- Natural Gas prices are trading flat to lower on Friday, as supply concerns ease due to higher-than-expected reserves in Europe.

- This greatly dwarfs US data released on Thursday, which shows inventories fell last week.

- The end of a threatened civil war in Russia, one of the main producers, and forecasts that the heat wave will pass further limit profits.

The price of Natural gas lowered at the start of the US session on Friday as supply concerns eased, after data showed European stocks are at 77% capacity, reassuring traders who they believe the storage tanks will be full in time for the winter surge. However, US data showed a surprising drop in inventories last week.

The avoidance of a civil war in Russia has further eased supply concerns, ending the recovery that began at the same time as the Wagner Group mutiny. In addition, the US heat wave, which most recently boosted demand for Natural Gas (for use in air conditioning), is expected to pass next week.

He USD/XNG It is trading at $2,600/MMBtu as the US wakes up.

News and movements of the Natural Gas market

-

Natural gas storage levels in Europe, stockpiled in preparation for the winter, are much higher than in previous years, easing supply concerns and keeping prices restrained.

-

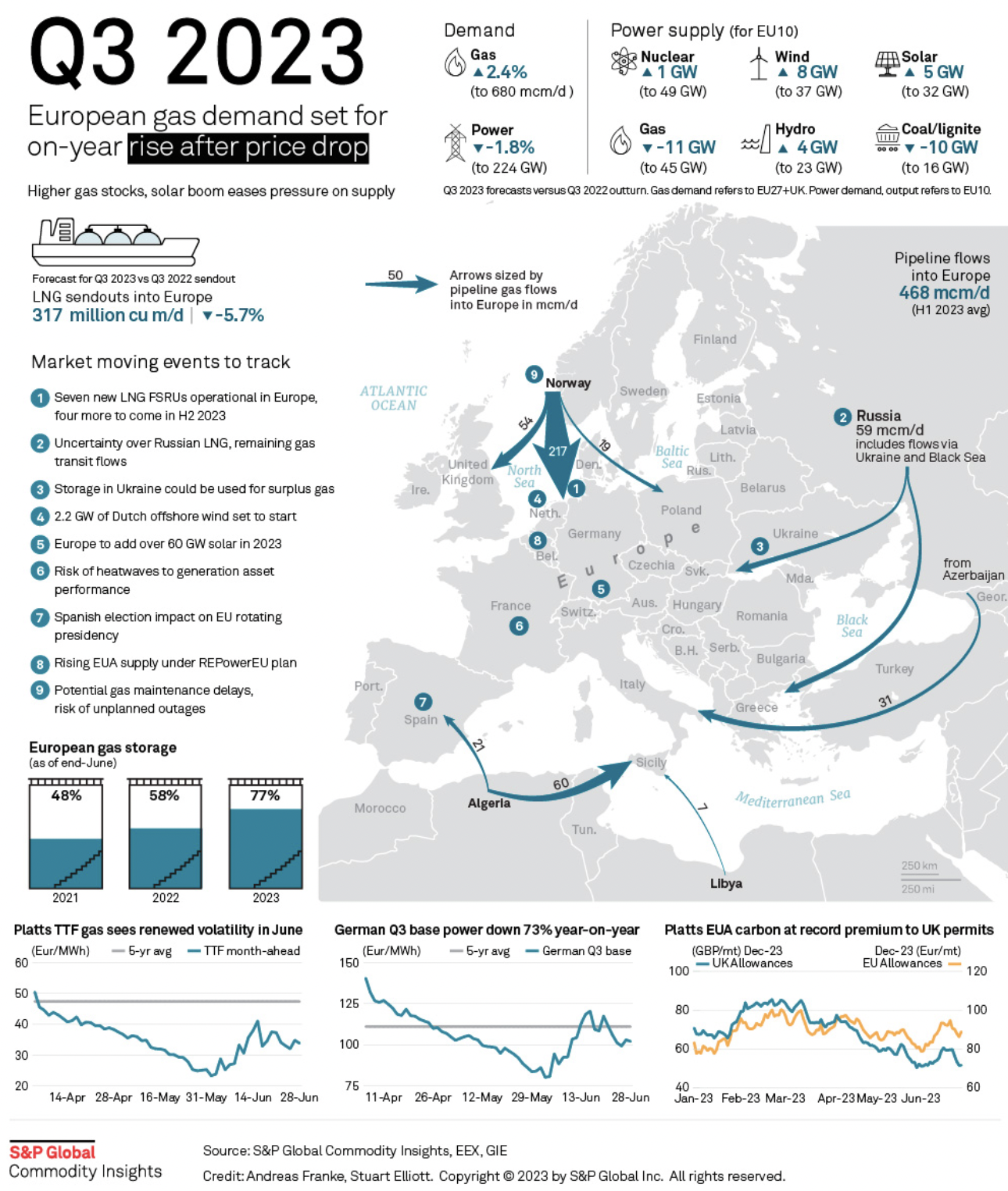

Natural Gas storage capacity in Europe has reached 77%, according to the latest data from S&P Global, up from 58% in 2022 for the same time of year and 48% in 2021.

