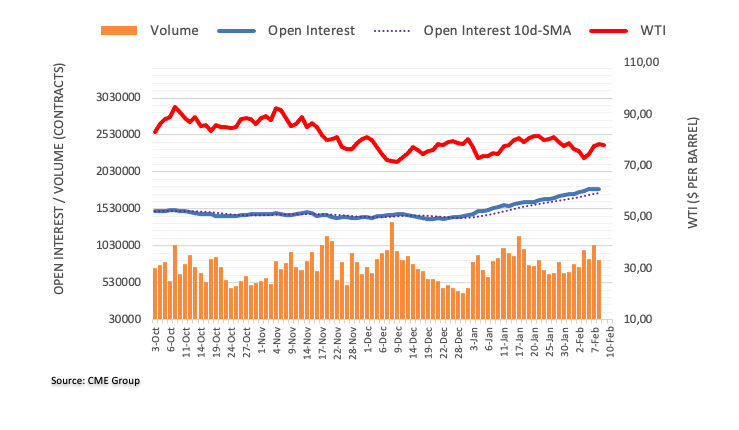

Preliminary data from the CME Group for the crude oil futures markets indicated that traders added around 4,300 contracts to their open interest positions on Wednesday, reversing the previous daily decline and resuming the uptrend at the same time. The volume, on the other hand, continued its erratic behavior and fell by around 201,100 contracts.

WTI: 2023 low seems likely to be retested

WTI prices rallied above the $78.00 level on Wednesday. The move was supported by rising open interest, which leaves the door open for continuation of this upward trend in the very short term. However, the notable drop in volume invites caution and could trigger a corrective pullback whose next target would be at the yearly low near $72.00 (February 6th).

Feed news

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.