Applications for spot bitcoin ETFs from BlackRock, Fidelity, and others were not “clear and comprehensive.” About it SEC reported to the Nasdaq exchanges and CBOEwrites Wall Street Journal citing informed sources.

According to them, the Commission returned the applications because they did not contain sufficient information regarding the so-called joint monitoring agreement or the details of this mechanism.

A CBOE spokesman in a comment to the publication clarified that they plan to update and resubmit the documents.

Fidelity’s filing mentions an agreement mechanism that was a key addition to BlackRock’s proposal. The investment giant filed paperwork to register a spot bitcoin ETF at the end of June, joining Valkyrie, WisdomTree and Invesco.

To date, the SEC has rejected almost all applications for exchange-traded funds based on the first cryptocurrency. The commission made an exception for ProShares and Valkyrie Investments products, which are based on Chicago Mercantile Exchange bitcoin futures. Grayscale sued the regulator after a negative response.

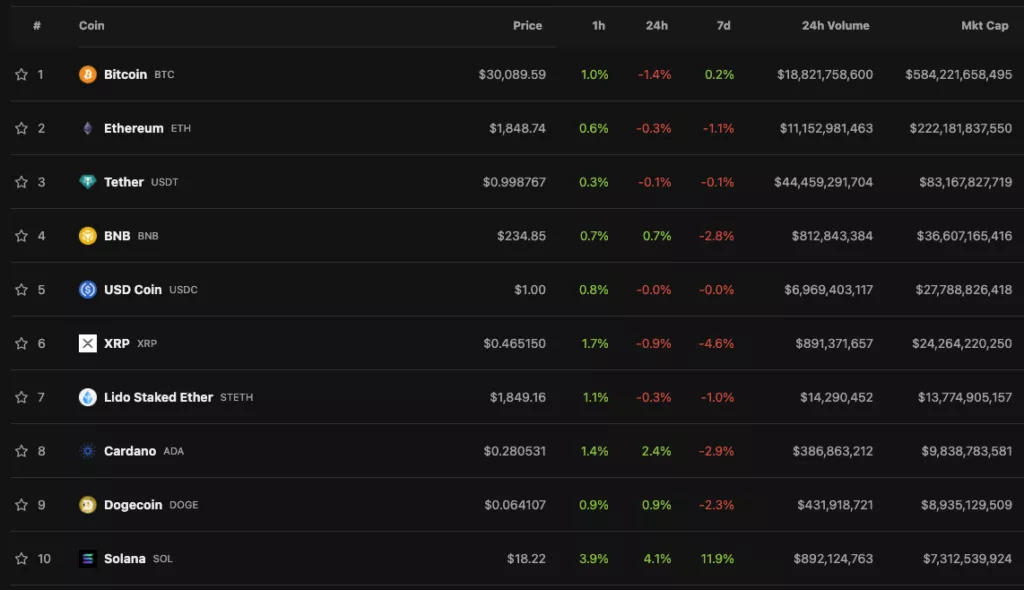

Against the background of the news, the price of bitcoin at the moment fell to levels near $29,500, but quickly returned to a level above $30,000. CoinGeckoover the past day, the asset has fallen in price by 1.4%.

Some assets from the top 10 by capitalization also ended up in the “red zone”.

Earlier, Circle CEO Jeremy Allair predicted that the recent wave of proposals to launch digital gold-based spot exchange-traded funds would lead to regulatory approval.

In the list of applications to the SEC to launch a spot bitcoin ETF, ARK Invest c 21Shares have priority over BlackRock and the rest based on the time of their submission.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.