- The S&P 500, the Nasdaq 100 and the Dow Jones remain positive.

- Softer-than-expected US CPI data raised speculation that the Fed will be less aggressive.

- Traders expect the Federal Reserve to raise interest rates to 5% and cut rates before the fourth quarter of 2023.

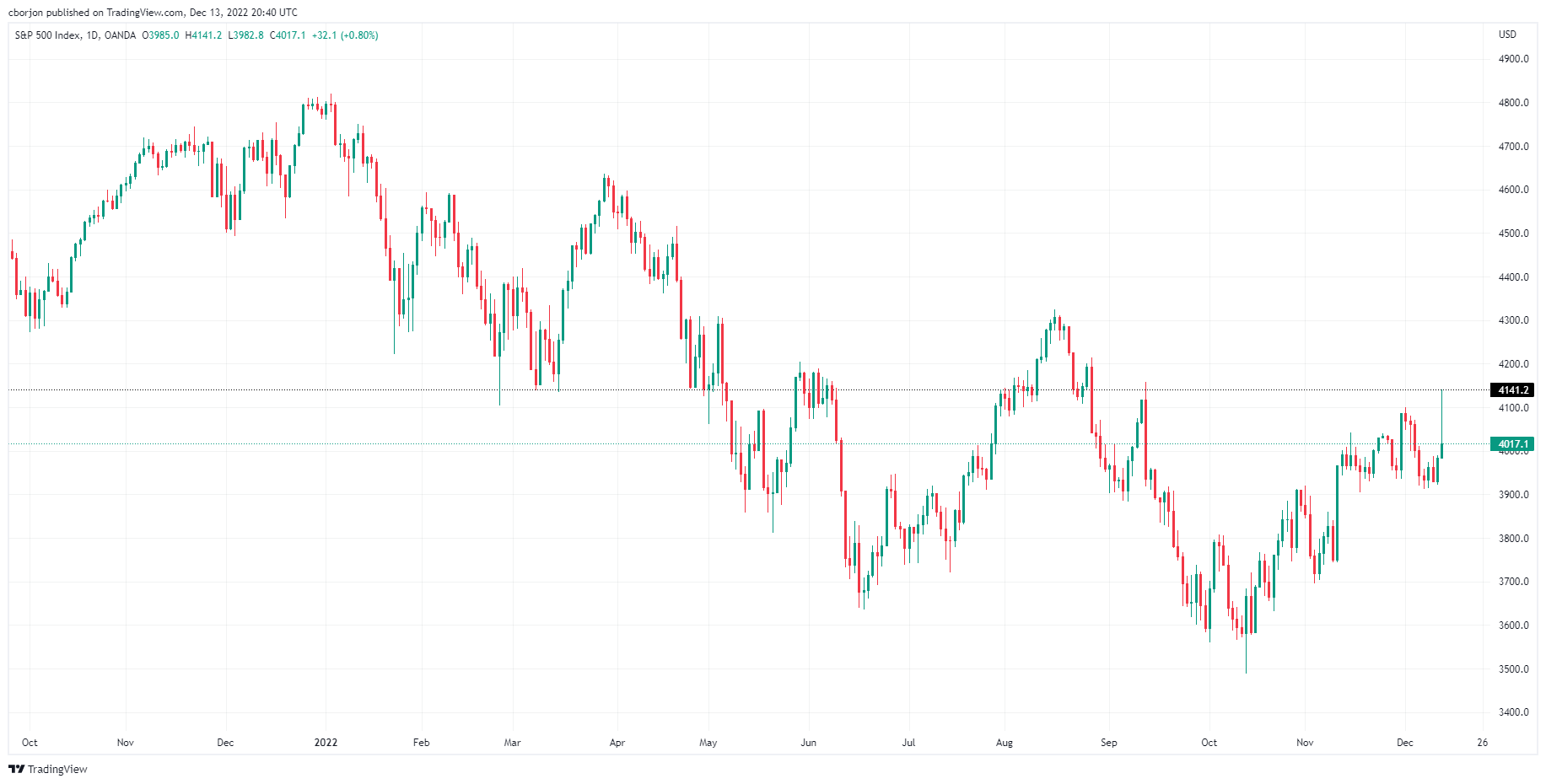

US stocks remained volatile following the release of US inflation data and remain positive, albeit far from the day’s highs, with the S&P 500, Nasdaq 100 and Dow Joines Industrial Average gaining 0.98%, or 1.33 % and 0.47% each. At the time of writing these lines, the S&P 500 stands at around 4,026.90 points.

It must be said that the indices, while still positive, are trading well below the day’s highs, as Tuesday’s price action shows, forming a broad “inverted hammer” candlestick chart. Some traders speculate that it is a reflection of profit taking ahead of the Federal Reserve’s policy meeting on Wednesday.

Before the opening of Wall Street, the US revealed that the Consumer Price Index (CPI) for November rose less than the expected 7.3% year-on-year to 7.1%. The so-called core CPI for the same period, which excludes volatile elements such as food and energy, stood at 6.0% compared to the estimated 6.1%. The reaction to these data sent the S&P 500 rising to all-time highs in three months.

Money market futures appear to indicate an upcoming Fed Funds rate hike, which is expected to peak at 5%. Eurodollar futures showed traders speculating that the Federal Reserve will make its first rate cut of around 20 basis points in September 2023. Meanwhile, the Dollar Index was volatile as it fell to lows of six months near 103,586, although it recovered soon after and now rests comfortably at 103,987.

On the other hand, US Treasury yields, specifically the benchmark 10-year bond rate, fell 15 basis points to 3.459% from around 3.630%, although they have recovered some of late. land, standing at around 3.514%.

Analysts at TD Securities reported that “the November CPI report does not affect expectations for a 50 basis point rate hike at tomorrow’s FOMC meeting.” Furthermore, given the strength of core services inflation, it is clear that the Fed will have to continue to tighten rates beyond the December meeting. We will be attentive to any announcement from the Fed tomorrow about a further reduction in the rate of increase for the February meeting.”

What must be considered?

On the US economic agenda, the meeting of the Federal Reserve Open Market Committee (FOMC) stands out, in which the Fed is expected to raise rates by 50 basis points, the federal funds rate (FFR). In addition, the Summary of Economic Projections (SEP) will be published, and the dot plot will reflect the expectations of Fed officials regarding interest rates.

S&P 500 daily chart

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.