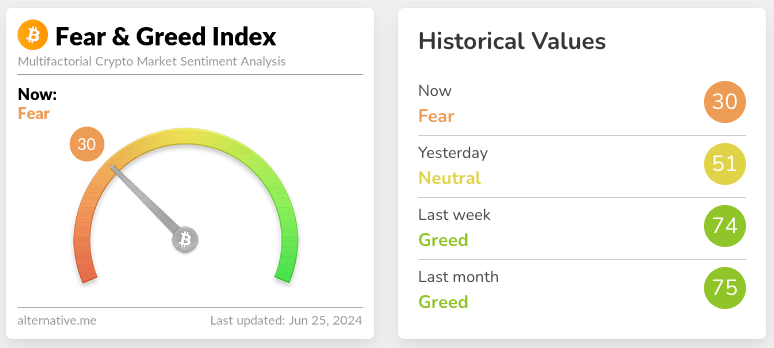

On June 25, the cryptocurrency index of fear and greed fell to 30 points. The last time such values were observed was in September 2023.

The decrease in the metric occurred against the backdrop of a general decline in the crypto market. From June 24 to June 25, Bitcoin fell from $62,500 to $59,100, dragging other assets with it.

At the time of writing, digital gold has recovered to $60,800.

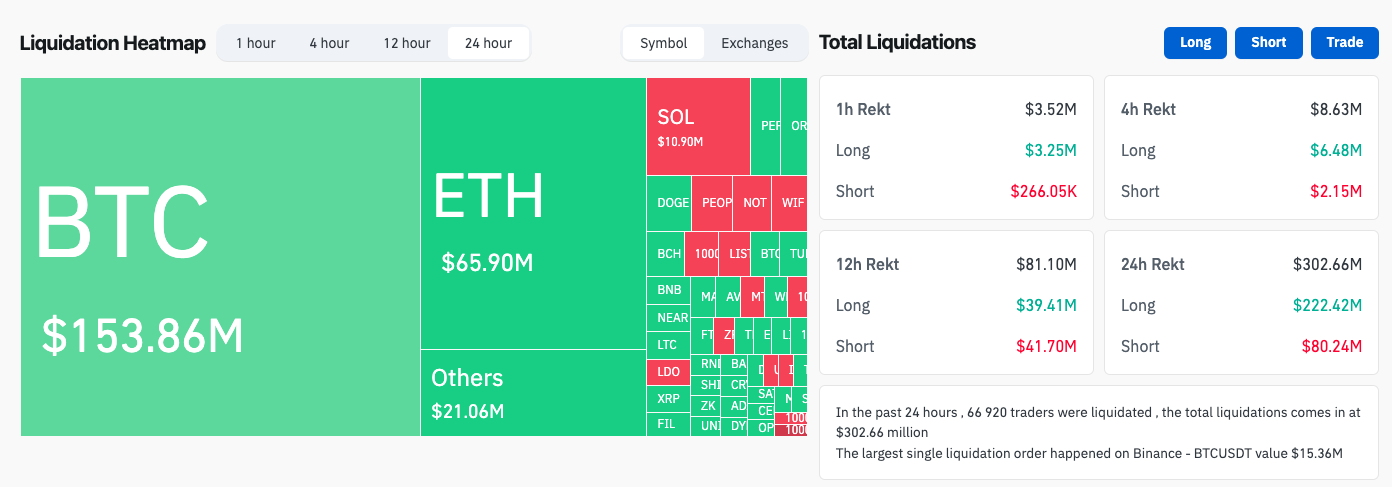

According to Coinglassover the past 24 hours positions worth $302 million were liquidated, of which $222 million were long positions.

According to analyst Willy Wu, there has been a “cascading long squeeze” of Bitcoin, which is explained by the asset falling to a 53-day low and the capitulation of miners after the halving.

…speculators kept adding to new long positions, just adding more fuel for more liquidations in a cascading long squeeze.

Bridging us down to the 58k cluster, which just got taken out. pic.twitter.com/8Pvzccm8vF

— Willy Woo (@woonomic) June 24, 2024

Wu added that miners are “actively selling” the first cryptocurrency to upgrade equipment as older devices are no longer profitable.

The analyst named $54,000 as the next important level for Bitcoin. If it falls below this level, the market risks going into a bearish phase.

Analyst and founder of MN Trading Michael van de Poppe drew attention to the strong rebound of digital gold from the lows of the range.

Relatively strong bounce on #Bitcoin from the range lows. #Altcoins are up even more since that level.

Bitcoin dominance starts to fall slightly, through which the Mt. Gox even starts to get priced in. pic.twitter.com/b8qhVaX20V

— Michaël van de Poppe (@CryptoMichNL) June 25, 2024

He added that from this level, altcoins rose even more, and the dominance of the leading asset began to decline.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.