Binance Restrictions

Restrictions for Russians from Binance did not come as a surprise. Back in March, citizens of the country were prohibited from buying/selling dollars and euros on the platform. Now trade in any foreign currency is banned. What are the new bans about?

On August 22, the Wall Street Journal published article, where the share of Binance in the Russian crypto market is named and evidence of assistance in circumventing international economic sanctions is provided. At first, Binance simply renamed the sanctioned banks: Sberbank and Tinkoff cards began to appear on the exchange as “green local” and “yellow local”.

However, users and regulators quickly understood everything, and the platform almost immediately refused to support toxic cards at all, and then banned P2P transactions for Russians with any currency other than the ruble. On August 29, the OKX exchange blocked, on the contrary, the ability to pay in the ruble – and with cards of sanctioned banks. Major Russian banks were banned from Kucoin and Bybit.

The new restrictions have caused inconvenience to ruble holders who need foreign currency. Travelers, businessmen, Russians living abroad, anyone who paid for foreign services like Steam, PS Store or a subscription to Netflix.

The result of the initiative will be the outflow of a certain number of clients from Binance and similar sites. The largest exchange considers option of complete withdrawal from the Russian market.

Despite the restrictions of large sites, there are enough platforms left ready to work with the Russians. We list some of the most convenient.

Alternative P2P sites

1.emcd.

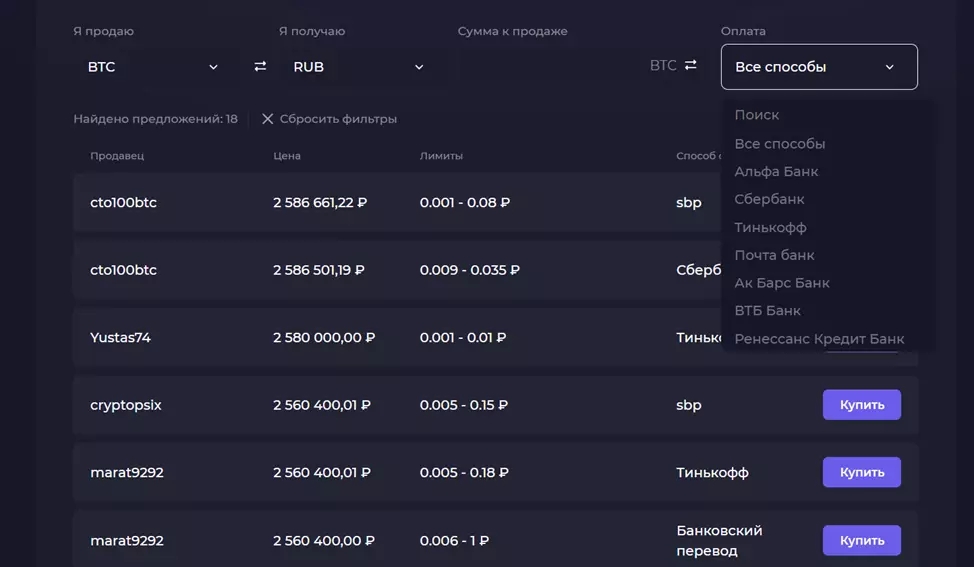

Cyberbank emcd. is one of the top 10 mining pools in the world, and is also one of the largest software companies for mining and trading cryptocurrencies. in emcd. have their own P2P platformavailable to Russians. For transactions, you can use cards of various banks: there are both popular Sberbank and Tinkoff, and something more rare, such as Ak Bars Bank. User offers can be sorted by the bank of interest.

Transactions are carried out quite quickly: on average, from a few minutes to two hours. Until they are fully completed, your funds will be frozen. If there are any difficulties, you can resolve disagreements with the 24/7 support service. Soon KYC verification will be introduced, but it is currently missing, which provides additional opportunities for traders. Now, to make P2P transactions, it is enough to register via e-mail.

