Greg Chipolaro believes that Bitcoin finally began to work as a means of savings, which was originally considered:

“The last few weeks, barely noticeable changes in his behavior have been observed. The department from traditional assets is still fragile, but for those who monitor cryptocurrency markets 24/7, the change is noticeable. Against this background, it should not be surprised that investors are hunting for alternatives for investments that are not affected by global frauds-assets-shelters. ”

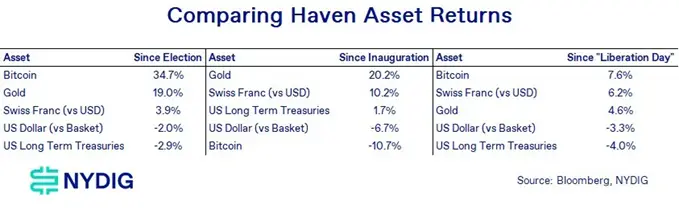

According to the expert, the macroeconomic instability caused by the import duties of US President Donald Trump, forced the market participants to doubt the treasury bonds and the dollar as investment standards:

“In the presence of few globally available on a global scale, large and liquid alternatives outside the traditional financial and banking systems, investors seem to turn to bitcoin, which has become one of the winners.”

However, the recognition of the role of the first cryptocurrency as a demanded asset-refuge is still in an early stage, the analyst emphasized.

Earlier, chief analyst of the Bitget crypto -tank Ryan Lee (Ryan Lee) reportedthat in the short term, the first cryptocurrency can break a bear trend and start the rally in the market.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.