Outlier Ventures urged all investors to no longer count on the previously observed pattern.

“The halving of the miner reward has no fundamental impact on Bitcoin and other digital assets, and we are forced to conclude that the halving is dead,” the report says.

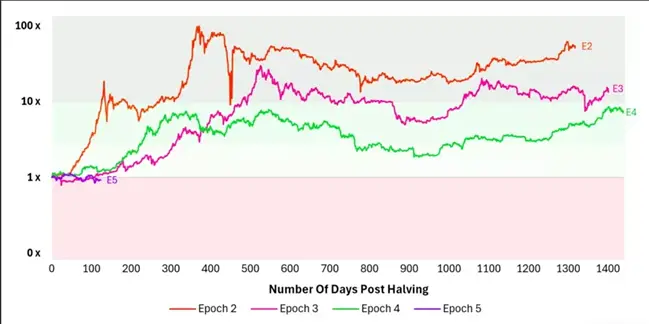

125 days after the April halving, the first cryptocurrency has lost about 8% in value, which is in sharp contrast to what was observed in previous periods at a similar distance. In 2012, Bitcoin rose in price by 739%, in 2016 – by 10%, in 2020 – by 22%, experts said.

According to their estimates, miners’ daily rewards are now equivalent to 0.17% of the cryptocurrency turnover, while until mid-2017 this value varied from 1% to 5%.

Analysts linked the sharp rise in the price of Bitcoin in 2020 after the halving to the effect of the boom in decentralized finance and active injections of funds into the global economy suffering from COVID.

Earlier, Kaiko experts reported that the crypto market is experiencing a significant oversupply of Bitcoin amid the sell-off of government reserves and the sale of assets of the bankrupt exchange MtGox.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.