Source: https://emcd.io/p2p/

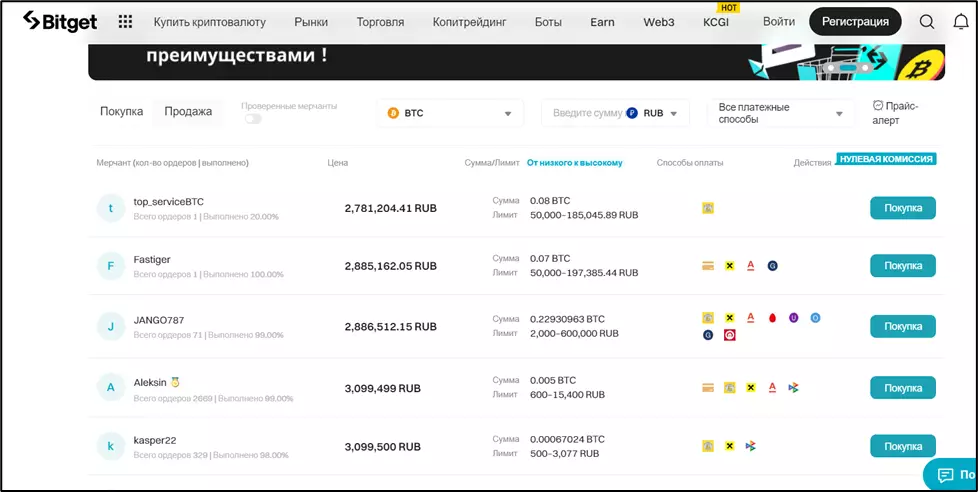

2.Bitget

Exchange bitget has been operating since 2018, it has its own P2P exchanger. There are quite a lot of payment methods available here, including cards of the Russian MTS-Bank, Raiffeisen, Tinkoff, Uralsib and others. There are currently six crypto assets available for purchase: USDT, USDC, BTC, ETH, DAI, BGB.

From September 1, 2023, only those new users who have passed the KYC procedure can trade on the P2P platform. For those who do not verify their identity, only the functions of withdrawing money and closing positions will be available. Previously registered users have time to pass the verification until October 1. There are zero commissions on the Bitget P2P platform, and you can also filter trusted sellers (merchants).

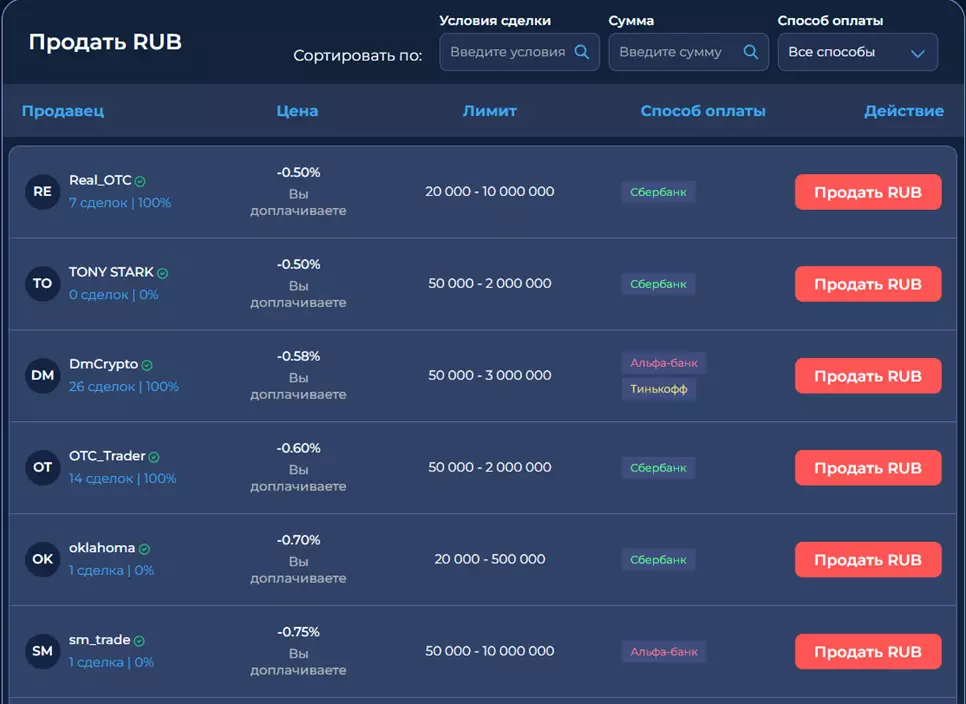

3. Beribit

Exchange Beribit launched P2P trading in March 2023. Deals are available to registered customers. To trade, you must go through the AML / KYC procedures: identify yourself and provide data on the address of residence. Users are checked for suspicious activity. On the site, you can both buy rubles and sell them. Offers in the table are ranked from the most profitable to the least. For payment, you can choose cards of large Russian banks: Sberbank, VTB, Uralsib, Alfa-Bank and others.