-

However, the S&P Global article suggests that demand could still pick up in the third quarter (2023) due to low prices.

- Their infographic for the third quarter (see below) forecasts an increase of 2.

- 4% in the demand for Natural Gas in the quarter to 680 million cubic meters of Gas per day (mcm/d).

-

S&P Global says rising Natural Gas values and a rise in solar will “relieve supply pressure.”

-

According to Irina Slav, a journalist for Oilprice.com, the current relatively low Natural Gas prices are in turn the result of a lower overall level of demand so far in 2023.

-

Cutting consumption has become the norm in Europe after energy bills skyrocketed in 2022, and pressure from some governments to reduce consumption have combined to force consumers to be more prudent, Slav says.

-

The winter of 2022-2023 was also relatively mild in both the US and Europe, which reduced demand for Natural Gas and left reserves high compared to last year. This means that fewer reserves will be needed in 2023, Slav writes.

-

“The reason for the lower prices is, as expected, lower demand. It is true that Europe buys liquefied natural gas. But it is buying much less than last year: because its storage caverns are not infinite, and there is still in them quite a bit of gas from last year,” reports Slav on Friday.

-

Natural Gas has also fallen after the return of geopolitical stability to Russia, which continues to be one of the main producers. When the Wagner mutiny began, prices rose on fears that supplies would be interrupted by civil war. However, now that the riot is over, they have fallen again.

-

Norwegian supply concerns, following disruptions at the Hammerfest LNG export terminal and processing plants at Nyhamna and Kollsnes, continue to support prices. However, the high storage levels seen in Europe make the outages in Norway now less of a concern.

-

According to Natural Gas Intelligence (NGI), volatility caused by changes in traders’ positions prior to the expiration date of futures contracts i

-

In the US, the Natural Gas price rose on Thursday after EIA data showed a smaller-than-expected change in US storage data for the week ending June 23.

-

The sudden recovery came after a nearly 10% drop from the June highs.

-

Demand for Natural Gas to power air conditioning may be about to moderate after reports that temperatures in the US will return to mid-ranges for this time of year next week.

Natural Gas: S&P Global Infographic

Natural Gas Technical Analysis: Recovery Stalls Near Significant Trend Determination Level

Natural Gas price is trading just below a key trend-setting level on long-term charts. Although the commodity remains in a long-term downtrend since the turn down at the August 2022 high, the bearish momentum has subsided considerably.

The Relative Strength Index (RSI) is converging bullishly with the price on the weekly chart, something that happens when the price makes new lows but the RSI does not.

Breaking above the latest long-term downtrend lower high at $3,079 MMBtu would signal a broader downtrend reversal.

-638237258617255695.png)

Natural Gas: Weekly Chart

However, as this level has not yet been breached, the downtrend remains intact, and a break below the year-to-date lows at $2,110 would confirm bearish continuation to a target of $1,546. This target is the 61.8% Fibonacci extension of the roughly sideways consolidation range height that has been developing through 2023 (marked 161.8% on the charts).

On the daily chart, the price has been rallying within a more or less sideways market, although it has broken above the 50 and 100 day SMAs.

-638237259147690923.png)

Natural Gas: Daily Chart

However, a break above the latest long-term downtrend lower high at $3.079 MMBtu would be needed to signal a general trend reversal.

Prices rally towards the next resistance level at the 200-week SMA, located at $3,813.

However, until that happens, prices will probably continue to consolidate within their range.

Frequently Asked Questions about Natural Gas

What fundamental factors determine the price of Natural Gas?

Supply and demand dynamics is a key factor influencing Natural Gas prices, and is in turn influenced by global economic growth, industrial activity, population growth, production levels and inventories. Weather influences Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources influences prices, as consumers may opt for cheaper sources. Geopolitical events, such as the war in Ukraine, also play a role. Government policies related to extraction, transportation and environmental issues also influence prices.

What are the main macroeconomic publications that influence Natural Gas Prices?

The main economic publication that influences Natural Gas prices is the weekly inventory bulletin of the Energy Information Administration (EIA), a US government agency that produces data on the US gas market. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, one day after the EIA publishes its weekly oil bulletin. The economic data of the large consumers of Natural Gas can influence supply and demand, among which China, Germany and Japan stand out. Natural gas is quoted and traded primarily in US dollars, so economic releases affecting the US dollar are also factors.

How does the dollar influence Natural Gas prices?

The US dollar is the world’s reserve currency and most commodities, including natural gas, are quoted and traded on international markets in US dollars. For this reason, the value of the Dollar influences the price of Natural Gas, since if the dollar strengthens, fewer dollars are needed to buy the same volume of gas (the price falls), and vice versa if the Dollar strengthens.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.