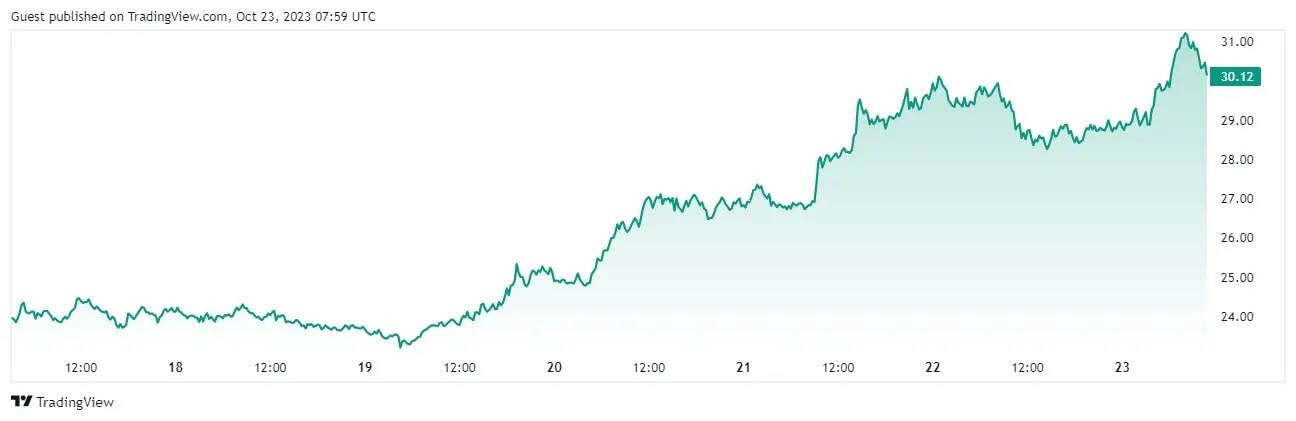

Over the past week, from October 16 to October 22, 2023, the SOL rate jumped by 37.3%, according to TradingView. Investors’ fears about the liquidation of the FTX exchange portfolio turned out to be exaggerated, reports CoinDesk.

At the time of writing, the asset is trying to gain a foothold above $30.1, according to TradingView:

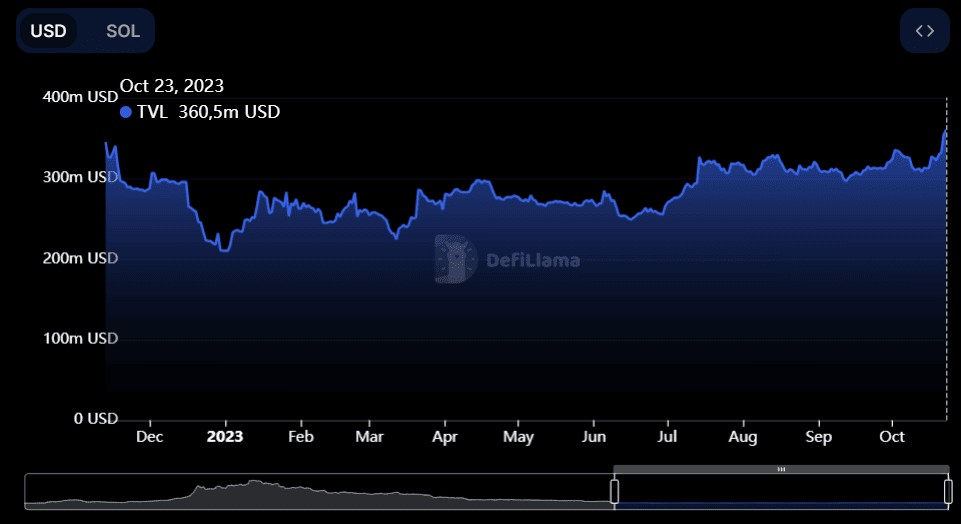

Solana’s TVL set a new high from mid-November 2022 at $360.5 million, according to DeFiLlama:

Let us remind you that TVL reflects the total amount of assets blocked in the smart contracts of the network.

In a comment to CoinDesk, IntoTheBlock analyst Lucas Outumuro said that the effect of the phased liquidation of the FTX exchange SOL was softer than expected.

CoinShares experts noted the influx of capital into funds based on this token. Over the past week, from October 16 to October 22, 2023, it amounted to $15.5 million.

This is less than Bitcoin ($55 million), but significantly more compared to other altcoins. This makes SOL the preferred asset among the latter, CoinShares believes.

FTX crypto portfolio

In August 2023, the exchange filed a petition with the court to liquidate its portfolio of crypto assets. The company received permission to do so in September.

The news raised concerns among investors about the volume of funds that were expected to flow into the market. The exchange’s portfolio was valued at $3.4 billion.

Most of this amount is SOL tokens ($1.162 billion). However, the conditions set by the court likely significantly mitigated the effect of the sale of assets. The expected collapse did not happen.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.