A report on the performance of the largest South Korean crypto exchanges published by Kaiko states that the reason for the incident was an improvement in the macroeconomic environment and increased competition in the domestic market.

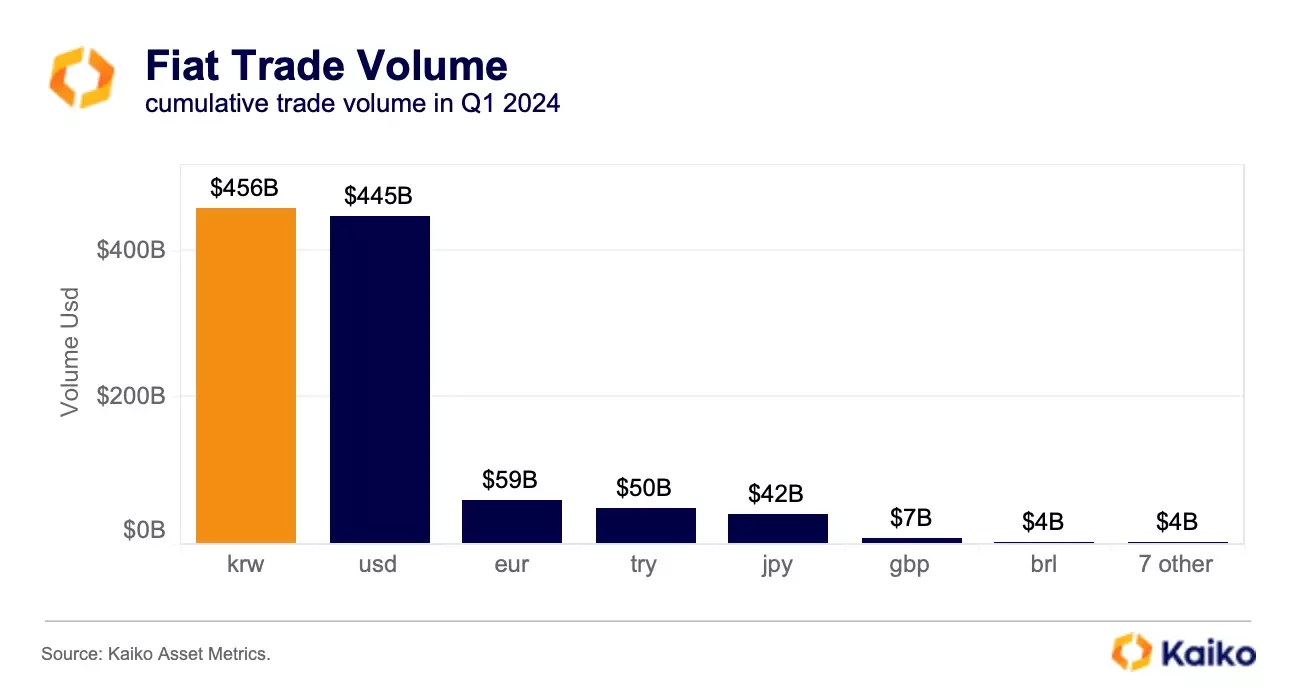

The South Korean won (KRW) surpassed the US dollar (USD) in total trading volume, according to first-quarter spot market results. The total trading volume of the Korean won on centralized crypto exchanges in January-March amounted to $456 billion, Kaiko experts state. A year ago, in January-March 2023, it was $445 billion.

Upbit has maintained its dominance in the local market with an average share of around 80%. The launch of zero-fee policies by rival crypto platforms Bithumb and Korbit has failed to make a significant impact on the landscape, and it appears that due to declining revenues, the two exchanges will be forced to withdraw this generous offer to customers.

Kaiko analysts believe that the recent approval for the launch of Bitcoin and Ether spot ETFs in Hong Kong could have a positive impact on investment sentiment in the South Korean crypto market and the entire Asia-Pacific region.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.