The conclusions of experts are built on the value of the influx of capital in exchange funds based on gold and the activity of investors on the futures market. In particular, in the first quarter, these products received $ 21.1 billion.

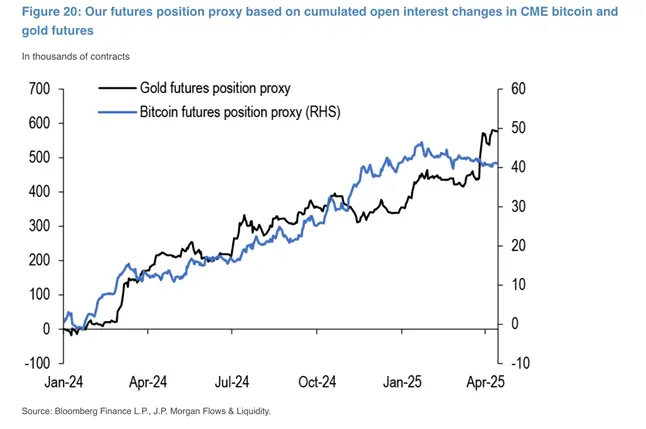

“Despite the decrease in the latitude of the market and liquidity, gold continues to benefit from the growth of demand for hedge assets, like such currencies as the Swiss Frank and Yen. These are traced both in the ETF and in the futures market. Bitcoin, in turn, failed to benefit from changes in the market, ”analysts pointed out.

According to them, since February, the demand for futures based on gold has been steadily growing, which can not be said about Bitcoin contracts. This trend will remain within the next few months, JPMorgan experts predict.

Earlier, experts of the American Exchange Coinbase said that the trade war between the United States and China led to cryptosima, but in July-September we should expect a more optimistic mood of investors.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.

.jpg)