- The S&P 500 reacted lower as investors interpreted that the Federal Reserve could keep rates high for longer.

- 272,000 Non-Farm Payrolls were created in the US in May, exceeding the market consensus of 185,000.

The S&P 500 began the European session setting a daily high of 5,360 and a daily low of 5,318 during the American session. The Non-Agricultural Payrolls report has been released, highlighting the greater than expected job creation. On the other hand, it is reported that annual salaries have grown by 4.1% compared to the previous 4% and the expected 3.9%. Currently, the index is trading at 5,346, with a marginal loss of 0.05%.

The US Department of Labor reports the creation of 272,000 non-farm payrolls, exceeding the market consensus of 185,000

Non-Farm Payrolls have exceeded expectations of 185,000 new jobs, an increase to 272,000 is reported. However, the unemployment rate has risen one tenth, to stand at 4% compared to the 3.9% expected by the market. This increase represents its highest level since January 2022. Investors interpret that this data will lead the Federal Reserve to keep interest rates high for longer.

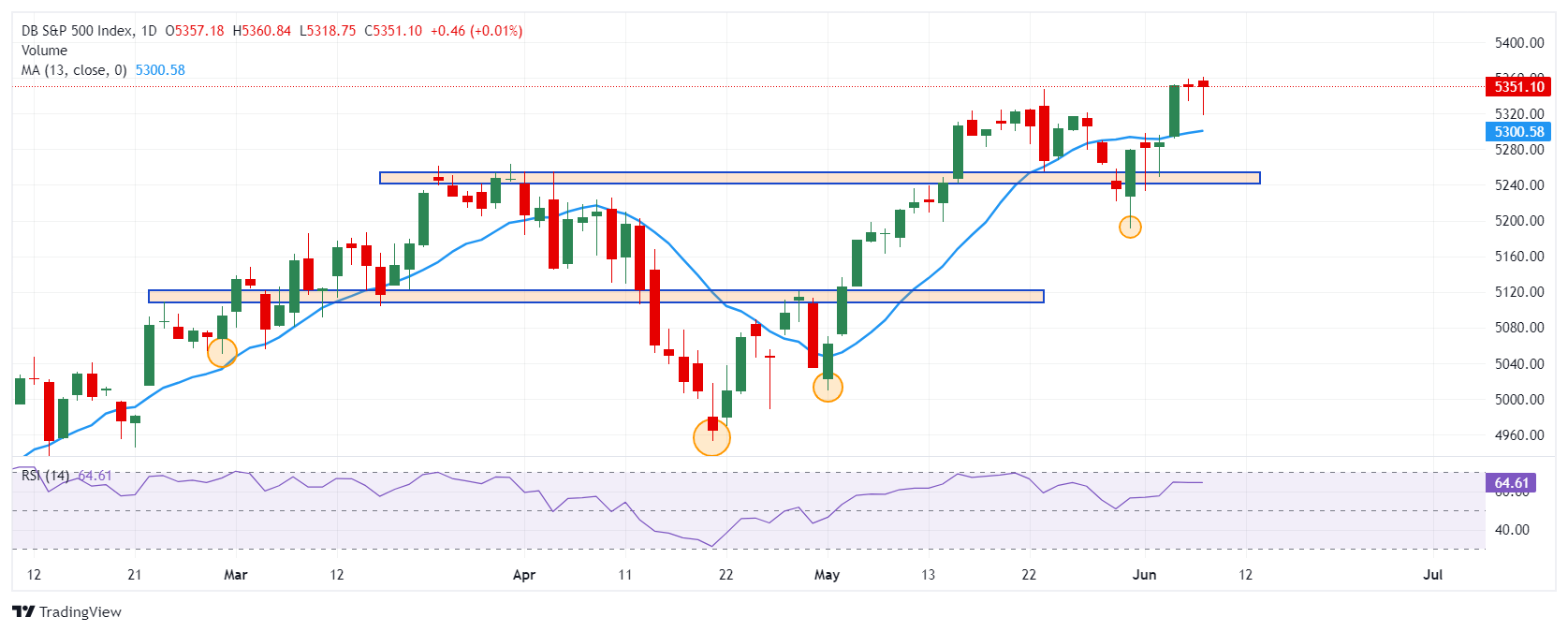

Technical levels in the S&P 500

We observe a first medium-term support at 5,250, in confluence with the pivot points and the June 4 low. The second support is at 5,200, a number closed in convergence with the minimum of the session on May 31. The next target level that could function as resistance is 5,500, which coincides with the 178.6% Fibonacci extension.

S&P 500 daily chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.