GBP/USD Forecast: Esterlina pound has difficulties for attracting buyers

The GBP/USD remains down after Thursday’s rebound and quotes slightly below 1,3300 in the European session on Friday. The renewed fortress of the US dollar (USD) makes it difficult for the torque to maintain its position, since investors are still focused on the latest developments around commercial relations between the US and China.

US President Donald Trump said late on Thursday that a meeting was held between Chinese and American officials earlier in the day. During Asian negotiation hours, Bloomberg reported that China was considering suspending its 125% tariff on some US imports, including medical and ethane teams, and that officials were discussing the possibility of exempting tariffs on airplane leases. Read more…

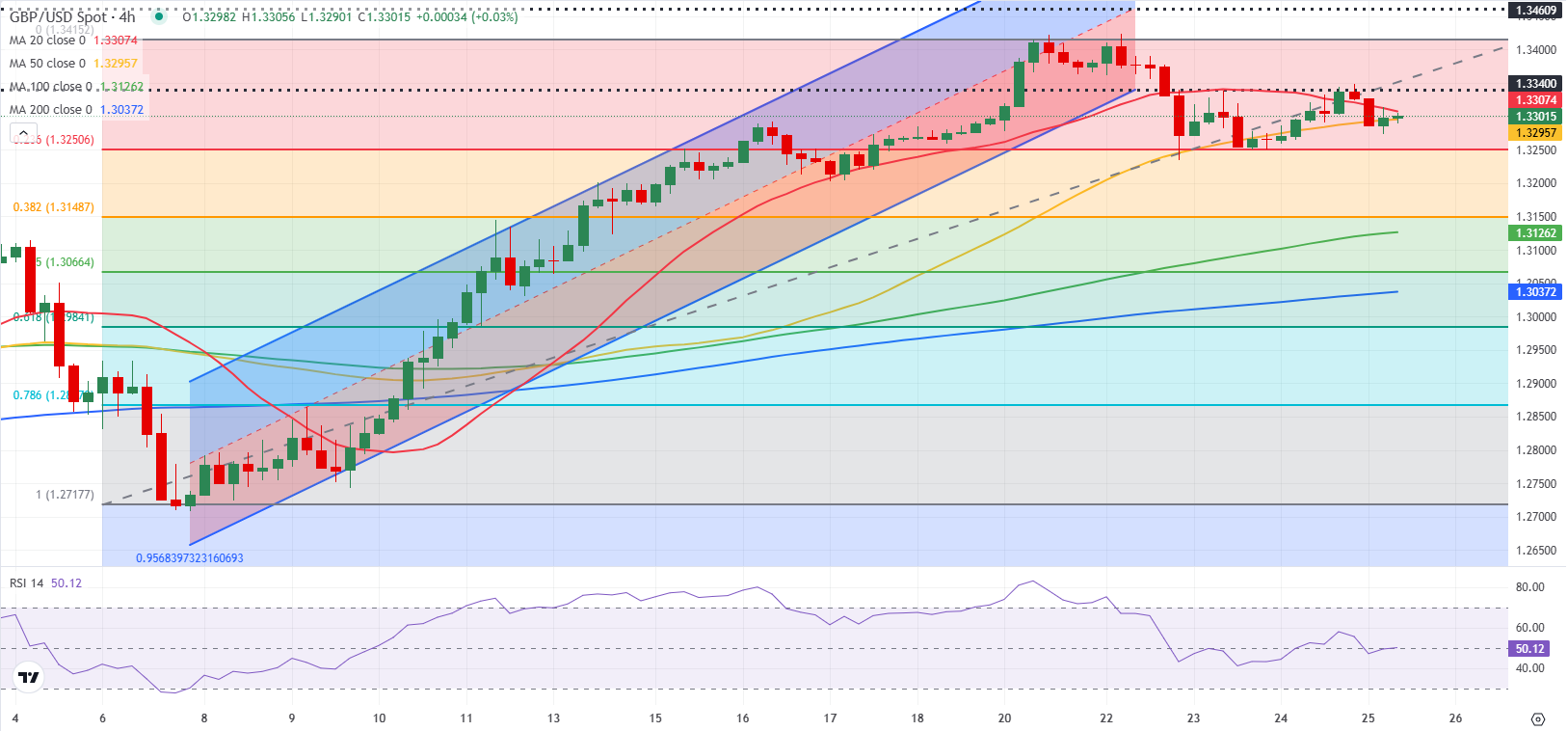

GBP/USD forecast: The sterling pound could lower if the 1,3250 support fails

The GBP/USD extended its fall for a second consecutive day on Wednesday and registered its lowest daily closure in a week about 1,3250. The pair maintains its position early on Thursday and recovers around 1,3300.

The disappointing data of the purchasing managers index (PMI) of the United Kingdom, which showed a contraction in the business activity of the private sector in April, caused the sterling pound to weaken in front of its rivals during the European negotiation hours on Wednesday. Later in the day, the US dollar (USD) benefited from growing optimism about the relaxation of tensions between China and the US, which caused the pair to spread down. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.