Bitcoin

Bitcoin from April 18 to April 25, 2025 increased by more than 10%. The largest cryptocurrency in capitalization again costs more than $ 90,000, which did not happen since March 7. Six of the seven trading sessions ended for BTC in the plus.

Source: TradingView.com

Bitcoin showed the greatest growth on Tuesday April 22. This was due to Trump’s rhetoric about relations with China, as well as regarding the head of the US Federal Reserve, Jerome Powell. The American president expressed confidence that interest rates for imports from the Middle Kingdom will decrease. In relation to the head of Federal Reserve, the American president is not going to take sharp steps. There is no question of the dismissal of Powell (although the president does not have the right to do so). Trump said that he only wanted a slightly more active behavior of the head of the Fed, which should

manifest In a decrease in the interest rate.

Another reason for the growth of bitcoin is the shortage of exchanges. According to Fidelity Digital Assets, Fidelity Investments investment giant units, BTC stocks on exchanges fell to six years of minimum. At the same time, institutional investors since November 2024, that is, from the date of re -election of Trump to the post of president of the United States, bought an additional 350,000 tokens. By

opinion Representatives of Fidelity, the tendency to reduce bitcoin reserves on exchanges will be aggravated.

If such a scenario of the development of events is implemented, then the price of BTC should increase in connection with a reduced offer.

Demand from institutional investors is confirmed by the statistics of spotes ETF on Bitcoin. Over the past week, the influx of funds in exchange funds amounted to $ 2.68 billion. Over the last five trading sessions, investors are actively investing in ETF.

Source: sosovalue.com

From the point of view of technical analysis, the Bitcoin trend has changed from the bear to the bull. At the end of April, the price significantly exceeds a 50-day sliding average (indicated in blue). At the same time, Stohastik is already in the overwhelming area, which can indicate a potential correction in the short term. The next purpose for BTC will be the level of resistance at a psychologically important mark of $ 100,000. The level of support is the bar of $ 89 164.

Source: TradingView.com

Index

Fear and greed demonstrated a significant leap compared to last week. He rose immediately by 27 points, and now its value is 60. This suggests that greed has come to the mood of the crypto -investors.

Ethereum

Air from April 18 to April 25 went up by 11.33%. At the same time, the dynamics of ETH was significantly different from bitcoin. If the latter costs all week, then the growth of the broadcast was due, in fact, by one trading session on Tuesday, April 22, when the asset added 11.21%at once.

Source: TradingView.com

Activity has finally began to grow in the Ethereum network. From April 20 to April 22, the number of addresses increased by 9.85% from 306 211 to 336 666. Such information

She shared On its official website, the analytical platform Cryptoquant.

A larger increase in the broadcast is still impossible due to the fact that large companies continue to get rid of the asset. For example, Galaxy Digital

Translated In Binance only in the last two weeks more than 65,000 ETH (over $ 105 million). Another investment company, Paradigm, on April 21, transferred 5,500 ETH (about $ 8.66 million) to the Anchorage Digital trading platform. In total, since January 2024, transfers to centralized exchanges

Compiled 96 955 ETH (about $ 301.51 million).

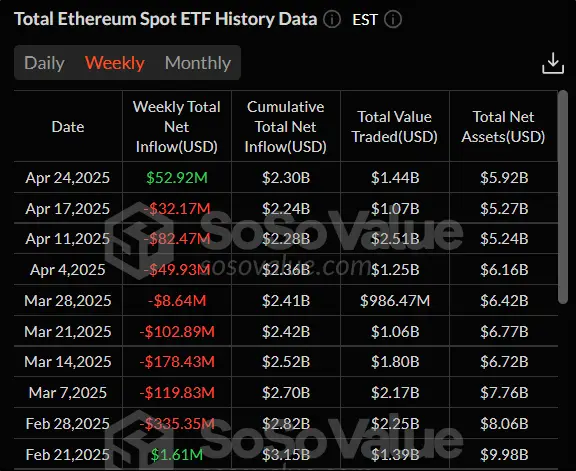

In the spotal ETF on the air this week, mixed dynamics was observed. Two days of cash flow were two days of outflow of money for two trading sessions of the flow of money. In terms of amount, the tributary surpassed the outflow of $ 52.92 million. Thus, it was possible to interrupt the eight -day series when the outflow was more than the influx.

Source: sosovalue.com

From the point of view of technical analysis, the ether remains in the descending trend. In favor of this, the price is below the price below the 50-day sliding average (indicated in blue). Nevertheless, there are positive signals. For example, the RSI indicator rose above the 50 mark, and this is a harbinger of the bull trend. In addition, ETH managed to rise above the former resistance level of $ 1754.2, which now has become the level of support. The next closest level of resistance is $ 2112.

Source: TradingView.com

Avalanche

Avalanche over the past from April 18 to 25, a week added 16%at once. The growth lasts from April 7, after the cryptocurrency has reached its minimum in a year and a half. At the same time, Avalanche (AVAX) is still seven times cheaper than at its peak at the beginning of 2021.

Source: TradingView.com

The increase in the cost of AVAX may be associated with the accumulations of large players (whales), which have taken place in recent weeks. By

data The analytical platform of Intotheblock, since the beginning of January there has been a jump in the accumulation of 45%. Thus, over four months, the whales purchased an additional AVAX tokens in the amount of $ 231.5 million. This suggests that large capital believes in the increase in the cost of Avalanche – in the future.

It is possible that the activity of whales is associated with the implementation

Updates Octane on the main network in early April. The update made it possible to reduce the commission for transfers by 30%.

This week, it became known that the US Securities and Exchange Commission (SEC) accepted the application of the Vaneck investment company for a spare Avalanche-ETF. This does not mean that the tool will be allowed for auction. Nevertheless, what is happening shows the interest of large investors-lawns in cryptocurrencies outside the Bitcoin-Efir pair. After all, if the application is in the end approved, for them

It will simplify Access to investments in Avalanche.

From the point of view of technical analysis, Avalanche in an upward trend. This is confirmed by the fact that the price has surpassed a 50-day sliding average (indicated in blue). To continue Avalanche growth, it is necessary to gain a foothold above the resistance level of $ 23.47. Despite the growth, the ATR indicator dropped to the minimum values over the past six months. This indicates a decrease in the volatility of the cryptocurrency. The nearest level of support is $ 18.95.

Source: TradingView.com

Conclusion

There was a U -turn on the crypto carp. Bitcoin, broadcast and Avalanche added more than 10%per week. This is primarily due to the change in the rhetoric of US President Donald Trump in relation to China and the head of the Fed Jerome Powella.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.