The volume of open positions (OI) in Bitcoin futures on CME exceeded 100,000 BTC for the first time. K33 Research analyst Vetle Lunde drew attention to this.

CME BTC futures OI has breached 100k BTC for the first time ever.

While offshore perp OI shrank by 26,735 BTC yesterday, CME’s OI grew by 4,380 BTC. pic.twitter.com/kjKBRYCoSX

— Vetle Lunde (@VetleLunde) October 24, 2023

According to his observations, over the past 24 hours the OI on the platform has increased by 4380 BTC.

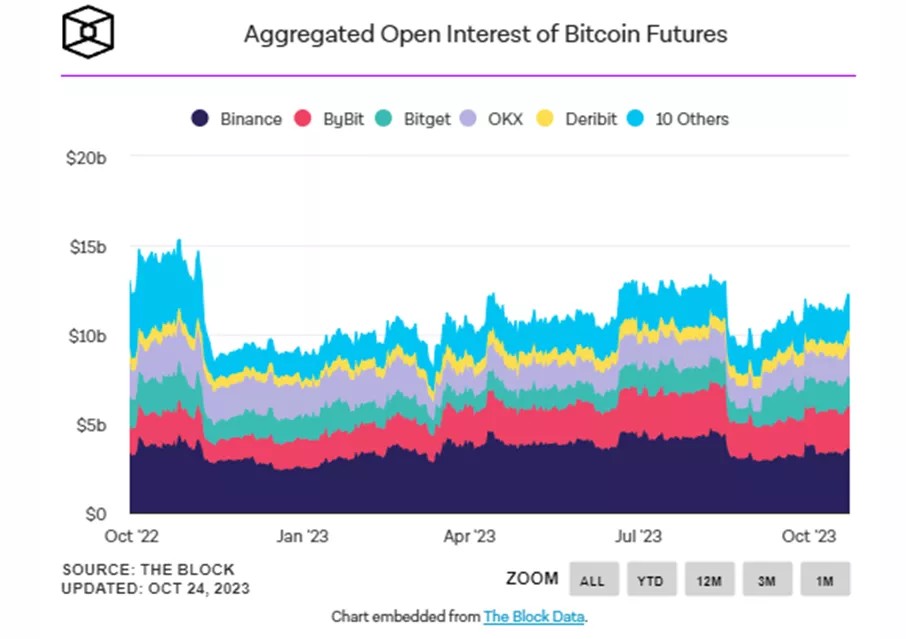

The total indicator of perpetual contracts on offshore exchanges during the same period fell by 26,735 BTC.

As a result, CME’s share of this metric rose to a record 25%, which is close to Binance’s 29%.

A similar situation has developed in the Bitcoin options market, according to The Block. The OI of the Deribit exchange ($12.4 billion) approached its highest levels in history.

Platform CEO Luuk Striers attributed the noticeable increase in activity to expectations for the approval of a spot Bitcoin ETF.

According to the publication, professional traders are becoming increasingly optimistic. In interviews, the interlocutors said that new buyers have entered the market and are quickly collecting calls.

On October 23, BlackRock’s proposed ETF, the iShares Bitcoin Trust, appeared on DTCC’s list of assets for which the company provides post-trade, clearing and settlement services.

Previously, Matrixport analysts predicted the growth of digital gold to $42,000-56,000 if the product is approved. CryptoQuant received values of $50,000-73,000.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.