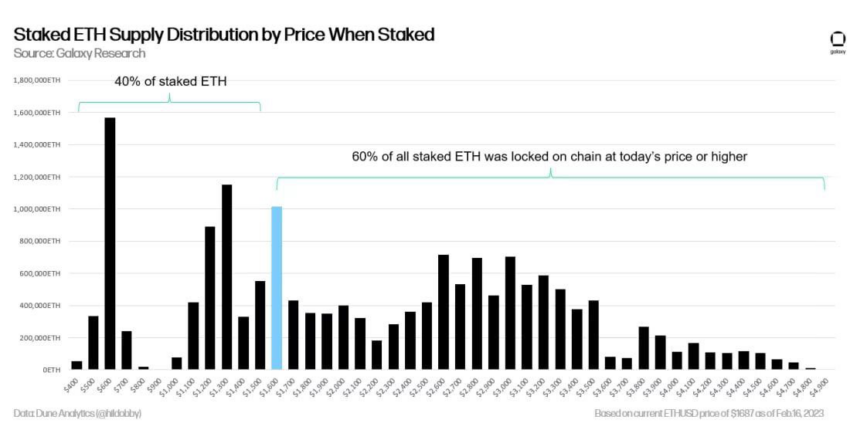

The number of people blocked in Ethereum staking protocols is on the rise. However, more than half of the coins are still unprofitable – even though the price of ETH has recently reached local highs.

The chart below shows that 60% of all ETH was staked at $1,600 or higher. The remaining 40% of the coins are in profit. Most of them are Ethereum at a price of $500-700, blocked during the launch of Beacon Chain in December 2020.

ETH Stakers Await Shanghai Update

The situation worsened even more last year. When the price of ETH fell to $1,000, more than 80% of the coins were in the red zone.

But this does not seem to scare investors at all. According to Ultrasound Moneyabout 16.7 million ETH or 13.8% of the total supply is currently locked on staking platforms.

The upcoming Shanghai update will gradually release the coins locked in Beacon Chain. Analysts believe that users will place them on liquid staking protocols such as Lido and RocketPool. Both platforms offer the best opportunities for profit.

According to the data DeFiLlamamore than $7M ETH has already been staking on liquid staking platforms, valued at around $11.8B.

What happens to the price of Ethereum

Over the weekend, the asset overcame the resistance at $1,700. At the time of writing, its price is $1714.

But despite the impressive growth, Ethereum is still 65.4% below its all-time high of $4,878 reached in November 2021.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.