Iron ore prices hit two-week highs on Tuesday, extending a rally on hopes that improving margins by Chinese steelmakers and Beijing’s support for a struggling domestic real estate sector would lift demand for the steel ingredient. .

The top-traded ore contract for September delivery on China’s Dalian Commodity Exchange ended trading up 5.6% at 748.50 yuan ($110.81) a tonne after hitting early session its highest level since July 11 at 749 yuan.

On the Singapore Stock Exchange, the iron ore contract for August rose 5.7% to US$ 111.40 a tonne.

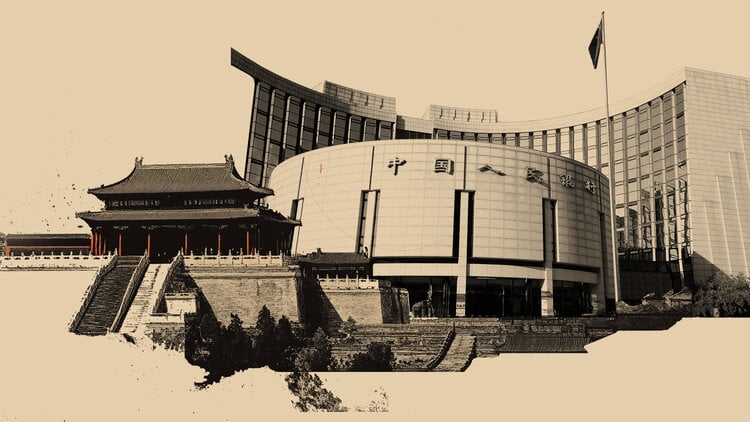

Market sentiment improved after reports that China, the world’s biggest steel producer, will launch a rescue fund worth up to 300 billion yuan for property developers hit by a debt crisis, seeking to restore confidence in the sector.

Speculation has also increased that Chinese steelmakers were preparing to restart some of their idle blast furnaces next week, as reported by Chinese metals information provider SMM.

The resumption would aim to increase production as inventories fell and profits rose.

But uncertainty remains whether recent iron ore gains can be sustained.

“In our view, access to credit does not fundamentally solve the underlying problem of weak property sales,” which were hit by Covid-19 restrictions during the first half of the year, said commodities analyst at Commonwealth Bank of Australia, Vivek Dhar.

Source: CNN Brasil

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.