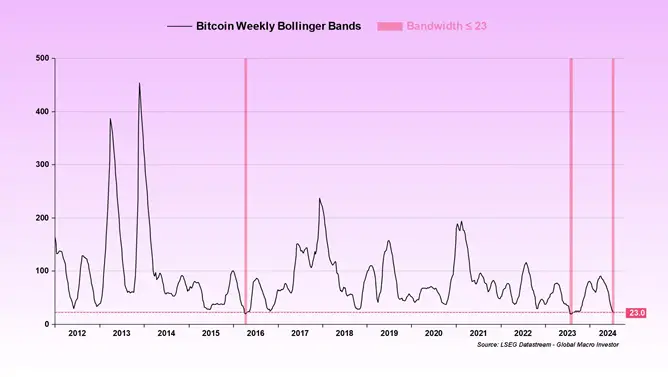

Julian Bittel reported that the Bollinger Bands indicator is currently in a very tight range by historical standards. According to him, such a compression of the weekly Bollinger Bands has only been observed twice in the history of the market: in April 2016 and July 2023.

Bollinger Bands is one of the main indicators of cryptocurrency volatility. It provides traders and investors with information about the strength of price trends in the market. On weekly charts, the gap between the upper and lower bands is extremely rare and historically such a situation has turned out to be good news for bulls, the expert emphasized.

“In both previous cases, Bitcoin prices rose significantly over the next twelve months. A similar move this time could take Bitcoin into the $140,000 to $190,000 range,” Bittel said.

Let us recall that this is not the first time that the indicator shows significant growth potential for the first cryptocurrency in the current bull market. At the end of 2023, the compression of Bollinger Bands preceded the asset’s growth to local highs shortly before the launch of spot Bitcoin ETFs in the US.

Earlier, former Blockstream director and Jan3 CEO Samson Mow said that Bitcoin could reach $1 million despite its recent decline.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.