Google Cloud is the official Polygon validator

In general, the fact that the Google cloud service will become a validator for Polygon is not something revolutionary. The platform already has more than a hundred other validators. However, the advertising effect of this news is felt quite strongly, since Google itself will do the validation, and this will add trust to Polygon.

For the American technology company, such a collaboration was also not something new – at the end of 2022, Google Cloud was already becoming a Solana validator. Around the same time, Google introduced its Blockchain Node Hosting product, a fully managed node hosting service for Web3 organizations. So interaction with Polygon is simply the company’s expansion in the crypto industry.

The collaboration between Polygon and Google began back in April, when announced on the formation of an alliance, the main goal of which should be the implementation of key Polygon protocols.

Deploying USDC on Polygon

Polygon is expected to deploy USDC on its network on October 10, 2023. This will reduce the impact of bridges on Circle’s stablecoin. In company note a number of advantages of such a step:

-

full support and access to constant conversion into dollars 1:1;

-

support for Circle Account and its APIs;

-

further support for CCTP to eliminate delays in withdrawing money across bridges;

-

the opportunity for institutional investors to convert cryptocurrency into fiat and vice versa.

To implement this transition, USDC on Ethereum will be renamed USDC.e. This modification will be deployed, including in ecosystem applications and user interfaces. Circle Account will continue to support withdrawals and deposits of both native USDC and USDC.e for 30 days after deployment on the Polygon network.

Starting November 10th, Circle will no longer support USDC.e, including express withdrawals. To avoid losing their funds, users are advised not to transfer USDC.e to their Circle Account after the designated date.

There will also be changes to the Circle API to ensure a smooth transition of USDC to Polygon. In the future, Polygon plans to expand its cross-chain capabilities using the CCTP protocol. This will allow forward USDC between Polygon, Ethereum and other chains instantly.

Developer activity

At the end of September, the Chainstack portal released report about the activity of Web3 developers in the USA, Europe and Asia. Analysts reported that Polygon is among the top 3 in this segment in the United States with a share of 17.2%. In terms of development activity, the platform is second only to Ethereum with a share of 38.9% and BNB Chain with 31.3%.

The situation for Polygon is even better in Europe. The platform ranks second with 22.8%, only slightly behind BNB Chain, which accounts for 24.4%, and 0.2% ahead of Avalanche with 22.6%.

In Asia, Polygon ranks third. However, here activity share in Web3 developments the platform has a much lower share of 4.5%. The first two places are occupied by BNB Chain (72.1%) and Ethereum (25.4%).

How Polygon compares to other second-tier solutions

Polygon cryptocurrency (MATIC) is the largest by capitalization among second-level solutions for the Ethereum network. It ranks 13th, while Arbitrum is in 39th place and Optimism is in 40th place.

Source: app.artemis.xyz

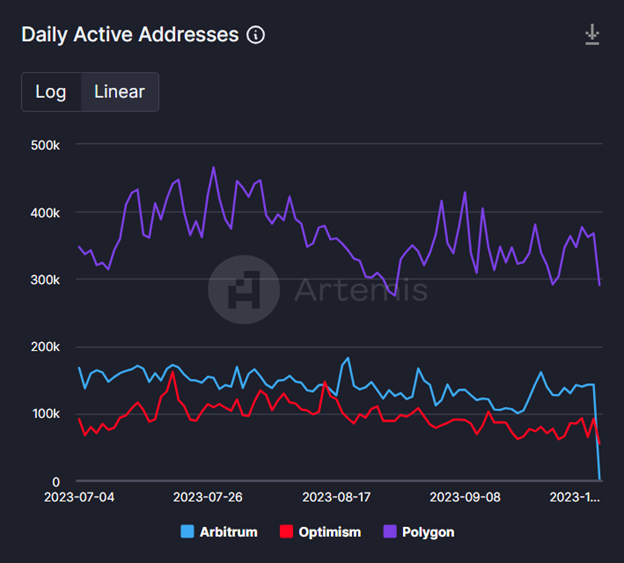

In terms of the number of active addresses per day, Polygon outpaces Optimism by almost 5 times, and Arbitrum by more than 100 times.

Source: app.artemis.xyz

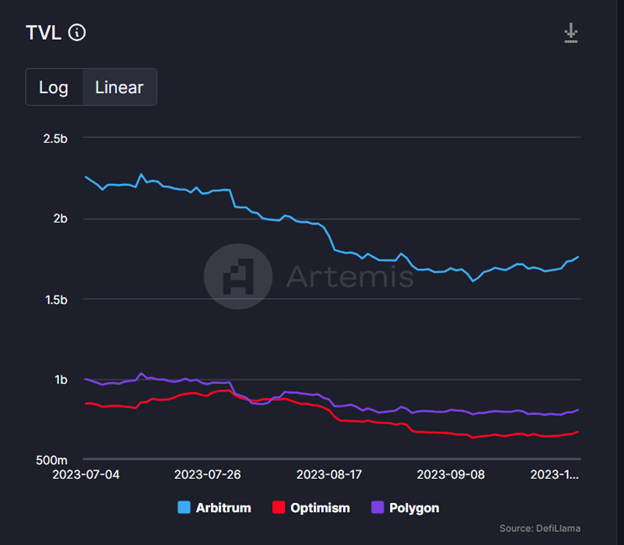

But the total locked value (TVL) of Polygon is more than two times less than that of Arbitrum, but exceeds Optimism by 20%.

Source: app.artemis.xyz

Technical analysis

After almost two months of decline – from mid-July to mid-September – the Polygon cryptocurrency began to rise. From its minimum values, MATIC has already gained about 14.5%, which may indicate that the bulls are seizing the initiative.

This conclusion can also be reached based on the fact that the MATIC price has crossed the 50-day moving average (indicated in blue), and the RSI indicator is above the 50% mark. However, Polygon’s volatility remains at fairly low levels, as can be judged based on ATR indicators.

In general, MATIC has an open road to the $0.635 mark – the resistance level and at the same time the August 2023 maximum. The support level is the previous resistance level of $0.549.

Source: tradingview.com

Polygon continues to develop, and this has led to the fact that the cryptocurrency began to again be in demand among investors, adding about 15% in just 20 days.

Let us recall that in July, the developers of Polygon, a solution for scaling the Ethereum network, proposed to issue a multi-purpose coin POL, which should become a replacement for MATIC.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.