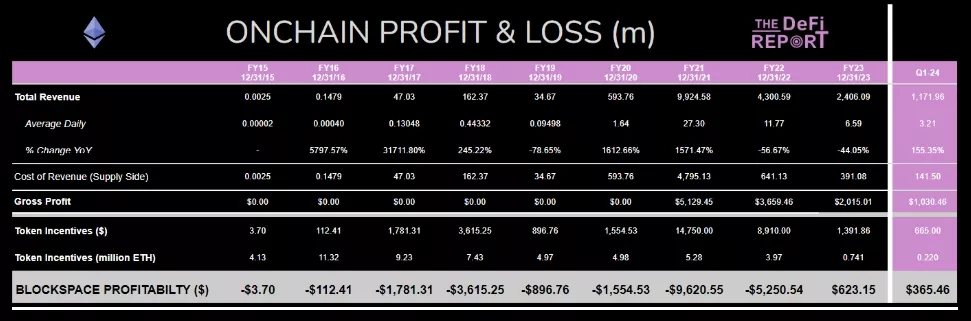

Analysts note that the commission income of the Ethereum network due to customer payments for transactions amounted to more than $1.17 billion. Compared to the fourth quarter of 2023, the increase in income was 155%.

Experts at The DeFi Report believe that the main reason for this sharp increase in revenue is increased activity in the decentralized finance (DeFi) industry. Against this background, the average daily number of transactions in the first quarter exceeded 1.15 million.

Let us recall that the Ethereum blockchain has been operating for more than eight years, and its first profitable year was 2023. The network earned $623 million after switching to Proof-of-Stake consensus.

Messari specialists indicated that in the first quarter of 2024, the value of locked assets (TVL) in decentralized finance protocols increased by 65.6% and reached $101 billion.

“This is primarily due to rising prices and liquidity re-staking, which led to a 71% increase in Ethereum TVL.”

Earlier, the auditing company Ernst&Young launched the EY OpsChain Contract Manager (OCM) solution based on the Ethereum blockchain to conduct business transactions and reduce associated costs.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.