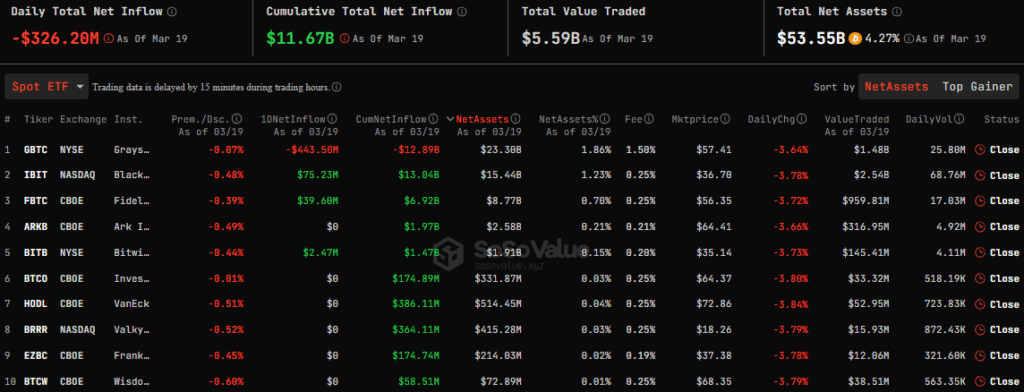

On March 19, 2024, the net daily capital outflow in the spot Bitcoin ETF sector was $326.20 million, according to SoSo Value.

The negative trend continues for the second day in a row. During the period from March 18 to 19, the total outflow of funds from Bitcoin spot funds amounted to $480.65 million.

The change in trend is due to an increase in outflows of $443.50 million from the GBTC fund from Grayscale Investments. In two days, this figure rose to $1.086 billion.

Capital inflow/outflow in the spot Bitcoin ETF sector. Source: SoSo Value.

Capital inflow/outflow in the spot Bitcoin ETF sector. Source: SoSo Value.

According to the data, the first place in terms of capital inflows was taken by the iShares Bitcoin Trust (IBIT) crypto fund from BlacRock. It added $75.23 million to its balance sheet, bringing funds under management to $13.04 billion.

In second place is Fidelity Wise Origin Bitcoin BTC (FBTC) with an indicator of $39.60 million, in third place is an investment product from Bitwise Asset Management – $2.47 million. Note that for some positions, data on trading volume has not yet been updated.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.