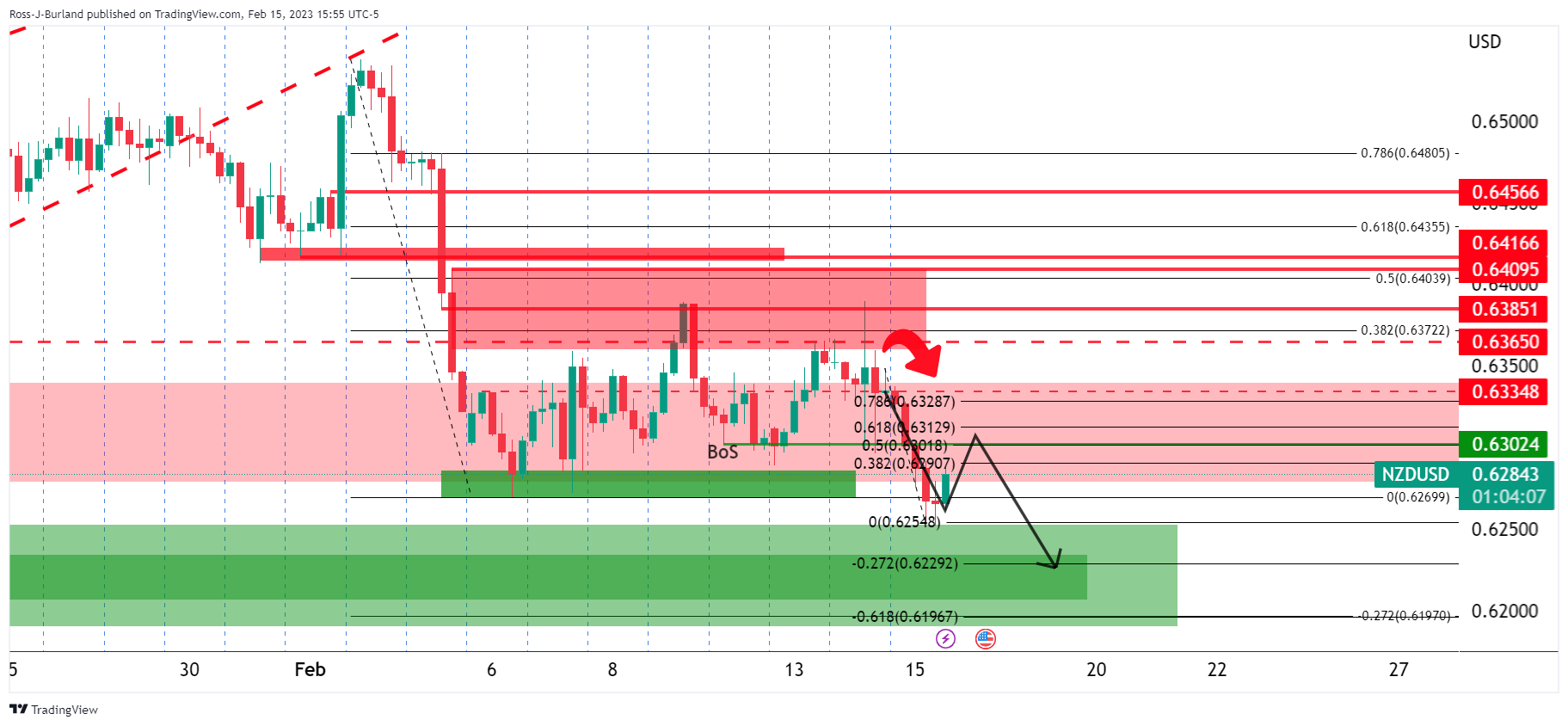

- NZD/USD bears target the 0.6250 low zone after the breakout of the structure.

- A bullish correction is currently in the works, but if the bears commit below 0.6300 then this correlates to close to a 61.8% ratio.

The pair NZD/USD is down on the day as we enter the tail end of the North American session as markets wrestle with the prospect of higher inflation for longer in the US and watch the Fed pivot disappear over the horizon.

At time of writing, the NZD/USD pair is trading at 0.6280 and has lost 0.8% on the day, after falling from a high of 0.6337 to a low of 0.6252. The US dollar, as measured by the DXY index, broke higher on the strength of US retail sales and the Consumer Price Index from the previous day. In both reports, bond yields rose another notch, which has supported risky assets and the dollar.

According to analysts at ANZ Bank, “Regular readers will know that we have been concerned for some time about the possibility of a firming dollar if interest rate expectations start to rise and expectations of rate cuts at the end of 2023 fade, And that’s what seems to be happening.”

But at the same time, unlike last year’s USD rally, we don’t have other central banks going slow this time around, with the European Central Bank and Reserve Bank of New Zealand on track to raise 50bps in their next meetings. “That, and valuations, may limit (but perhaps not stop) the USD rally, but counting on that could be risky.”

NZD/USD Technical Analysis

Meanwhile, prospects for a move lower are seen.

While below resistance, odds are for a move to the 0.6250 low after the structure breaks. A correction is currently in the works, but if the bears commit to, say below 0.6300, then a sell-off of the 50% ratio region, 61.8% could be on the cards tomorrow.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.