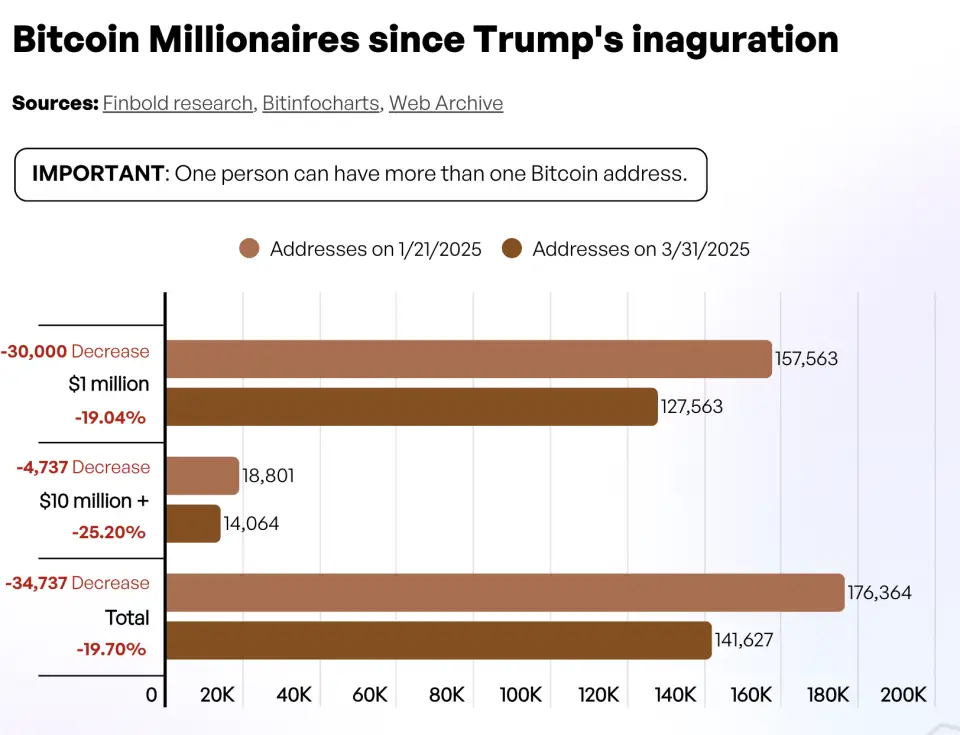

Researchers of Finbold draw a direct analogy between a reduction in the number of millionaire bites with the moment of the official entry of Donald Trump’s office of the President of the United States of America. By the beginning of the year, there were 176,364 addresses with BTC assets exceeding $ 1 million. However, as of March 31, this number decreased to 141,627 or, as experts of Finbold, 34737 addresses.

The number of cryptocurrencies with amounts in the range from $ 1 million to $ 9.99 million decreased by exactly 30,000, and with amounts of more than $ 10 million by 4,737. The study of Finbold notes that the number of bitcoin millionaires is actually not known, since cryptoinvestors can own several addresses, and several traders can add their resources into one address.

Moreover, the appearance and disappearance of BTC holders with capital from $ 1 million or no longer necessarily means that people leave the cryptocurrency market. However, it demonstrates how political events and dynamics of BTC prices can influence the welfare of crypto -investors.

Earlier, CEX.IO published a report that states that against the backdrop of financial uncertainty caused by the Donald Trump Tariffs War, the volume of trading tokenized gold for the first time since 2023 exceeded $ 1 billion.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.