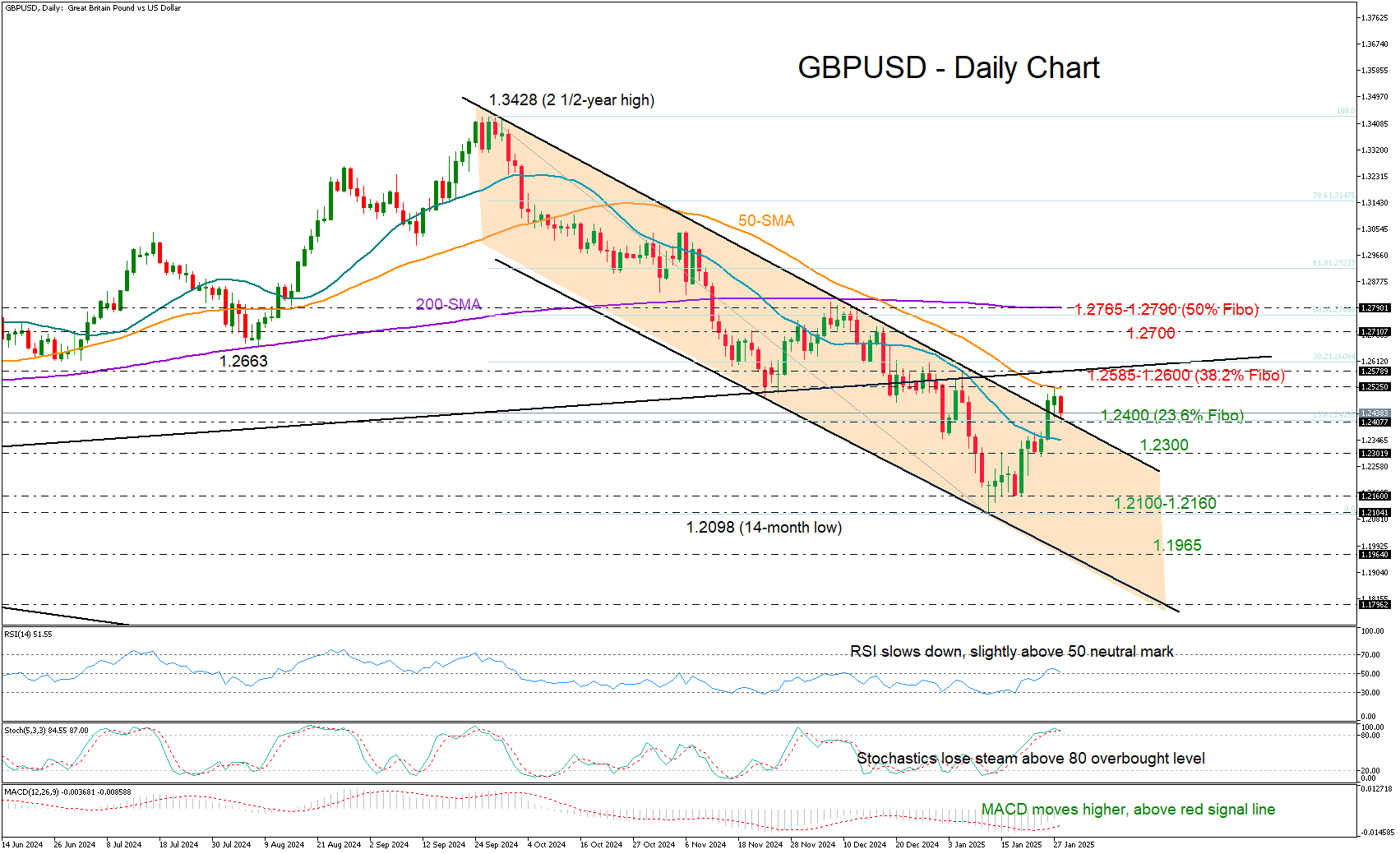

GBP/USD Forecast: The sterling pound fails to stabilize above 1,2500

The GBP/USD rose to its highest level in three weeks above 1,2500 on Monday and recorded profits for the third consecutive day. However, early on Tuesday, the Tar reversed its direction and fell below 1,2450.

In the absence of high -level data publications, investors continue to react to the holders about the commercial policy of the US president, Donald Trump. The US Treasury Secretary, Scott Besent, said Monday night he is pressing so that universal tariffs on imports begin in 2.5% and gradually increase, according to Financial Times. When talking with journalists in the early Asian session on Tuesday, President Trump responded to these comments, saying that he wants “much greater than 2.5%” tariffs. In addition, Trump said they will impose tariffs on foreign computer production, semiconductors and pharmaceutical products “in the very close future”, to return the production of these essential goods to the US to the US to read more … Read more …

GBP/USD: A false bullish rupture?

The GBP/USD stopped around the single mobile average (SMA) of 50 days descending in 1,2525 shortly after leaving the rising bearish channel.

Was this a false bullish rupture? No, not as long as the price continues to quote above the upper limit of the channel seen about 1,2400. The area is currently under examination along with the fibonacci setback of 23.6% of the last bearish trend. Therefore, the failure to pivot there could disappoint the traders, carrying the round level of 1,2300 in sight, while a deeper fall could point to a bearish extension below the crucial support area of 1,2100-1.2160. Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.