- The Canada Bank (BOC) is expected to maintain its unchanged policy rate.

- The Canadian dollar has been persistently appreciating against the US dollar.

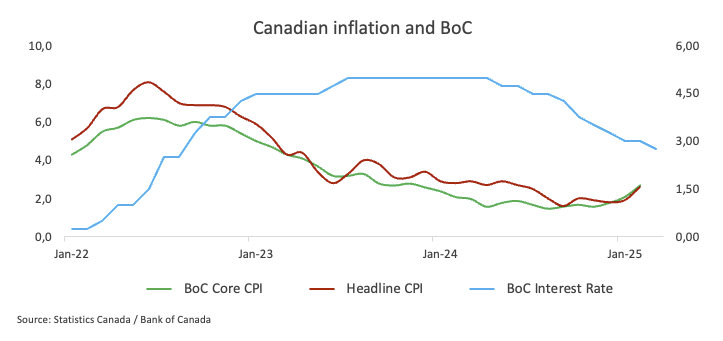

- The general inflation in Canada was again above the objective of the BOC.

- Governor Macklem’s press conference is expected to focus on US tariffs.

All the attention is expected to be at the Canada Bank (BOC) on Wednesday, since market experts widely anticipate that the Central Bank will maintain its interest rate at 2.75%, stopping seven consecutive cuts of interest rates.

At the same time, the Canadian dollar (CAD) has been gaining impulse in recent weeks, appreciating in the 1,3840 region against the US dollar (USD) from monthly minimums around the 1,4400 area.

Since the president of the United States (USA) Trump returned to the Oval Office in January, everything has revolved around its commercial policies, particularly those related to tariffs. It is predicted that this specific theme will dominate the BOC event, including comments by Governor Tiff Macklem as well as media questions.

The Bank of Canada is planning a pause in its flexibility cycle for April, since the growing global uncertainties – largely implemented by the erratic approach of the White House towards tariffs – obligate to rethink commercial policies. This unpredictability context suggests that a cautious tone will probably define both the BOC statement and the Governor Macklem monitoring press conference this week.

In his most recent press conference on March 20, Governor Macklem explained that ambiguity about the impact of US tariffs had forced the bank to adjust its monetary policy, making it less anticipative than usual. He emphasized that despite these challenges, there was no doubt about the unwavering commitment of the bank to maintain low inflation.

In addition, according to the Central Bank’s business perspective survey published on April 7, Canadian companies and consumers are now preparing for a much higher risk of recession in next year, since President Trump’s tariffs and possible reprisal measures feed a generalized uncertainty. According to the survey, many companies have paused their investment and hiring plans, with employment expectations now lower than at any time during the pandemic.

The BOC said that companies no longer anticipate a slowdown in increasing input prices – a remarkable change regarding recent trends – which suggests that inflationary pressures will probably intensify. In fact, inflation in Canada shot at a maximum of eight months of 2.6% in February. The survey revealed that 65% of companies expect their costs to increase if tariffs become more generalized, which leads to 40% of respondents to plan an increase in their sales prices.

By anticipating the decision of interest rates of the BOC, TD Securities analysts pointed out: “We hope that Boc Pause in 2.75% in April while waiting for more clarity on the impacts of tariffs before making even more flexible. Governor Macklem suggested that the bank would be less anticipative in its speech on March 20, and with the economy showing more strength during January/February, that should be sufficient for a return for January/February. To the lateral line.

When will the BOC announce your monetary policy decision and how could it affect USD/CAD?

The Bank of Canada is scheduled to reveal its policy decision on Wednesday at 13:45 GMT, followed by the press conference of Governor Tiff Macklem at 14:30 GMT.

Although important surprises are not anticipated, market observers believe that the message of the Central Bank will continue to focus on the implications of US tariffs for the Canadian economy – a feeling that could also influence currency movements.

Senior Analyst Pablo Piovano of FXSTRET said that “the USD/CAD has recently broken below its simple mobile (SMA) average (SMA) in 1,3995, which could open the door to an additional weakness in the short -term horizon.”

“If the Canadian dollar extends its recovery, it is likely that the USD/CAD returns to visit its 2025 floor in 1,3838 (April 11), closely followed by the minimum of November 2024 in 1,3817, and before the minimum of September 2024 in 1,3418 (September 25),” Piovano added.

Piovano points out that “on the positive side, the torque should find initial resistance in its April peak in 1,4414 (April 1), before March maximum in 1,4542 (March 4). The rupture of the latter could again put a possible test of the maximum of 2025 of 1,4792 (February 3)”.

“Currently, the spot is being negotiated in overall conditions according to the Relative Force Index (RSI), so a technical rebound should not be ruled out. However, the ongoing bearish trend could also gain strength, as suggested by the average directional index (ADX) near level 25,” concludes Piovano.

Canadian dollar faqs

The key factors that determine the contribution of the Canadian dollar (CAD) are the level of interest rates set by the Bank of Canada (BOC), the price of oil, the main export product of Canada, the health of its economy, inflation and commercial balance, which is the difference between the value of Canadian exports and that of its imports. Other factors are market confidence, that is, if investors bet on riskier assets (Risk-on) or seek safe assets (Risk-Off), being the positive risk-on CAD. As its largest commercial partner, the health of the US economy is also a key factor that influences the Canadian dollar.

The Canada Bank (BOC) exerts a significant influence on the Canadian dollar by setting the level of interest rates that banks can provide with each other. This influences the level of interest rates for everyone. The main objective of the BOC is to maintain inflation between 1% and 3% by adjusting interest rates to the loss. Relatively high interest rates are usually positive for CAD. The Bank of Canada can also use quantitative relaxation and hardening to influence credit conditions, being the first refusal for CAD and the second positive for CAD.

The price of oil is a key factor that influences the value of the Canadian dollar. Oil is the largest export in Canada, so the price of oil tends to have an immediate impact on the value of the CAD. Generally, if the price of oil rises, the CAD also rises, since the aggregate demand of the currency increases. The opposite occurs if the price of oil drops. The highest prices of oil also tend to give rise to a greater probability of a positive commercial balance, which also supports the CAD.

Although traditionally it has always been considered that inflation is a negative factor for a currency, since it reduces the value of money, the opposite has actually happened in modern times, with the relaxation of cross -border capital controls. Higher inflation usually leads to central banks to raise interest rates, which attracts more capital of world investors who are looking for a lucrative place to save their money. This increases the demand for the local currency, which in the case of Canada is the Canadian dollar.

The published macroeconomic data measure the health of the economy and can have an impact on the Canadian dollar. Indicators such as GDP, manufacturing and services PMIs, employment and consumer confidence surveys can influence the CAD direction. A strong economy is good for the Canadian dollar. Not only attracts more foreign investment, but it can encourage the Bank of Canada to raise interest rates, which translates into a stronger currency. However, if the economic data is weak, the CAD is likely to fall.

Economic indicator

BAD monetary policy declaration

In each of the eight meetings of the Bank of Canada (BOC), the Governing Council publishes a statement after the meeting explaining its policy decision. The statement can influence the volatility of the Canadian dollar (CAD) and determine a positive or negative short -term trend. A hard line vision is considered bullish for the CAD, while a moderate vision is considered bassist.

Read more.

Last publication:

LIE MAR 12, 2025 13:45

Frequency:

Irregular

Current:

–

Dear:

–

Previous:

–

Fountain:

Bank of Canada

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.