MicroStrategy acquired an additional 12,222 BTC for $805 million in Q2, bringing its total holdings to 226,500 BTC (~$14.7 billion), according to report companies.

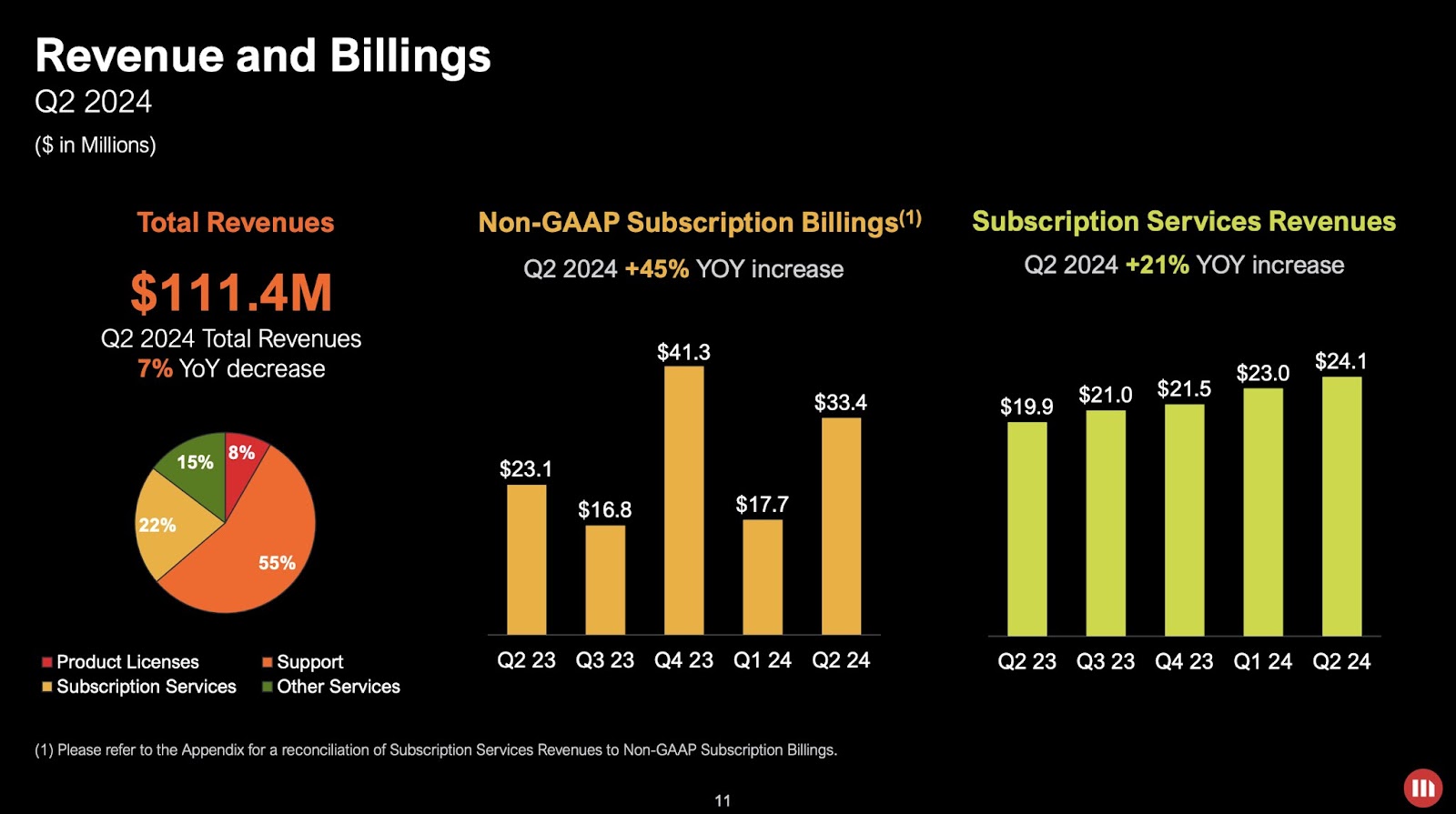

Over the past three months, the company’s loss was $5.74 per share on quarterly revenue of $111.4 million, a 7% drop from the previous year.

The figures came in below analysts’ expectations, according to a survey Bloombergforecast a loss of $0.78 per share and revenue of $119.3 million.

The company reported that 226,500 BTC were purchased for $8.5 billion, with the average price per coin being $36,821.

The firm also introduced a new key performance indicator called Bitcoin Return, which reflects the percentage change in the ratio between a company’s holdings of the first cryptocurrency and its diluted shares outstanding.

Since the beginning of the year, this metric has amounted to 12.2%. At the same time, MicroStrategy emphasized that it intends to maintain it in the range of 4% to 8% per year over the next three years.

The firm confirmed that its 10-for-1 stock split, originally scheduled for July 11, will now take place on August 7.

According to the report, the company will file a registration form to offer its securities on the market worth $2 billion in an attempt to raise additional capital.

At the time of writing, MicroStrategy shares trading at $1569up 3.7% after the close.

In June, the company reported the purchase of 11,931 BTC for $785 million and the issuance of shares for $800 million.

That same month, the value of open short positions in MicroStrategy shares rose to $6.9 billion, a figure that has tripled in the past six months.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.