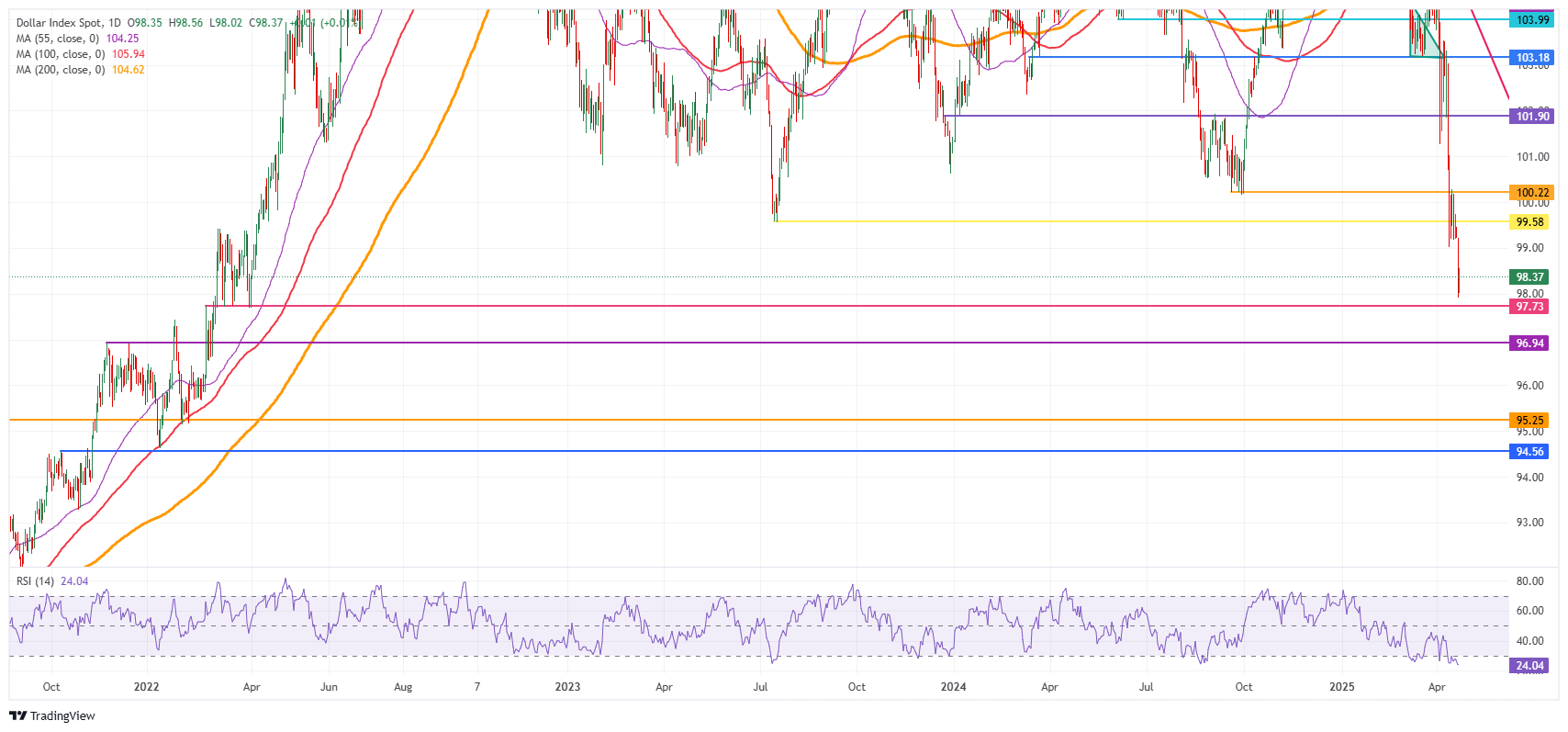

The American dollar index (DXY) says goodbye for the 100.00 mark. The losses incurred on Monday are consolidating this Tuesday while the relative force index (RSI) penetrates the overall area. More downward could be quite limited from here, since some type of technical rebound seems likely before the DXY can fall another lower step.

On the positive side, the first resistance is found in 99.58, which could trigger a firm rejection in any attempt to recover. If the dollar bundles resurface, look for 100.22 with a break above 100.00 as a bull sign of their return. A firm recovery would be a return to 101.90, which has acted as a head and shoulder baseline since 2023.

On the other hand, the minimum at 97.73 is very close and could be broken at any time. Below, a quite thin technical support is located at 96.94, before starting to look at the lowest levels of this new price range. These would be 95.25 and 94.56, which would mean new minimums not seen since 2022.

US dollar index: daily graphics

US dollar FAQS

The US dollar (USD) is the official currency of the United States of America, and the “de facto” currency of a significant number of other countries where it is in circulation along with local tickets. According to data from 2022, it is the most negotiated currency in the world, with more than 88% of all global currency change operations, which is equivalent to an average of 6.6 billion dollars in daily transactions. After World War II, the USD took over the pound sterling as a world reserve currency.

The most important individual factor that influences the value of the US dollar is monetary policy, which is determined by the Federal Reserve (FED). The Fed has two mandates: to achieve price stability (control inflation) and promote full employment. Its main tool to achieve these two objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the 2% objective set by the Fed, it rises the types, which favors the price of the dollar. When inflation falls below 2% or the unemployment rate is too high, the Fed can lower interest rates, which weighs on the dollar.

In extreme situations, the Federal Reserve can also print more dollars and promulgate quantitative flexibility (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is an unconventional policy measure that is used when the credit has been exhausted because banks do not lend each other (for fear of the default of the counterparts). It is the last resort when it is unlikely that a simple decrease in interest rates will achieve the necessary result. It was the weapon chosen by the Fed to combat the contraction of the credit that occurred during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy bonds of the US government, mainly of financial institutions. Which usually leads to a weakening of the US dollar.

The quantitative hardening (QT) is the reverse process for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the wallet values that overcome in new purchases. It is usually positive for the US dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.