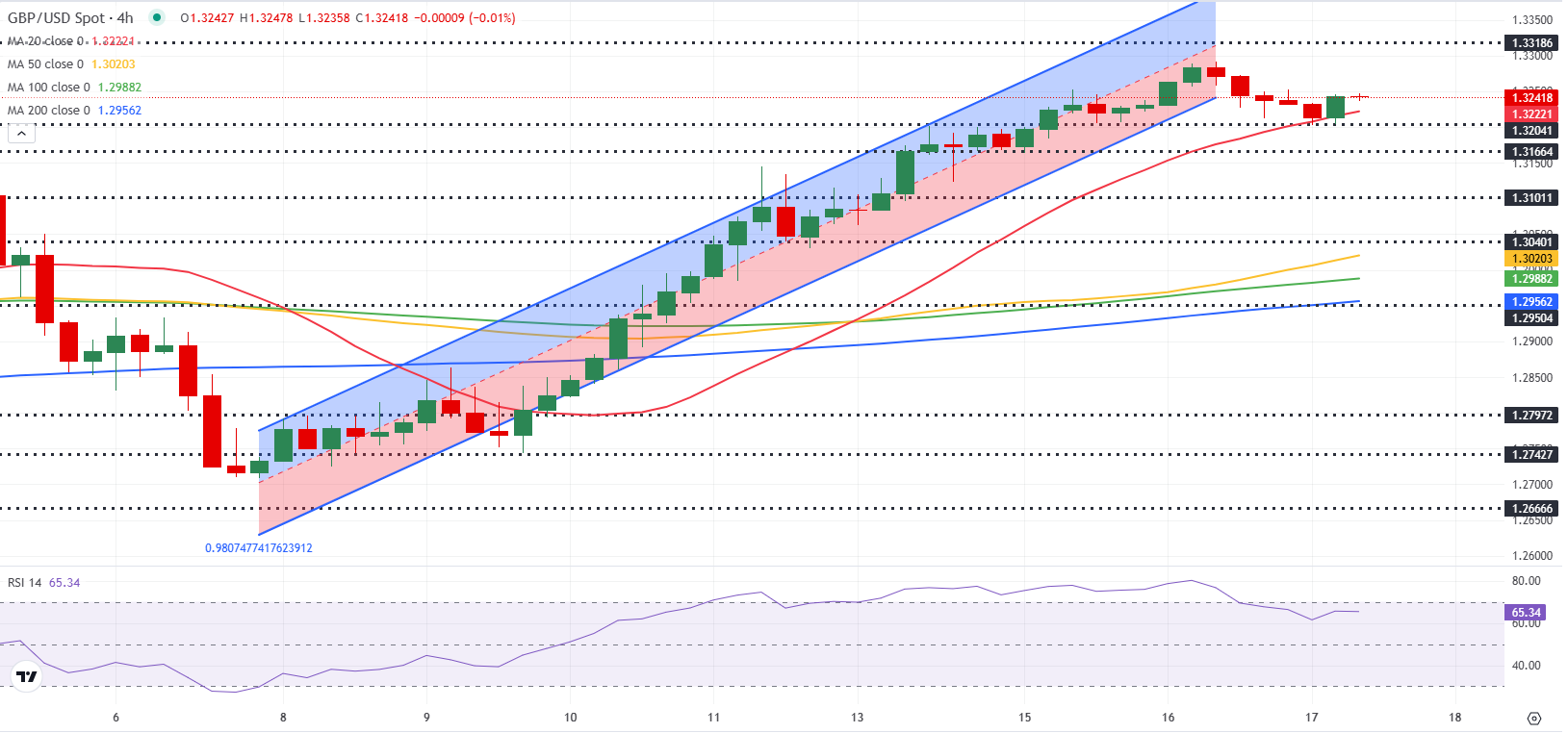

GBP/USD price forecast: Recovery stops about 1,3300

The GBP/USD torque drops to about 1,3230 during the European negotiation hours on Thursday. He Wire Low slightly while the US dollar (USD) attracts some offers due to significant progress in commercial conversations between USA (USA) and Japan.

He US dollar index (DXY), which tracks the value of the dollar against six main currencies, bounces about 99.50 from the minimum of three years of 99.00. Investors see this as a sign that the growing global economic uncertainty, promoted by the imposition of strong tariffs by US President Donald Trump, will be relieved in the midst of the growing confidence that Trump is inclined to have bilateral agreements that avoid a commercial war with all nations. Read more…

GBP/USD forecast: The sterling pound maintains a bullish bias before the long weekend

After reaching a new maximum of 2025 about 1,3300 on Wednesday, The GBP/USD lost its bullish impulse and ended the day practically unchanged. The PAR extends its lateral movement around 1,3250 in the European session on Thursday.

The improvement in the feeling of risk helps GBP/USD to stand firm on Thursday, but the modest recovery observed in the US dollar (USD) limits the torque potential. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.