GBP/USD forecast: the recovery of the sterling pound could lose strength after the United Kingdom inflation data

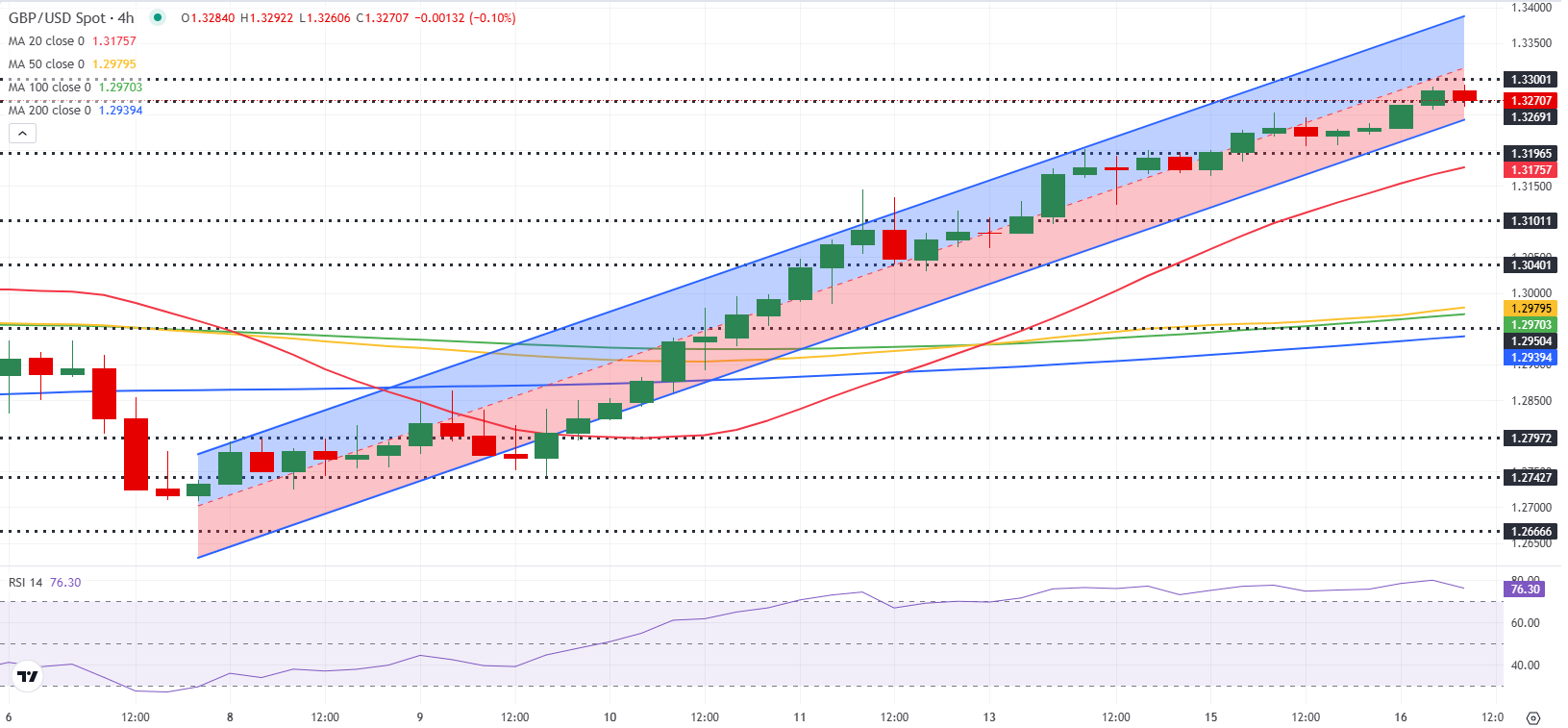

The GBP/USD stretched up and touched its strongest level since the beginning of October over 1,3290 in the early hours of the European session on Wednesday. The torque corrects down after the latest data from the United Kingdom, but remains in positive territory, while short -term technical perspectives continue to highlight overcompra conditions.

The National Statistics Office (ONS) of the United Kingdom reported Wednesday that annual inflation, measured by the variation of the Consumer price index (CPI), softened 2.6% in March from 2.8% in February. This figure was below the expectation of the market of 2.7% and made it difficult for the GBP/USD to gather more bullish impulse. In monthly terms, the CPI rose 0.3% after the increase of 0.4% previously registered. Read more…

The GBP/USD has resumed its upward movement [Video]

The GBP/USD has recently exceeded its peak of April 3, 2025 of 1,3207, which we identify as the wave (1) in the graph. This rupture indicates the beginning of an upward trend from the minimum of January 13, 2025 of 1,2705, suggesting more upward movement ahead. The recovery from this minimum follows a pattern of Elliott waves of five waves. This is a common structure in the technical analysis that indicates a strong trend. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.