The sterling pound shows mixed performance before the preliminary data of the United Kingdom PMI

The sterling pound (GBP) demonstrates a mixed performance in front of its main peers on Tuesday, since investors are cautious about how the Bank of England (BOE) will shape the monetary policy perspective under the threat of Trump’s international policies.

The operators have become increasingly confident that the BOE could cut interest rates in the May policy meeting amid the ongoing global economic tensions.There is a great possibility that the United Kingdom has a commercial agreement with Washington after the Trump administration imposed 10% reciprocal tariffs and 25% levies on steel and foreign cars. However, the main threat to the United Kingdom is the intense competition with other nations, assuming that Trump’s protectionist policies will force their commercial partners to sell their products in other territories at lower prices.Read more…

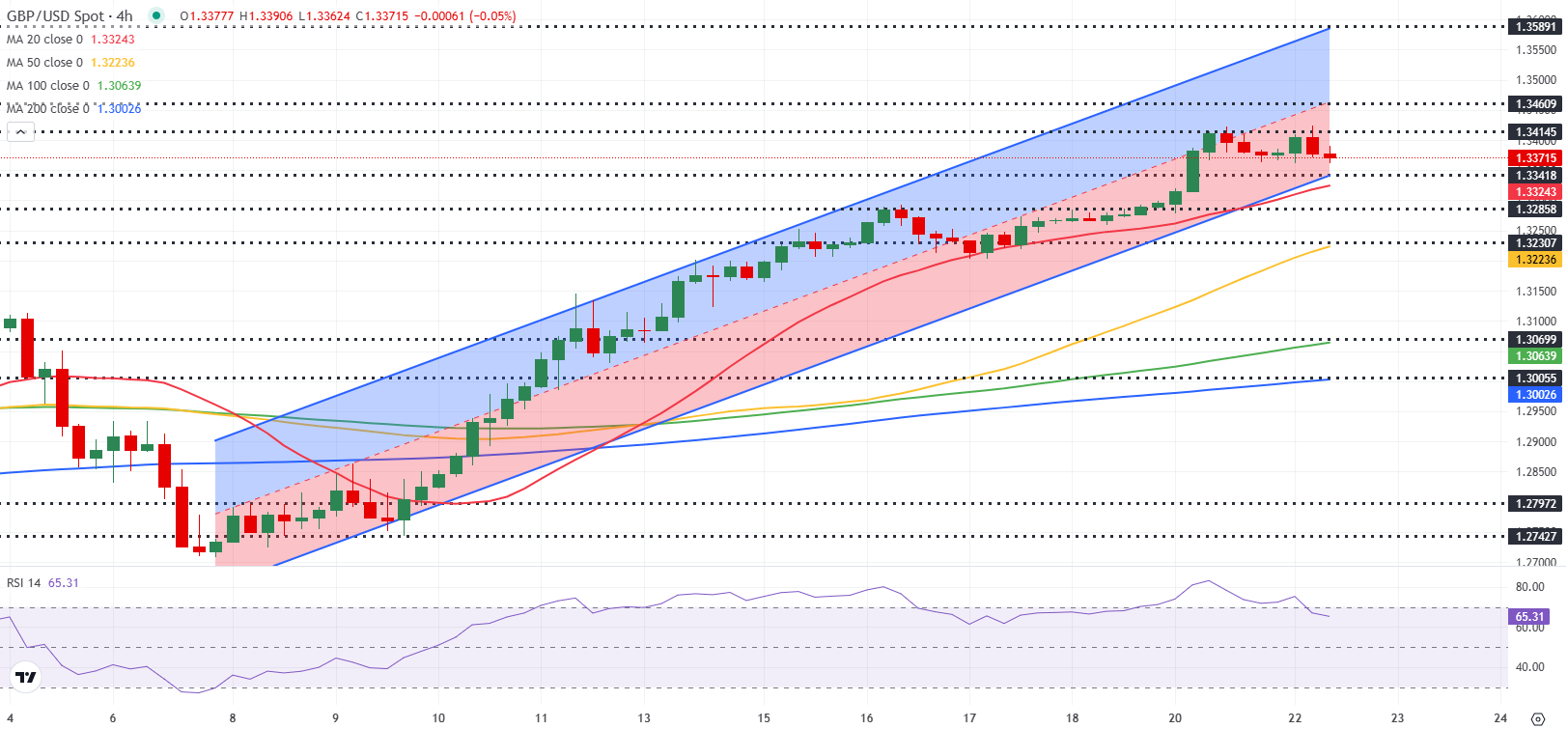

GBP/USD forecast: buyers doubt while the sterling pound fails to stabilize above 1,3400

The GBP/USD moves up and down in an adjusted range below 1,3400 after having reached a new 2025 maximum above 1,3420 early in the day.The short-term technical perspective suggests that the bullish position remains unchanged, but a break below 1,3340-1.3330 could discourage buyers.

The generalized weakness of the US dollar (USD) allowed the GBP/USD to start the week with a bullish tone, since investors reevaluate the political threat to the independence of the Federal Reserve (FED).Read more…

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.