Source: https://beribit.com/p2p/buy-rub

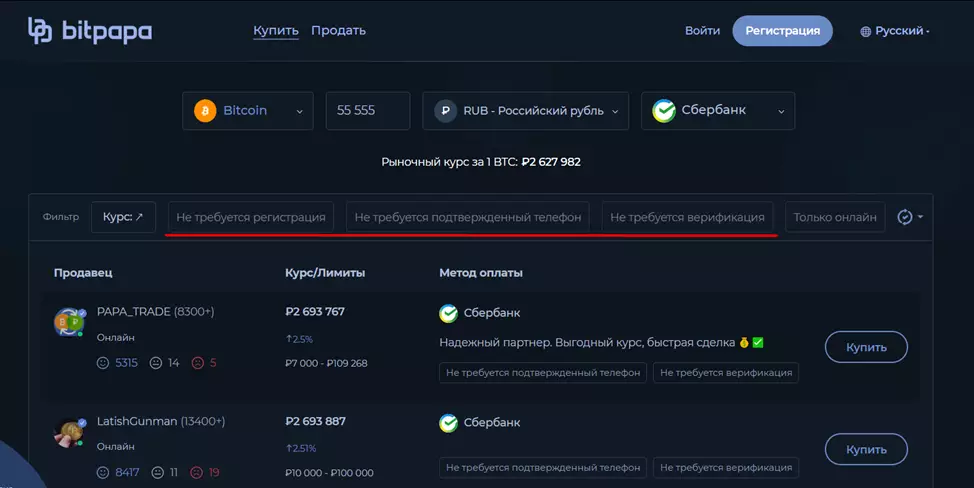

4. Bitpapa

An international P2P marketplace that supports Russian bank cards. In addition to the usual Sberbank and Tinkoff, Bitpapa supports Gazprombank, Post Bank and other banks. Bitpapa has a telegram bot, a mobile application for IOS and Android, as well as a crypto wallet that allows you to store and send bitcoins, ethers and USDT. All transactions are carried out using an escrow account. Cryptocurrency is safely held on it until the transaction is completed. There are no transaction fees.

For some transactions on the platform, verification may be required, for others it is enough to indicate a mobile phone, and in the third case, even registration is not required. Offers can be filtered by each criterion.

Source: https://bitpapa.com

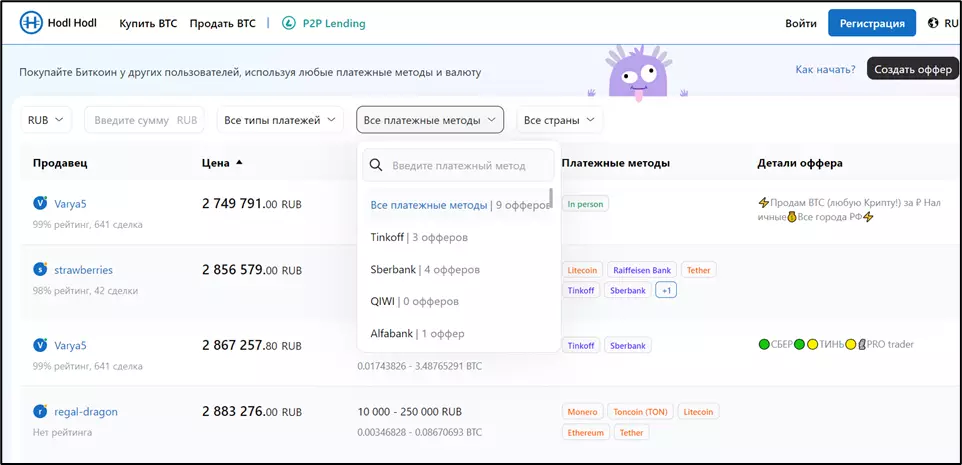

5. Hodl Hodl

Another P2P platform that is available to Russians. To make transactions on Hodl Hodl no KYC verification required. Commissions are taken for operations, but not more than 0.3% per transaction from each participant.

Registration on Hodl Hodl is standard: e-mail, nickname, password and its confirmation, as well as a referral code, if available. Two-factor authentication is available. Among the supported banks: Sberbank, Alfa-Bank, Uralsib and others, but there are far from all offers. You can verify this in the “All payment methods” tab. Hodl Hodl uses multi-signature escrow addresses for secure transactions.

Source: https://hodlhodl.com

This material and the information in it does not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts. The editors are not responsible for the actions of any trading platforms, and all information is for informational purposes only.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.