The S&P 500 had a troubled day refusing the pullback, which was to be expected after the poor JOLTs numbers and the Beige Book acknowledging the challenges of the real economy (job market). However, NVDA surprised with its statement that it is not being quoted (no feared antitrust for the chip leader), but that did not help SMCI much, and AMD cannot carry the weight of the Nasdaq alone, not by a long shot. So, it was up to AAPL to provide a ray of hope, with TSLA also having a good day.

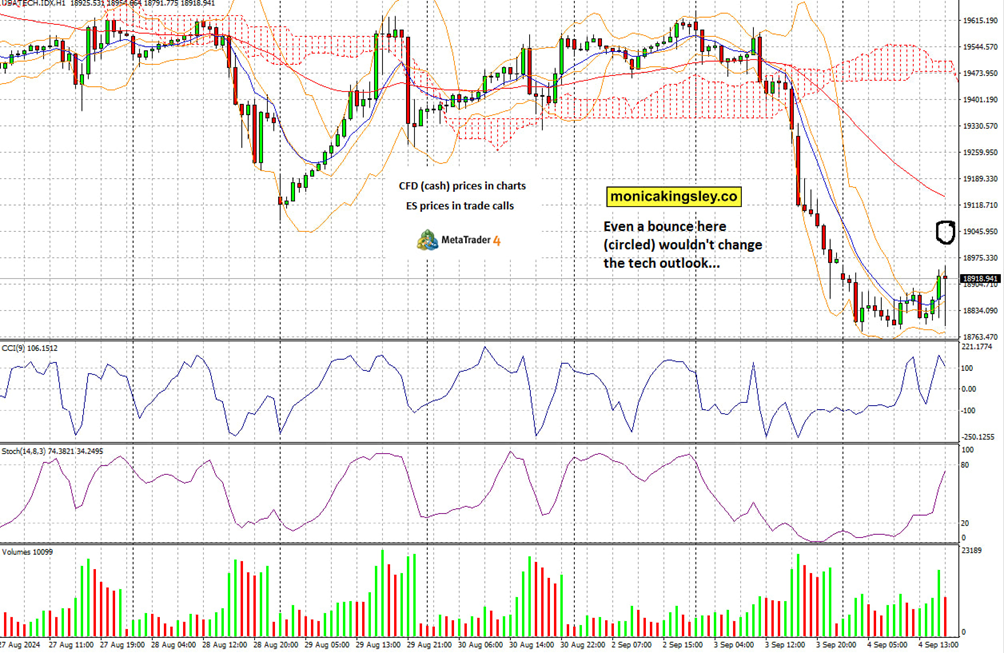

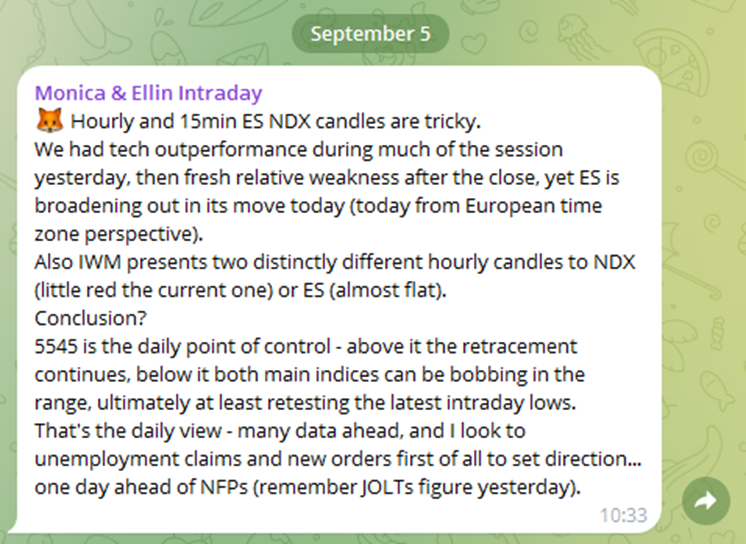

The day, however, started on a bullish note, with XLK, XLC and XLY trading well, along with the almost usual performance of XLF lately. On a daily basis, the Nasdaq performed well compared to the S&P 500, which is usually a bullish sign, but how has the picture changed after yesterday? Let’s check out my hourly Nasdaq CFD chart posted on our channel at the start of the session, and accompany it with the bond market snapshot and the contribution from this European morning.

Today a very good set of data is required since the marked area was respected yesterday, and customers knew this well, well in advance.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.